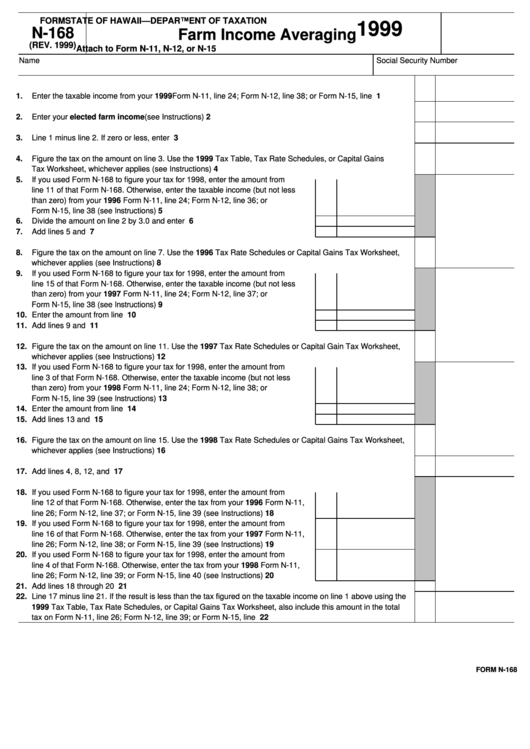

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

1999

N-168

Farm Income Averaging

(REV. 1999)

Attach to Form N-11, N-12, or N-15

Name

Social Security Number

1.

Enter the taxable income from your 1999 Form N-11, line 24; Form N-12, line 38; or Form N-15, line 40..........

1

2.

Enter your elected farm income (see Instructions) .............................................................................................

2

3.

3

Line 1 minus line 2. If zero or less, enter -0- .........................................................................................................

4.

Figure the tax on the amount on line 3. Use the 1999 Tax Table, Tax Rate Schedules, or Capital Gains

Tax Worksheet, whichever applies (see Instructions)...........................................................................................

4

5.

If you used Form N-168 to figure your tax for 1998, enter the amount from

line 11 of that Form N-168. Otherwise, enter the taxable income (but not less

than zero) from your 1996 Form N-11, line 24; Form N-12, line 36; or

Form N-15, line 38 (see Instructions) ...................................................................

5

6.

Divide the amount on line 2 by 3.0 and enter here ..............................................

6

7.

7

Add lines 5 and 6..................................................................................................

8.

Figure the tax on the amount on line 7. Use the 1996 Tax Rate Schedules or Capital Gains Tax Worksheet,

whichever applies (see Instructions) .....................................................................................................................

8

9.

If you used Form N-168 to figure your tax for 1998, enter the amount from

line 15 of that Form N-168. Otherwise, enter the taxable income (but not less

than zero) from your 1997 Form N-11, line 24; Form N-12, line 37; or

Form N-15, line 38 (see Instructions) ...................................................................

9

10. Enter the amount from line 6 ................................................................................

10

11. Add lines 9 and 10................................................................................................

11

12. Figure the tax on the amount on line 11. Use the 1997 Tax Rate Schedules or Capital Gain Tax Worksheet,

whichever applies (see Instructions) .....................................................................................................................

12

13. If you used Form N-168 to figure your tax for 1998, enter the amount from

line 3 of that Form N-168. Otherwise, enter the taxable income (but not less

than zero) from your 1998 Form N-11, line 24; Form N-12, line 38; or

Form N-15, line 39 (see Instructions) ...................................................................

13

14. Enter the amount from line 6 ................................................................................

14

15. Add lines 13 and 14..............................................................................................

15

16. Figure the tax on the amount on line 15. Use the 1998 Tax Rate Schedules or Capital Gains Tax Worksheet,

whichever applies (see Instructions) .....................................................................................................................

16

17. Add lines 4, 8, 12, and 16......................................................................................................................................

17

18. If you used Form N-168 to figure your tax for 1998, enter the amount from

line 12 of that Form N-168. Otherwise, enter the tax from your 1996 Form N-11,

line 26; Form N-12, line 37; or Form N-15, line 39 (see Instructions) ..................

18

19. If you used Form N-168 to figure your tax for 1998, enter the amount from

line 16 of that Form N-168. Otherwise, enter the tax from your 1997 Form N-11,

line 26; Form N-12, line 38; or Form N-15, line 39 (see Instructions) ..................

19

20. If you used Form N-168 to figure your tax for 1998, enter the amount from

line 4 of that Form N-168. Otherwise, enter the tax from your 1998 Form N-11,

line 26; Form N-12, line 39; or Form N-15, line 40 (see Instructions) ..................

20

21. Add lines 18 through 20 ........................................................................................................................................

21

22. Line 17 minus line 21. If the result is less than the tax figured on the taxable income on line 1 above using the

1999 Tax Table, Tax Rate Schedules, or Capital Gains Tax Worksheet, also include this amount in the total

tax on Form N-11, line 26; Form N-12, line 39; or Form N-15, line 41..................................................................

22

FORM N-168

1

1