Consent To Use Personal Tax Return Information

ADVERTISEMENT

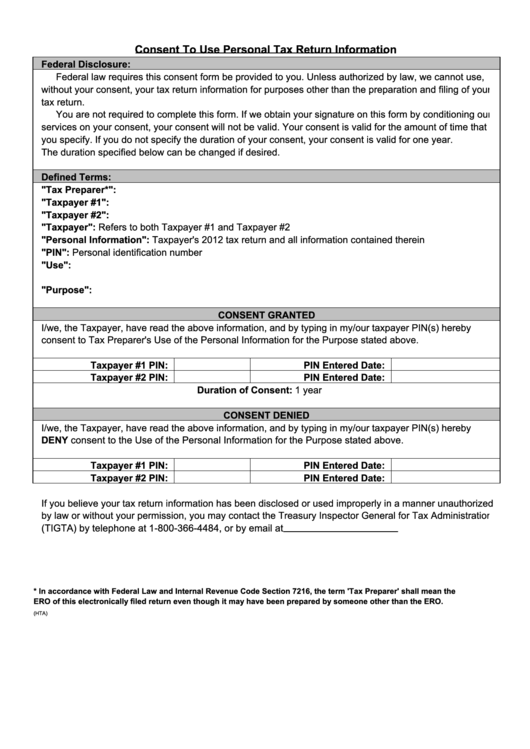

Consent To Use Personal Tax Return Information

Federal Disclosure:

Federal law requires this consent form be provided to you. Unless authorized by law, we cannot use,

without your consent, your tax return information for purposes other than the preparation and filing of your

tax return.

You are not required to complete this form. If we obtain your signature on this form by conditioning our

services on your consent, your consent will not be valid. Your consent is valid for the amount of time that

you specify. If you do not specify the duration of your consent, your consent is valid for one year.

The duration specified below can be changed if desired.

Defined Terms:

"Tax Preparer*":

"Taxpayer #1":

"Taxpayer #2":

"Taxpayer": Refers to both Taxpayer #1 and Taxpayer #2

"Personal Information": Taxpayer's 2012 tax return and all information contained therein

"PIN": Personal identification number

"Use":

"Purpose":

CONSENT GRANTED

I/we, the Taxpayer, have read the above information, and by typing in my/our taxpayer PIN(s) hereby

consent to Tax Preparer's Use of the Personal Information for the Purpose stated above.

Taxpayer #1 PIN:

PIN Entered Date:

Taxpayer #2 PIN:

PIN Entered Date:

Duration of Consent: 1 year

CONSENT DENIED

I/we, the Taxpayer, have read the above information, and by typing in my/our taxpayer PIN(s) hereby

DENY consent to the Use of the Personal Information for the Purpose stated above.

Taxpayer #1 PIN:

PIN Entered Date:

Taxpayer #2 PIN:

PIN Entered Date:

If you believe your tax return information has been disclosed or used improperly in a manner unauthorized

by law or without your permission, you may contact the Treasury Inspector General for Tax Administration

(TIGTA) by telephone at 1-800-366-4484, or by email at complaints@tigta.treas.gov.

* In accordance with Federal Law and Internal Revenue Code Section 7216, the term 'Tax Preparer' shall mean the

ERO of this electronically filed return even though it may have been prepared by someone other than the ERO.

(HTA)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2