Instructions For Alaska Fisheries Business Tax Return - 1999

ADVERTISEMENT

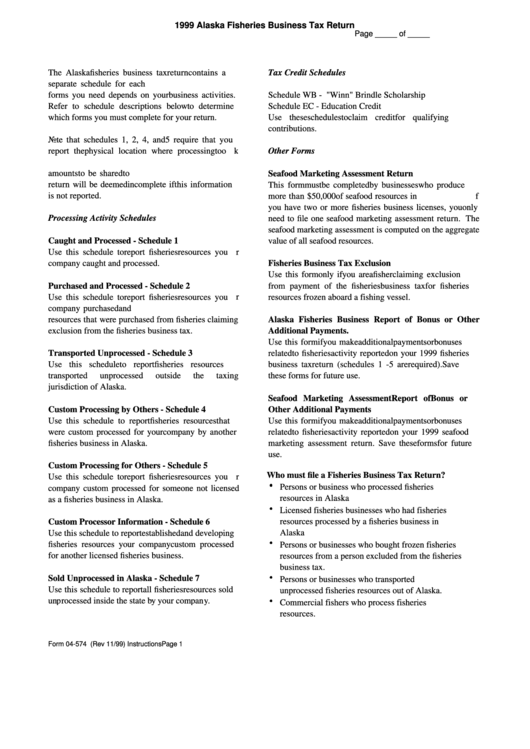

1999 Alaska Fisheries Business Tax Return

Page _____ of _____

The Alaska fisheries business tax return contains a

Tax Credit Schedules

separate schedule for each processing activity. The

forms you need depends on your business activities.

Schedule WB - A.W. "Winn" Brindle Scholarship

Refer to schedule descriptions below to determine

Schedule EC - Education Credit

which forms you must complete for your return.

Use these schedules to claim credit for qualifying

contributions.

Note that schedules 1, 2, 4, and 5 require that you

report the physical location where processing took

Other Forms

place. This information is required for calculating

amounts to be shared to Alaska communities. Your

Seafood Marketing Assessment Return

return will be deemed incomplete if this information

This form must be completed by businesses who produce

is not reported.

more than $50,000 of seafood resources in Alaska. Even if

you have two or more fisheries business licenses, you only

Processing Activity Schedules

need to file one seafood marketing assessment return. The

seafood marketing assessment is computed on the aggregate

Caught and Processed - Schedule 1

value of all seafood resources.

Use this schedule to report fisheries resources your

company caught and processed.

Fisheries Business Tax Exclusion

Use this form only if you are a fisher claiming exclusion

Purchased and Processed - Schedule 2

from payment of the fisheries business tax for fisheries

Use this schedule to report fisheries resources your

resources frozen aboard a fishing vessel.

company purchased and processed. Include fisheries

resources that were purchased from fisheries claiming

Alaska Fisheries Business Report of Bonus or Other

exclusion from the fisheries business tax.

Additional Payments.

Use this form if you make additional payments or bonuses

Transported Unprocessed - Schedule 3

related to fisheries activity reported on your 1999 fisheries

Use this schedule to report fisheries resources

business tax return (schedules 1 - 5 are required). Save

transported

unprocessed

outside

the

taxing

these forms for future use.

jurisdiction of Alaska.

Seafood Marketing Assessment Report of Bonus or

Custom Processing by Others - Schedule 4

Other Additional Payments

Use this schedule to report fisheries resources that

Use this form if you make additional payments or bonuses

were custom processed for your company by another

related to fisheries activity reported on your 1999 seafood

fisheries business in Alaska.

marketing assessment return. Save these forms for future

use.

Custom Processing for Others - Schedule 5

Who must file a Fisheries Business Tax Return?

Use this schedule to report fisheries resources your

Persons or business who processed fisheries

company custom processed for someone not licensed

resources in Alaska

as a fisheries business in Alaska.

Licensed fisheries businesses who had fisheries

resources processed by a fisheries business in

Custom Processor Information - Schedule 6

Alaska

Use this schedule to report established and developing

fisheries resources your company custom processed

Persons or businesses who bought frozen fisheries

for another licensed fisheries business.

resources from a person excluded from the fisheries

business tax.

Sold Unprocessed in Alaska - Schedule 7

Persons or businesses who transported

Use this schedule to report all fisheries resources sold

unprocessed fisheries resources out of Alaska.

unprocessed inside the state by your company.

Commercial fishers who process fisheries

resources.

Form 04-574 (Rev 11/99) Instructions

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3