Estimated Tax Payments (It-2106) And It-205 Balance Due Payments - Check Transmittal Form

ADVERTISEMENT

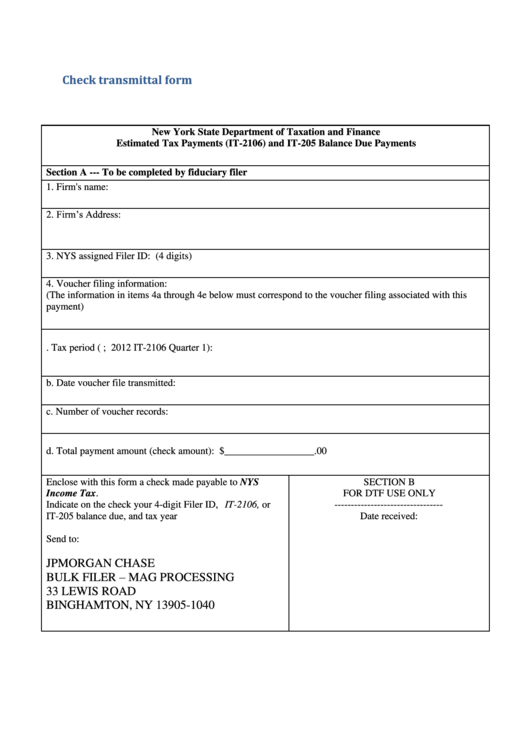

Check transmittal form

New York State Department of Taxation and Finance

Estimated Tax Payments (IT-2106) and IT-205 Balance Due Payments

Section A --- To be completed by fiduciary filer

1. Firm's name:

2. Firm’s Address:

3. NYS assigned Filer ID: (4 digits)

4. Voucher filing information:

(The information in items 4a through 4e below must correspond to the voucher filing associated with this

payment)

.

Tax period (e.g. 2011 IT-205 balance due; 2012 IT-2106 Quarter 1):

b. Date voucher file transmitted:

c. Number of voucher records:

d. Total payment amount (check amount): $__________________.00

Enclose with this form a check made payable to NYS

SECTION B

Income Tax.

FOR DTF USE ONLY

Indicate on the check your 4-digit Filer ID, IT-2106, or

---------------------------------

IT-205 balance due, and tax year

Date received:

Send to:

JPMORGAN CHASE

BULK FILER – MAG PROCESSING

33 LEWIS ROAD

BINGHAMTON, NY 13905-1040

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1