Instructions For Deposit In The Nature Of A Cash Bond Form Apl-004

ADVERTISEMENT

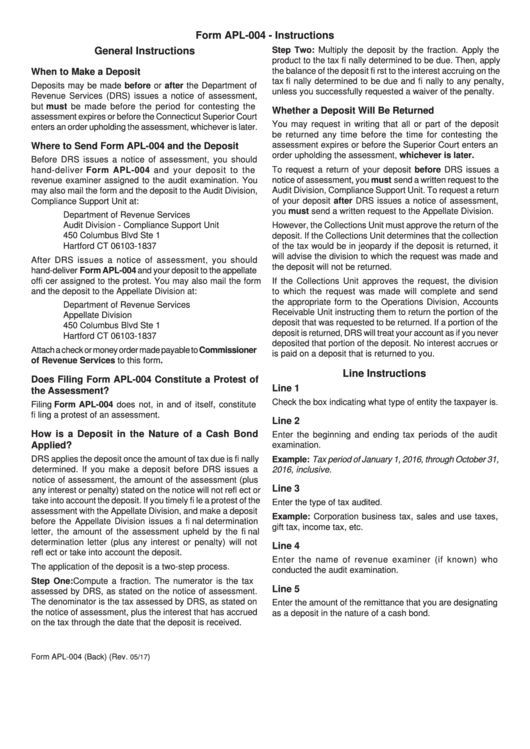

Form APL-004 - Instructions

General Instructions

Step Two: Multiply the deposit by the fraction. Apply the

product to the tax fi nally determined to be due. Then, apply

the balance of the deposit fi rst to the interest accruing on the

When to Make a Deposit

tax fi nally determined to be due and fi nally to any penalty,

Deposits may be made before or after the Department of

unless you successfully requested a waiver of the penalty.

Revenue Services (DRS) issues a notice of assessment,

but must be made before the period for contesting the

Whether a Deposit Will Be Returned

assessment expires or before the Connecticut Superior Court

You may request in writing that all or part of the deposit

enters an order upholding the assessment, whichever is later.

be returned any time before the time for contesting the

assessment expires or before the Superior Court enters an

Where to Send Form APL-004 and the Deposit

order upholding the assessment, whichever is later.

Before DRS issues a notice of assessment, you should

To request a return of your deposit before DRS issues a

hand-deliver Form APL-004 and your deposit to the

notice of assessment, you must send a written request to the

revenue examiner assigned to the audit examination. You

Audit Division, Compliance Support Unit. To request a return

may also mail the form and the deposit to the Audit Division,

of your deposit after DRS issues a notice of assessment,

Compliance Support Unit at:

you must send a written request to the Appellate Division.

Department of Revenue Services

Audit Division - Compliance Support Unit

However, the Collections Unit must approve the return of the

450 Columbus Blvd Ste 1

deposit. If the Collections Unit determines that the collection

Hartford CT 06103-1837

of the tax would be in jeopardy if the deposit is returned, it

will advise the division to which the request was made and

After DRS issues a notice of assessment, you should

the deposit will not be returned.

hand-deliver Form APL-004 and your deposit to the appellate

offi cer assigned to the protest. You may also mail the form

If the Collections Unit approves the request, the division

and the deposit to the Appellate Division at:

to which the request was made will complete and send

the appropriate form to the Operations Division, Accounts

Department of Revenue Services

Receivable Unit instructing them to return the portion of the

Appellate Division

deposit that was requested to be returned. If a portion of the

450 Columbus Blvd Ste 1

deposit is returned, DRS will treat your account as if you never

Hartford CT 06103-1837

deposited that portion of the deposit. No interest accrues or

Attach a check or money order made payable to Commissioner

is paid on a deposit that is returned to you.

of Revenue Services to this form.

Line Instructions

Does Filing Form APL-004 Constitute a Protest of

Line 1

the Assessment?

Check the box indicating what type of entity the taxpayer is.

Filing Form APL-004 does not, in and of itself, constitute

fi ling a protest of an assessment.

Line 2

How is a Deposit in the Nature of a Cash Bond

Enter the beginning and ending tax periods of the audit

Applied?

examination.

DRS applies the deposit once the amount of tax due is fi nally

Example: Tax period of January 1, 2016, through October 31,

determined. If you make a deposit before DRS issues a

2016, inclusive.

notice of assessment, the amount of the assessment (plus

Line 3

any interest or penalty) stated on the notice will not refl ect or

take into account the deposit. If you timely fi le a protest of the

Enter the type of tax audited.

assessment with the Appellate Division, and make a deposit

Example: Corporation business tax, sales and use taxes,

before the Appellate Division issues a fi nal determination

gift tax, income tax, etc.

letter, the amount of the assessment upheld by the fi nal

determination letter (plus any interest or penalty) will not

Line 4

refl ect or take into account the deposit.

Enter the name of revenue examiner (if known) who

The application of the deposit is a two-step process.

conducted the audit examination.

Step One: Compute a fraction. The numerator is the tax

Line 5

assessed by DRS, as stated on the notice of assessment.

The denominator is the tax assessed by DRS, as stated on

Enter the amount of the remittance that you are designating

the notice of assessment, plus the interest that has accrued

as a deposit in the nature of a cash bond.

on the tax through the date that the deposit is received.

Form APL-004 (Back) (Rev.

)

05/17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1