Clear Form

2011

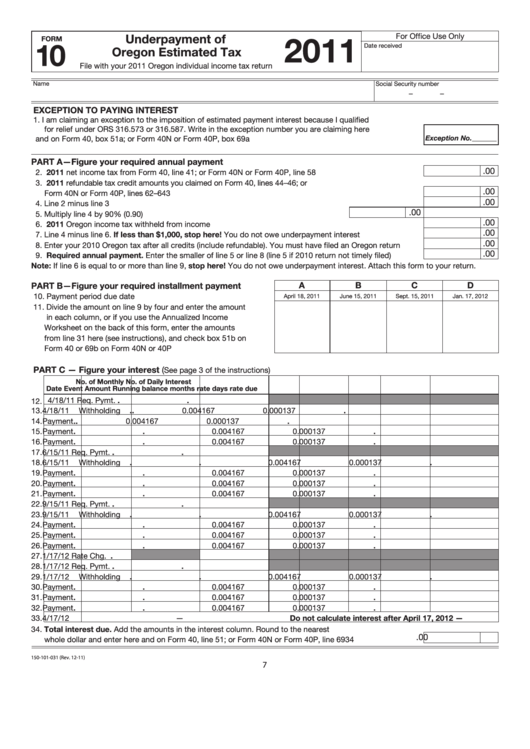

Underpayment of

For Office Use Only

FORM

10

Date received

Oregon Estimated Tax

File with your 2011 Oregon individual income tax return

Name

Social Security number

–

–

EXCEPTION TO PAYING INTEREST

1. I am claiming an exception to the imposition of estimated payment interest because I qualified

for relief under ORS 316.573 or 316.587. Write in the exception number you are claiming here

and on Form 40, box 51a; or Form 40N or Form 40P, box 69a ........................................................................ 1

Exception No._______

PART A—Figure your required annual payment

.00

2. 2011 net income tax from Form 40, line 41; or Form 40N or Form 40P, line 58 ............................................... 2

3. 2011 refundable tax credit amounts you claimed on Form 40, lines 44–46; or

.00

Form 40N or Form 40P, lines 62–64 .........................................................................................................................3

.00

4. Line 2 minus line 3 ............................................................................................................................................. 4

.00

5. Multiply line 4 by 90% (0.90) ............................................................................................5

.00

6. 2011 Oregon income tax withheld from income ................................................................................................ 6

.00

7. Line 4 minus line 6. If less than $1,000, stop here! You do not owe underpayment interest .......................... 7

.00

8. Enter your 2010 Oregon tax after all credits (include refundable). You must have filed an Oregon return ........ 8

.00

9. Required annual payment. Enter the smaller of line 5 or line 8 (line 5 if 2010 return not timely filed) ............. 9

Note: If line 6 is equal to or more than line 9, stop here! You do not owe underpayment interest. Attach this form to your return.

PART B—Figure your required installment payment

A

B

C

D

10. Payment period due date ............................................................ 10

April 18, 2011

June 15, 2011

Sept. 15, 2011

Jan. 17, 2012

11. Divide the amount on line 9 by four and enter the amount

in each column, or if you use the Annualized Income

Worksheet on the back of this form, enter the amounts

from line 31 here (see instructions), and check box 51b on

Form 40 or 69b on Form 40N or 40P .......................................... 11

PART C — Figure your interest (

See page 3 of the instructions)

No. of

Monthly

No. of

Daily

Interest

Date

Event

Amount

Running balance

months

rate

days

rate

due

4/18/11

Req. Pymt.

.

.

12.

.

.

.

13. 4/18/11

Withholding

0.004167

0.000137

14.

Payment

.

.

0.004167

0.000137

.

15.

Payment

.

.

0.004167

0.000137

.

.

.

.

16.

Payment

0.004167

0.000137

17. 6/15/11

Req. Pymt.

.

.

.

.

.

18. 6/15/11

Withholding

0.004167

0.000137

19.

Payment

.

.

0.004167

0.000137

.

20.

Payment

.

.

0.004167

0.000137

.

.

.

.

21.

Payment

0.004167

0.000137

22. 9/15/11

Req. Pymt.

.

.

23. 9/15/11

Withholding

.

.

0.004167

0.000137

.

.

.

.

24.

Payment

0.004167

0.000137

25.

Payment

.

.

0.004167

0.000137

.

26.

Payment

.

.

0.004167

0.000137

.

27. 1/17/12

Rate Chg.

.

28. 1/17/12

Req. Pymt.

.

.

.

.

.

29. 1/17/12

Withholding

0.004167

0.000137

30.

Payment

.

.

0.004167

0.000137

.

31.

Payment

.

.

0.004167

0.000137

.

.

.

.

32.

Payment

0.004167

0.000137

33. 4/17/12

— Do not calculate interest after April 17, 2012 —

34. Total interest due. Add the amounts in the interest column. Round to the nearest

.00

whole dollar and enter here and on Form 40, line 51; or Form 40N or Form 40P, line 69 .............................. 34

150-101-031 (Rev. 12-11)

7

1

1 2

2