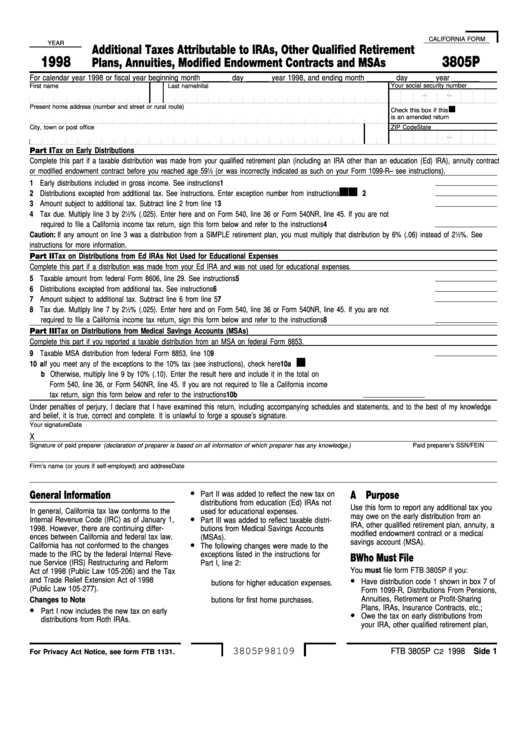

California Form Ftb 3805p - Additional Taxes Attributable To Iras, Other Qualified Retirement Plans, Annuities, Modified Endowment Contracts And Msas - 1998

ADVERTISEMENT

CALIFORNIA FORM

YEAR

Additional Taxes Attributable to IRAs, Other Qualified Retirement

1998

3805P

Plans, Annuities, Modified Endowment Contracts and MSAs

For calendar year 1998 or fiscal year beginning month _______ day ______ year 1998, and ending month _______ day ______ year _______

Your social security number

First name

Initial

Last name

Present home address (number and street or rural route)

Check this box if this

is an amended return

City, town or post office

State

ZIP Code

Part I

Tax on Early Distributions

Complete this part if a taxable distribution was made from your qualified retirement plan (including an IRA other than an education (Ed) IRA), annuity contract

or modified endowment contract before you reached age 59

1

⁄

(or was incorrectly indicated as such on your Form 1099-R – see instructions).

2

1 Early distributions included in gross income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Distributions excepted from additional tax. See instructions. Enter exception number from instructions

. . . . . . . . . . .

2

3 Amount subject to additional tax. Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Tax due. Multiply line 3 by 2

1

⁄

% (.025). Enter here and on Form 540, line 36 or Form 540NR, line 45. If you are not

2

required to file a California income tax return, sign this form below and refer to the instructions. . . . . . . . . . . . . . . . . . . .

4

Caution: If any amount on line 3 was a distribution from a SIMPLE retirement plan, you must multiply that distribution by 6% (.06) instead of 2

1

⁄

%. See

2

instructions for more information.

Part II Tax on Distributions from Ed IRAs Not Used for Educational Expenses

Complete this part if a distribution was made from your Ed IRA and was not used for educational expenses.

5 Taxable amount from federal Form 8606, line 29. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Distributions excepted from additional tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Amount subject to additional tax. Subtract line 6 from line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Tax due. Multiply line 7 by 2

1

⁄

% (.025). Enter here and on Form 540, line 36 or Form 540NR, line 45. If you are not

2

required to file a California income tax return, sign this form below and refer to the instructions. . . . . . . . . . . . . . . . . . . .

8

Part III Tax on Distributions from Medical Savings Accounts (MSAs)

Complete this part if you reported a taxable distribution from an MSA on federal Form 8853.

9 Taxable MSA distribution from federal Form 8853, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 a If you meet any of the exceptions to the 10% tax (see instructions), check here . . . . . . . . . . . . . . . . . . . .

10a

b Otherwise, multiply line 9 by 10% (.10). Enter the result here and include it in the total on

Form 540, line 36, or Form 540NR, line 45. If you are not required to file a California income

tax return, sign this form below and refer to the instructions . . . . . . . . . . . . . . . . . . . . .

10b

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete. It is unlawful to forge a spouse’s signature.

Your signature

Date

X

Signature of paid preparer (declaration of preparer is based on all information of which preparer has any knowledge.)

Paid preparer’s SSN/FEIN

Firm’s name (or yours if self-employed) and address

Date

•

General Information

Part II was added to reflect the new tax on

A Purpose

distributions from education (Ed) IRAs not

Use this form to report any additional tax you

In general, California tax law conforms to the

used for educational expenses.

•

may owe on the early distribution from an

Internal Revenue Code (IRC) as of January 1,

Part III was added to reflect taxable distri-

IRA, other qualified retirement plan, annuity, a

1998. However, there are continuing differ-

butions from Medical Savings Accounts

modified endowment contract or a medical

ences between California and federal tax law.

(MSAs).

•

savings account (MSA).

California has not conformed to the changes

The following changes were made to the

made to the IRC by the federal Internal Reve-

exceptions listed in the instructions for

B Who Must File

nue Service (IRS) Restructuring and Reform

Part I, line 2:

You must file form FTB 3805P if you:

Act of 1998 (Public Law 105-206) and the Tax

1. New exception 08 was added for distri-

•

and Trade Relief Extension Act of 1998

Have distribution code 1 shown in box 7 of

butions for higher education expenses.

(Public Law 105-277).

Form 1099-R, Distributions From Pensions,

2. New exception 09 was added for distri-

Annuities, Retirement or Profit-Sharing

Changes to Note

butions for first home purchases.

•

Plans, IRAs, Insurance Contracts, etc.;

Part I now includes the new tax on early

•

Owe the tax on early distributions from

distributions from Roth IRAs.

your IRA, other qualified retirement plan,

3805P98109

FTB 3805P

1998 Side 1

For Privacy Act Notice, see form FTB 1131.

C2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4