Ets Form 11a - Sales Tax Worksheet For Ets Form 10 With Instructions

ADVERTISEMENT

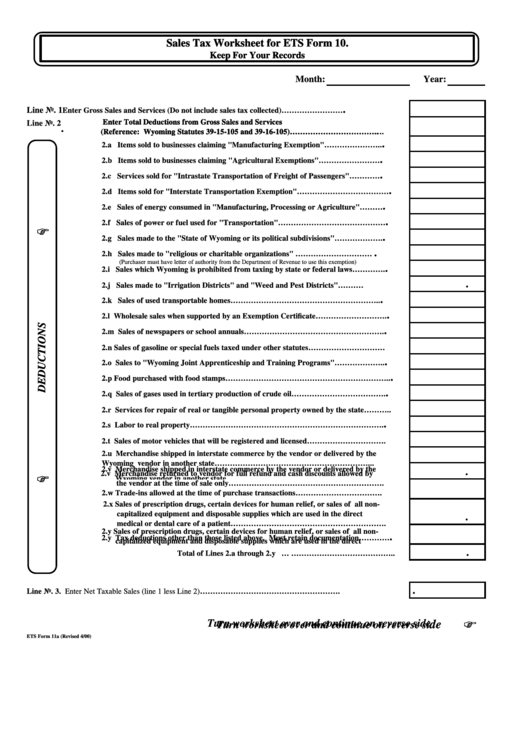

Sales Tax Worksheet for ETS Form 10.

Sales Tax Worksheet for ETS Form 10.

Keep For Your Records

Keep For Your Records

Month:

Year:

.

Line No. 1

Enter Gross Sales and Services (Do not include sales tax collected)……………………

Enter Total Deductions from Gross Sales and Services

Enter Total Deductions from Gross Sales and Services

Line No. 2

.

(Reference: Wyoming Statutes 39-15-105 and 39-16-105)……………………………….

(Reference: Wyoming Statutes 39-15-105 and 39-16-105)……………………………..

.

2.a Items sold to businesses claiming "Manufacturing Exemption"…………………..

.

2.b Items sold to businesses claiming "Agricultural Exemptions"……………………

.

2.c Services sold for "Intrastate Transportation of Freight of Passengers"…………

.

2.d Items sold for "Interstate Transportation Exemption"………………………………

.

2.e Sales of energy consumed in "Manufacturing, Processing or Agriculture"………

.

2.f Sales of power or fuel used for "Transportation"……………………………………

F

F

.

2.g Sales made to the "State of Wyoming or its political subdivisions"……………….

.

2.h Sales made to "religious or charitable organizations" …………………………....

(Purchaser must have letter of authority from the Department of Revenue to use this exemption)

.

2.i Sales which Wyoming is prohibited from taxing by state or federal laws………….

.

2.j Sales made to "Irrigation Districts" and "Weed and Pest Districts"…………………………….

.

2.k Sales of used transportable homes…………………………………………………..

.

2.l Wholesale sales when supported by an Exemption Certificate……………………….

.

2.m Sales of newspapers or school annuals……………………………………………….

2.n Sales of gasoline or special fuels taxed under other statutes…………………………

.

2.o Sales to "Wyoming Joint Apprenticeship and Training Programs"………………..

.

2.p Food purchased with food stamps………………………………………………………..

.

2.q Sales of gases used in tertiary production of crude oil……………………………….

2.r Services for repair of real or tangible personal property owned by the state………..

.

2.s Labor to real property………………………………………………………………….

2.t Sales of motor vehicles that will be registered and licensed………………………….

2.u Merchandise shipped in interstate commerce by the vendor or delivered by the

Wyoming vendor in another state……………………………………………………...

2.v Merchandise shipped in interstate commerce by the vendor or delivered by the

.

2.v Merchandise returned to vendor for full refund and cash discounts allowed by

F

F

Wyoming vendor in another state………………………………………………

the vendor at the time of sale only…………………………………………………….

2.w Trade-ins allowed at the time of purchase transactions…………………………….

2.x Sales of prescription drugs, certain devices for human relief, or sales of all non-

capitalized equipment and disposable supplies which are used in the direct

.

medical or dental care of a patient…………………………………………………….

2.y Sales of prescription drugs, certain devices for human relief, or sales of all non-

.

2.y Tax deductions other than those listed above. Must retain documentation…………

capitalized equipment and disposable supplies which are used in the direct

medical or dental care of a patient…………………………………………………….

.

Total of Lines 2.a through 2.y … …………………………………..

.

Line No. 3.

Enter Net Taxable Sales (line 1 less Line 2)

……………………………………………….

F

F

Turn worksheet over and continue on reverse side

de

Turn worksheet over and continue on reverse si

ETS Form 11a (Revised 4/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3