Form 4752 - 2012 Michigan Business Tax Unitary Business Group Combined Filing Schedule For Financial Institutions

ADVERTISEMENT

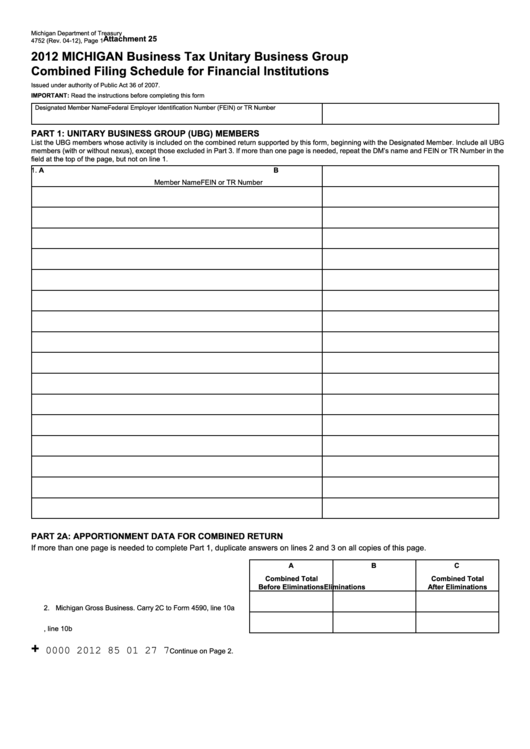

Michigan Department of Treasury

Attachment 25

4752 (Rev. 04-12), Page 1

2012 MICHIGAN Business Tax Unitary Business Group

Combined Filing Schedule for Financial Institutions

Issued under authority of Public Act 36 of 2007.

IMPORTANT: Read the instructions before completing this form

Designated Member Name

Federal Employer Identification Number (FEIN) or TR Number

PART 1: UNITARy BUSINeSS GROUP (UBG) MeMBeRS

List the UBG members whose activity is included on the combined return supported by this form, beginning with the Designated Member. Include all UBG

members (with or without nexus), except those excluded in Part 3. If more than one page is needed, repeat the DM’s name and FEIN or TR Number in the

field at the top of the page, but not on line 1.

1.

A

B

Member Name

FEIN or TR Number

PART 2A: APPORTIONMeNT DATA FOR COMBINeD ReTURN

If more than one page is needed to complete Part 1, duplicate answers on lines 2 and 3 on all copies of this page.

A

B

C

Combined Total

Combined Total

Before eliminations

eliminations

After eliminations

2. Michigan Gross Business. Carry 2C to Form 4590, line 10a .......

3. Total Gross Business. Carry 3C to Form 4590, line 10b ...........

+

0000 2012 85 01 27 7

Continue on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4