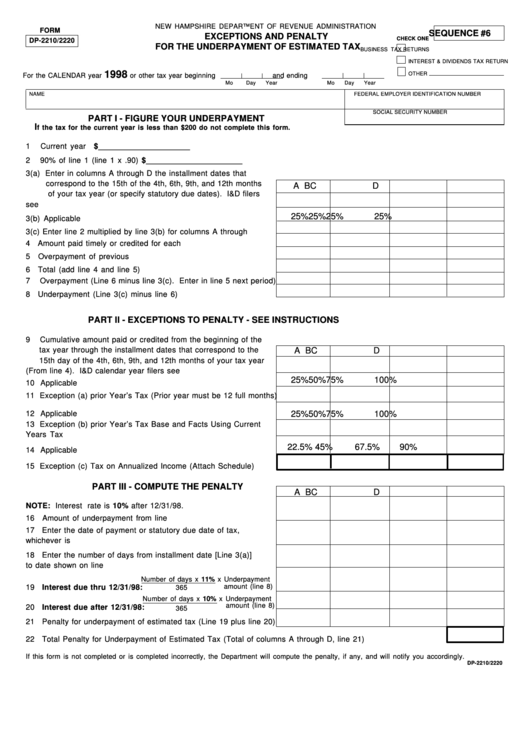

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

SEQUENCE #6

EXCEPTIONS AND PENALTY

CHECK ONE

DP-2210/2220

FOR THE UNDERPAYMENT OF ESTIMATED TAX

BUSINESS TAX RETURNS

INTEREST & DIVIDENDS TAX RETURN

1998

OTHER

For the CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

SOCIAL SECURITY NUMBER

PART I - FIGURE YOUR UNDERPAYMENT

I

f the tax for the current year is less than $200 do not complete this form.

1

Current year tax....................................................................................... $____________________

2

90% of line 1 (line 1 x .90)...................................................................... $_____________________

3(a) Enter in columns A through D the installment dates that

correspond to the 15th of the 4th, 6th, 9th, and 12th months

A

B

C

D

of your tax year (or specify statutory due dates). I&D filers

see instructions......................................................................

25%

25%

25%

25%

3(b) Applicable percentages................................................................

3(c) Enter line 2 multiplied by line 3(b) for columns A through D.......

4

Amount paid timely or credited for each period..............................

5

Overpayment of previous installment.............................................

6

Total (add line 4 and line 5)...........................................................

7

Overpayment (Line 6 minus line 3(c). Enter in line 5 next period)

8

Underpayment (Line 3(c) minus line 6)..........................................

PART II - EXCEPTIONS TO PENALTY - SEE INSTRUCTIONS

9

Cumulative amount paid or credited from the beginning of the

tax year through the installment dates that correspond to the

A

B

C

D

15th day of the 4th, 6th, 9th, and 12th months of your tax year

(From line 4). I&D calendar year filers see instructions..............

25%

50%

75%

100%

10 Applicable percentages.................................................................

11 Exception (a) prior Year’s Tax (Prior year must be 12 full months)

12 Applicable percentages.................................................................

25%

50%

75%

100%

13 Exception (b) prior Year’s Tax Base and Facts Using Current

Years Tax Rate...............................................................................

22.5%

45%

67.5%

90%

14 Applicable percentages.................................................................

15 Exception (c) Tax on Annualized Income (Attach Schedule).........

PART III - COMPUTE THE PENALTY

A

B

C

D

NOTE: Interest rate is 10% after 12/31/98.

16

Amount of underpayment from line 8...........................................

17 Enter the date of payment or statutory due date of tax,

whichever is earlier.....................................................................

18

Enter the number of days from installment date [Line 3(a)]

to date shown on line 17............................................................

Number of days x 11% x Underpayment

19 Interest due thru 12/31/98:

amount (line 8)

365

Number of days x 10% x Underpayment

amount (line 8)

20

Interest due after 12/31/98:

365

21

Penalty for underpayment of estimated tax (Line 19 plus line 20)

22

Total Penalty for Underpayment of Estimated Tax (Total of columns A through D, line 21)...................................

If this form is not completed or is completed incorrectly, the Department will compute the penalty, if any, and will notify you accordingly.

DP-2210/2220

1

1