DUALTT-AONM-YRXY-MOHJ-EUJY

6/13

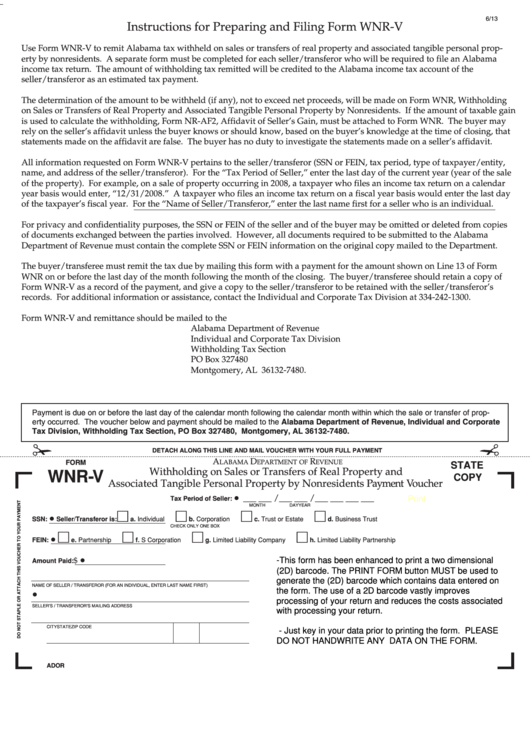

Instructions for Preparing and Filing Form WNR-V

Use Form WNR-V to remit Alabama tax withheld on sales or transfers of real property and associated tangible personal prop-

erty by nonresidents. A separate form must be completed for each seller/transferor who will be required to file an Alabama

income tax return. The amount of withholding tax remitted will be credited to the Alabama income tax account of the

seller/transferor as an estimated tax payment.

The determination of the amount to be withheld (if any), not to exceed net proceeds, will be made on Form WNR, Withholding

on Sales or Transfers of Real Property and Associated Tangible Personal Property by Nonresidents. If the amount of taxable gain

is used to calculate the withholding, Form NR-AF2, Affidavit of Seller’s Gain, must be attached to Form WNR. The buyer may

rely on the seller’s affidavit unless the buyer knows or should know, based on the buyer’s knowledge at the time of closing, that

statements made on the affidavit are false. The buyer has no duty to investigate the statements made on a seller’s affidavit.

All information requested on Form WNR-V pertains to the seller/transferor (SSN or FEIN, tax period, type of taxpayer/entity,

name, and address of the seller/transferor). For the “Tax Period of Seller,” enter the last day of the current year (year of the sale

of the property). For example, on a sale of property occurring in 2008, a taxpayer who files an income tax return on a calendar

year basis would enter, “12/31/2008.” A taxpayer who files an income tax return on a fiscal year basis would enter the last day

of the taxpayer’s fiscal year. For the “Name of Seller/Transferor,” enter the last name first for a seller who is an individual.

For privacy and confidentiality purposes, the SSN or FEIN of the seller and of the buyer may be omitted or deleted from copies

of documents exchanged between the parties involved. However, all documents required to be submitted to the Alabama

Department of Revenue must contain the complete SSN or FEIN information on the original copy mailed to the Department.

The buyer/transferee must remit the tax due by mailing this form with a payment for the amount shown on Line 13 of Form

WNR on or before the last day of the month following the month of the closing. The buyer/transferee should retain a copy of

Form WNR-V as a record of the payment, and give a copy to the seller/transferor to be retained with the seller/transferor’s

records. For additional information or assistance, contact the Individual and Corporate Tax Division at 334-242-1300.

Form WNR-V and remittance should be mailed to the

Alabama Department of Revenue

Individual and Corporate Tax Division

Withholding Tax Section

PO Box 327480

Montgomery, AL 36132-7480.

Payment is due on or before the last day of the calendar month following the calendar month within which the sale or transfer of prop-

erty occurred. The voucher below and payment should be mailed to the Alabama Department of Revenue, Individual and Corporate

Tax Division, Withholding Tax Section, PO Box 327480, Montgomery, AL 36132-7480.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

A

D

R

FORM

LABAMA

EPARTMENT OF

EVENUE

STATE

WNR-V

Withholding on Sales or Transfers of Real Property and

COPY

Associated Tangible Personal Property by Nonresidents Payment Voucher

Tax Period of Seller: •

___ ___ /___ ___ /___ ___ ___ ___

Print

Reset

MONTH

DAY

YEAR

SSN: •

Seller/Transferor is:

a. Individual

b. Corporation

c. Trust or Estate

d. Business Trust

CHECK ONLY ONE BOX

FEIN: •

e. Partnership

f. S Corporation

g. Limited Liability Company

h. Limited Liability Partnership

Amount Paid: $ •

-This form has been enhanced to print a two dimensional

(2D) barcode. The PRINT FORM button MUST be used to

generate the (2D) barcode which contains data entered on

NAME OF SELLER / TRANSFEROR (FOR AN INDIVIDUAL, ENTER LAST NAME FIRST)

the form. The use of a 2D barcode vastly improves

•

processing of your return and reduces the costs associated

SELLER’S / TRANSFEROR’S MAILING ADDRESS

with processing your return.

CITY

STATE

ZIP CODE

- Just key in your data prior to printing the form. PLEASE

DO NOT HANDWRITE ANY DATA ON THE FORM.

ADOR

1

1