Clear Form

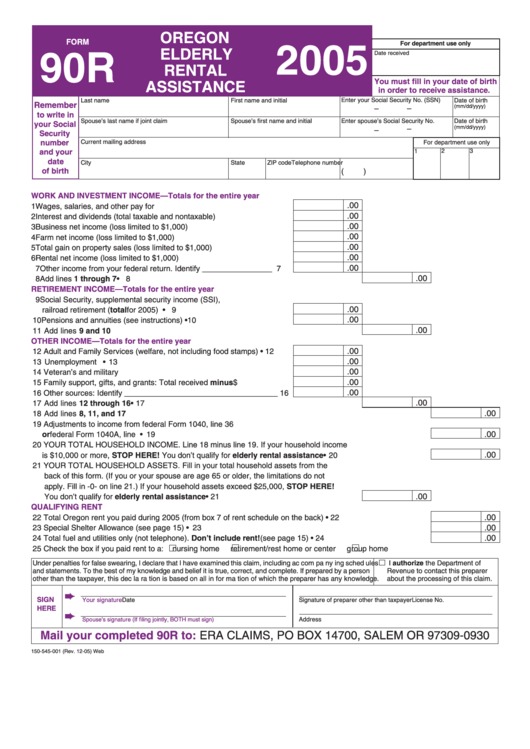

OREGON

FORM

For department use only

2005

ELDERLY

Date received

90R

RENTAL

You must fill in your date of birth

ASSISTANCE

in order to receive assistance.

Last name

First name and initial

Enter your Social Security No. (SSN)

Date of birth

Remember

(mm/dd/yyyy)

–

–

to write in

Spouse’s last name if joint claim

Spouse’s first name and initial

Enter spouse’s Social Security No.

Date of birth

your Social

(mm/dd/yyyy)

–

–

Security

Current mailing address

number

For department use only

1

2

3

and your

date

City

State

ZIP code

Telephone number

of birth

(

)

WORK AND INVESTMENT INCOME—Totals for the entire year

.00

1 Wages, salaries, and other pay for work............................................

1

.00

2 Interest and dividends (total taxable and nontaxable) .......................

2

.00

3 Business net income (loss limited to $1,000) ....................................

3

.00

4 Farm net income (loss limited to $1,000)...........................................

4

.00

5 Total gain on property sales (loss limited to $1,000)..........................

5

.00

6 Rental net income (loss limited to $1,000).........................................

6

.00

7 Other income from your federal return. Identify ________________

7

.00

8 Add lines 1 through 7.......................................................................................................• 8

RETIREMENT INCOME—Totals for the entire year

9 Social Security, supplemental security income (SSI),

.00

railroad retirement (total for 2005) ................................................... • 9

.00

10 Pensions and annuities (see instructions) ........................................ • 10

.00

11 Add lines 9 and 10............................................................................................................. 11

OTHER INCOME—Totals for the entire year

.00

12 Adult and Family Services (welfare, not including food stamps)....... • 12

.00

13 Unemployment benefits .................................................................... • 13

.00

14 Veteran’s and military benefits........................................................... 14

.00

15 Family support, gifts, and grants: Total received minus $500 ........... 15

.00

16 Other sources: Identify ___________________________________ 16

.00

17 Add lines 12 through 16 ..................................................................................................• 17

.00

18 Add lines 8, 11, and 17 ..................................................................................................................................... 18

19 Adjustments to income from federal Form 1040, line 36

.00

or federal Form 1040A, line 20........................................................................................................................ • 19

20 YOUR TOTAL HOUSEHOLD INCOME. Line 18 minus line 19. If your household income

.00

is $10,000 or more, STOP HERE! You don’t qualify for elderly rental assistance ....................................... • 20

21 YOUR TOTAL HOUSEHOLD ASSETS. Fill in your total household assets from the

back of this form. (If you or your spouse are age 65 or older, the limitations do not

apply. Fill in -0- on line 21.) If your household assets exceed $25,000, STOP HERE!

You don’t qualify for elderly rental assistance ...............................................................• 21

.00

QUALIFYING RENT

22 Total Oregon rent you paid during 2005 (from box 7 of rent schedule on the back)........................................ • 22

.00

23 Special Shelter Allowance (see page 15) ........................................................................................................ • 23

.00

24 Total fuel and utilities only (not telephone). Don’t include rent! (see page 15) ............................................. • 24

.00

25 Check the box if you paid rent to a:

nursing home

retirement/rest home or center

group home

Under penalties for false swearing, I declare that I have examined this claim, including ac com pa ny ing sched ules

I authorize the Department of

and statements. To the best of my knowledge and belief it is true, correct, and complete. If prepared by a person

Revenue to contact this preparer

other than the taxpayer, this dec la ra tion is based on all in for ma tion of which the preparer has any knowledge.

about the processing of this claim.

➨

SIGN

Your signature

Date

Signature of preparer other than taxpayer

License No.

HERE

➨

Spouse’s signature (If filing jointly, BOTH must sign)

Address

Mail your completed 90R to:

ERA CLAIMS, PO BOX 14700, SALEM OR 97309-0930

150-545-001 (Rev. 12-05) Web

1

1 2

2