Form Ar1000adj - Schedule Of Other Adjustments - 2010

ADVERTISEMENT

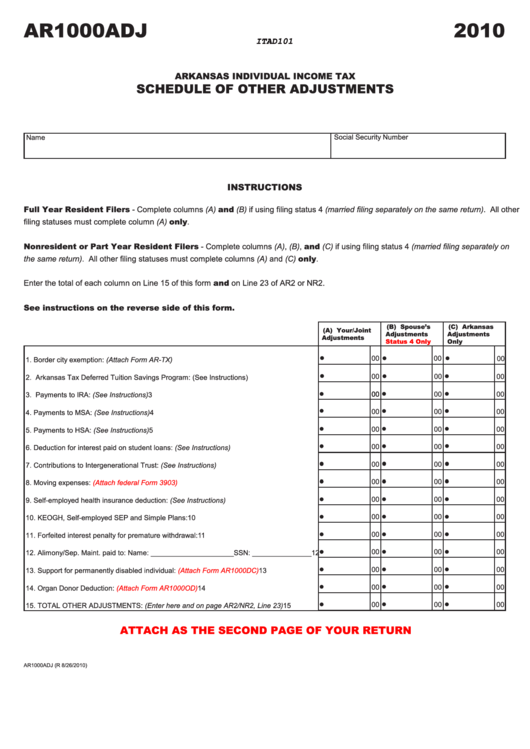

AR1000ADJ

2010

ITAD101

ARKANSAS INDIVIDUAL INCOME TAX

SCHEDULE OF OTHER ADJUSTMENTS

Name

Social Security Number

INSTRUCTIONS

Full Year Resident Filers - Complete columns (A) and (B) if using filing status 4 (married filing separately on the same return). All other

filing statuses must complete column (A) only.

Nonresident or Part Year Resident Filers - Complete columns (A), (B), and (C) if using filing status 4 (married filing separately on

the same return). All other filing statuses must complete columns (A) and (C) only.

Enter the total of each column on Line 15 of this form and on Line 23 of AR2 or NR2.

See instructions on the reverse side of this form.

(B)

Spouse’s

(C) Arkansas

(A) Your/Joint

Adjustments

Adjustments

Adjustments

Only

Status 4 Only

00

00

00

1. Border city exemption: (Attach Form AR-TX) .......................................................................1

00

00

00

2. Arkansas Tax Deferred Tuition Savings Program: (See Instructions) ...................................2

00

00

00

00

3. Payments to IRA: (See Instructions) ....................................................................................3

00

00

00

4. Payments to MSA: (See Instructions) ..................................................................................4

00

00

00

5. Payments to HSA: (See Instructions)...................................................................................5

00

00

00

6. Deduction for interest paid on student loans: (See Instructions)..........................................6

00

00

00

7. Contributions to Intergenerational Trust: (See Instructions) .................................................7

00

00

00

8. Moving expenses:

(Attach federal Form 3903)

....................................................................8

00

00

00

9. Self-employed health insurance deduction: (See Instructions) ............................................9

00

00

00

10. KEOGH, Self-employed SEP and Simple Plans: ...............................................................10

00

00

00

11. Forfeited interest penalty for premature withdrawal: .......................................................... 11

00

00

00

12. Alimony/Sep. Maint. paid to: Name: _____________________ SSN: _______________ 12

00

00

00

13. Support for permanently disabled individual:

(Attach Form AR1000DC)

...........................13

00

00

00

14. Organ Donor Deduction:

(Attach Form AR1000OD)

..........................................................14

00

00

00

15. TOTAL OTHER ADJUSTMENTS: (Enter here and on page AR2/NR2, Line 23) ............... 15

ATTACH AS THE SECOND PAGE OF YOUR RETURN

AR1000ADJ (R 8/26/2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2