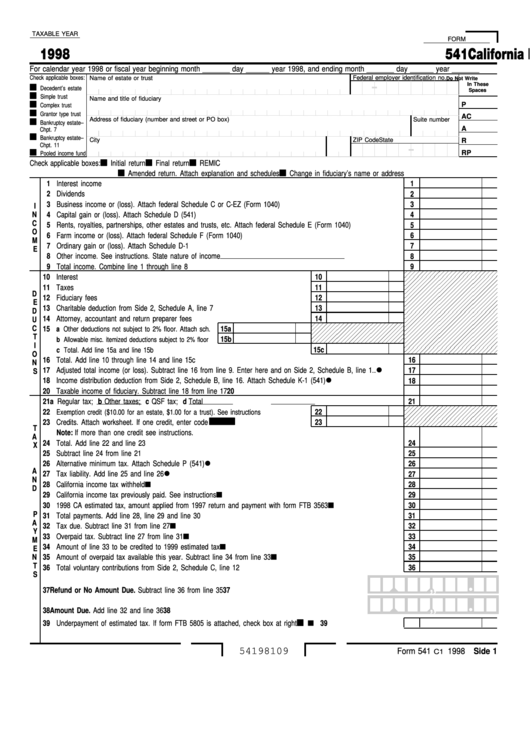

TAXABLE YEAR

FORM

1998

California Fiduciary Income Tax Return

541

For calendar year 1998 or fiscal year beginning month _______ day ______ year 1998, and ending month _______ day ______ year _______

Federal employer identification no.

Check applicable boxes:

Name of estate or trust

Do Not Write

In These

Decedent’s estate

Spaces

Simple trust

Name and title of fiduciary

P

Complex trust

Grantor type trust

AC

Address of fiduciary (number and street or PO box)

Suite number

Bankruptcy estate –

A

Chpt. 7

Bankruptcy estate –

City

State

ZIP Code

R

Chpt. 11

RP

Pooled income fund

Check applicable boxes:

Initial return

Final return

REMIC

Amended return. Attach explanation and schedules

Change in fiduciary’s name or address

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Business income or (loss). Attach federal Schedule C or C-EZ (Form 1040). . . . . . . . . . . . . . . . . . . . . . . .

3

I

N

4 Capital gain or (loss). Attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

C

5 Rents, royalties, partnerships, other estates and trusts, etc. Attach federal Schedule E (Form 1040) . . . . . . . . . .

5

O

6 Farm income or (loss). Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

M

7 Ordinary gain or (loss). Attach Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

E

8 Other income. See instructions. State nature of income

. . . . . . . . . . .

8

9 Total income. Combine line 1 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

D

12 Fiduciary fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

E

13 Charitable deduction from Side 2, Schedule A, line 7 . . . . . . . . . . . . . . . . . .

13

D

14 Attorney, accountant and return preparer fees. . . . . . . . . . . . . . . . . . . . . . .

14

U

C

15

a Other deductions not subject to 2% floor. Attach sch.

15a

T

15b

b Allowable misc. itemized deductions subject to 2% floor

I

15c

c Total. Add line 15a and line 15b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

O

16 Total. Add line 10 through line 14 and line 15c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

N

•

17 Adjusted total income (or loss). Subtract line 16 from line 9. Enter here and on Side 2, Schedule B, line 1

. .

17

S

•

18 Income distribution deduction from Side 2, Schedule B, line 16. Attach Schedule K-1 (541) . . . . . . . . . . . .

18

20 Taxable income of fiduciary. Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21 a Regular tax

; b Other taxes

; c QSF tax

; d Total . . . . . . . .

21

22

Exemption credit ($10.00 for an estate, $1.00 for a trust). See instructions . . . . . . . . .

22

23 Credits. Attach worksheet. If one credit, enter code

. . . . . . . . . . . . . .

23

T

Note: If more than one credit see instructions.

A

24 Total. Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

X

25 Subtract line 24 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

•

26 Alternative minimum tax. Attach Schedule P (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

•

A

27 Tax liability. Add line 25 and line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

N

28 California income tax withheld. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

D

29 California income tax previously paid. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 1998 CA estimated tax, amount applied from 1997 return and payment with form FTB 3563 . . . . . . . . . . .

30

P

31 Total payments. Add line 28, line 29 and line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

A

32 Tax due. Subtract line 31 from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

Y

33 Overpaid tax. Subtract line 27 from line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

M

34 Amount of line 33 to be credited to 1999 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

E

N

35 Amount of overpaid tax available this year. Subtract line 34 from line 33 . . . . . . . . . . . . . . . . . . . . . .

35

T

36 Total voluntary contributions from Side 2, Schedule C, line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

S

,

,

•

37 Refund or No Amount Due. Subtract line 36 from line 35 . . . . . . . . . . . . . . . . . . . . . .

37

,

,

•

38 Amount Due. Add line 32 and line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

39 Underpayment of estimated tax. If form FTB 5805 is attached, check box at right . . . . . . . . . . . . . . .

39

54198109

Form 541

1998 Side 1

C1

1

1 2

2