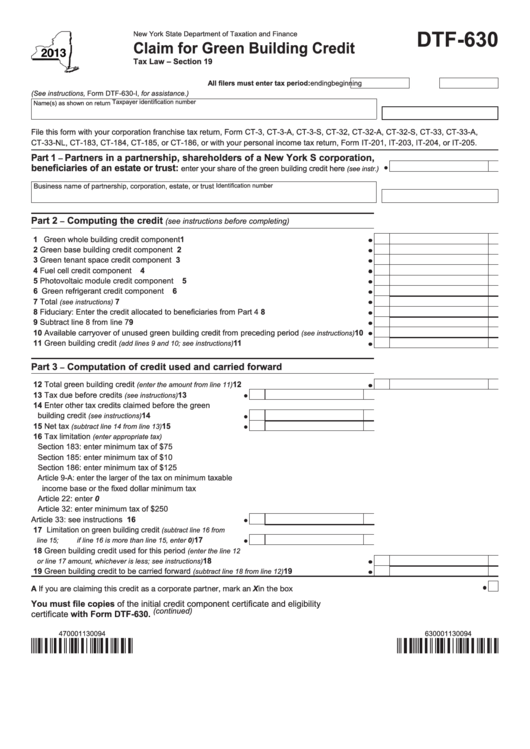

DTF-630

New York State Department of Taxation and Finance

Claim for Green Building Credit

Tax Law – Section 19

All filers must enter tax period:

beginning

ending

(See instructions, Form DTF-630-I, for assistance.)

Taxpayer identification number

Name(s) as shown on return

File this form with your corporation franchise tax return, Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A,

CT-33-NL, CT-183, CT-184, CT-185, or CT-186, or with your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Part 1

Partners in a partnership, shareholders of a New York S corporation,

–

beneficiaries of an estate or trust:

enter your share of the green building credit here

(see instr.)

Business name of partnership, corporation, estate, or trust

Identification number

Part 2

Computing the credit

–

(see instructions before completing)

1 Green whole building credit component .....................................................................................

1

2 Green base building credit component ......................................................................................

2

3 Green tenant space credit component .......................................................................................

3

4 Fuel cell credit component ........................................................................................................

4

5 Photovoltaic module credit component .....................................................................................

5

6 Green refrigerant credit component ..........................................................................................

6

7 Total

.................................................................................................................

7

(see instructions)

8 Fiduciary: Enter the credit allocated to beneficiaries from Part 4 ..............................................

8

9 Subtract line 8 from line 7...........................................................................................................

9

10 Available carryover of unused green building credit from preceding period

....

10

(see instructions)

11 Green building credit

............................................................

11

(add lines 9 and 10; see instructions)

Part 3

Computation of credit used and carried forward

–

12 Total green building credit

..............................................................

12

(enter the amount from line 11)

13 Tax due before credits

..............................

13

(see instructions)

14 Enter other tax credits claimed before the green

building credit

.......................................

14

(see instructions)

15 Net tax

.....................................

15

(subtract line 14 from line 13)

16 Tax limitation

(enter appropriate tax)

Section 183: enter minimum tax of $75

Section 185: enter minimum tax of $10

Section 186: enter minimum tax of $125

Article 9-A: enter the larger of the tax on minimum taxable

income base or the fixed dollar minimum tax

Article 22: enter 0

Article 32: enter minimum tax of $250

Article 33: see instructions .............................................

16

17 Limitation on green building credit

(subtract line 16 from

......................

17

line 15; if line 16 is more than line 15, enter 0)

18 Green building credit used for this period

(enter the line 12

...................................................................

18

or line 17 amount, whichever is less; see instructions)

19 Green building credit to be carried forward

.....................................

19

(subtract line 18 from line 12)

A If you are claiming this credit as a corporate partner, mark an X in the box ...................................................................................

You must file copies of the initial credit component certificate and eligibility

(continued)

certificate with Form DTF-630.

470001130094

630001130094

1

1 2

2