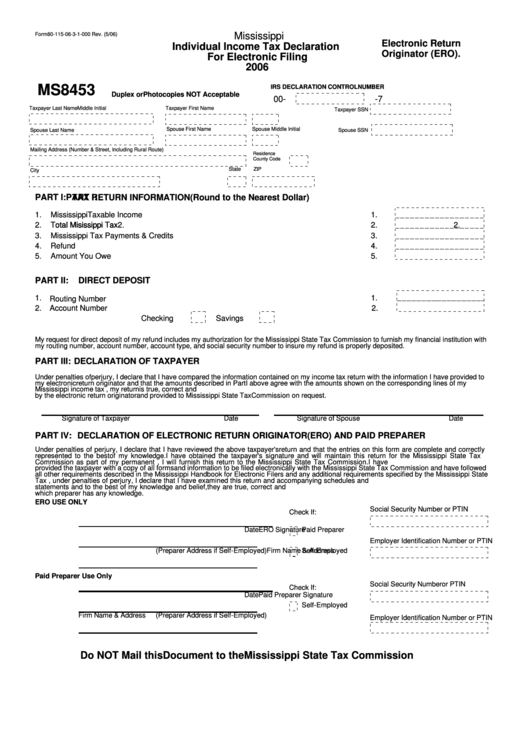

Form 80-115-06-3-1-000 - Individual Income Tax Declaration For Electronic Filing - State Of Mississippi - 2006

ADVERTISEMENT

Form 80-115-06-3-1-000 Rev. (5/06)

Mississippi

Electronic Return

Individual Income Tax Declaration

Originator (ERO).

For Electronic Filing

2006

MS8453

IRS DECLARATION CONTROL NUMBER

Duplex or Photocopies NOT Acceptable

00-

-7

Taxpayer Last Name

Taxpayer First Name

Middle Initial

Taxpayer SSN

Spouse First Name

Spouse Middle Initial

Spouse Last Name

Spouse SSN

Mailing Address (Number & Street, Including Rural Route)

Residence

County Code

State

ZIP

City

PART I:

PART I:

TAX RETURN INFORMATION (Round to the Nearest Dollar)

1.

Mississippi Taxable Income

1.

2.

2.

Total Misissippi Tax

Total Misissippi Tax

2.

2.

3.

Mississippi Tax Payments & Credits

3.

4.

Refund

4.

Amount You Owe

5.

5.

PART II:

DIRECT DEPOSIT

1.

1.

Routing Number

2.

Account Number

2.

3. Type of Account

Checking

Savings

My request for direct deposit of my refund includes my authorization for the Mississippi State Tax Commission to furnish my financial institution with

my routing number, account number, account type, and social security number to insure my refund is properly deposited.

PART III:

DECLARATION OF TAXPAYER

Under penalties of perjury, I declare that I have compared the information contained on my income tax return with the information I have provided to

my electronic return originator and that the amounts described in Part I above agree with the amounts shown on the corresponding lines of my

Mississippi income tax return. To the best of my knowledge and belief, my return is true, correct and complete. This declaration is to be maintained

by the electronic return originator and provided to Mississippi State Tax Commission on request.

Signature of Taxpayer

Date

Signature of Spouse

Date

PART IV:

DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

Under penalties of perjury, I declare that I have reviewed the above taxpayer's return and that the entries on this form are complete and correctly

represented to the best of my knowledge. I have obtained the taxpayer's signature and will maintain this return for the Mississippi State Tax

Commission as part of my permanent records. Upon written request, I will furnish this return to the Mississippi State Tax Commission. I have

provided the taxpayer with a copy of all forms and information to be filed electronically with the Mississippi State Tax Commission and have followed

all other requirements described in the Mississippi Handbook for Electronic Filers and any additional requirements specified by the Mississippi State

Tax Commission. If I am the paid preparer, under penalties of perjury, I declare that I have examined this return and accompanying schedules and

statements and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer is based on all information of

which preparer has any knowledge.

ERO USE ONLY

Social Security Number or PTIN

Check If:

ERO Signature

Date

Paid Preparer

Employer Identification Number or PTIN

Firm Name & Address

(Preparer Address if Self-Employed)

Self-Employed

Paid Preparer Use Only

Social Security Number or PTIN

Check If:

Paid Preparer Signature

Date

Self-Employed

Firm Name & Address

(Preparer Address if Self-Employed)

Employer Identification Number or PTIN

Do NOT Mail this Document to the Mississippi State Tax Commission

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1