Clear Form

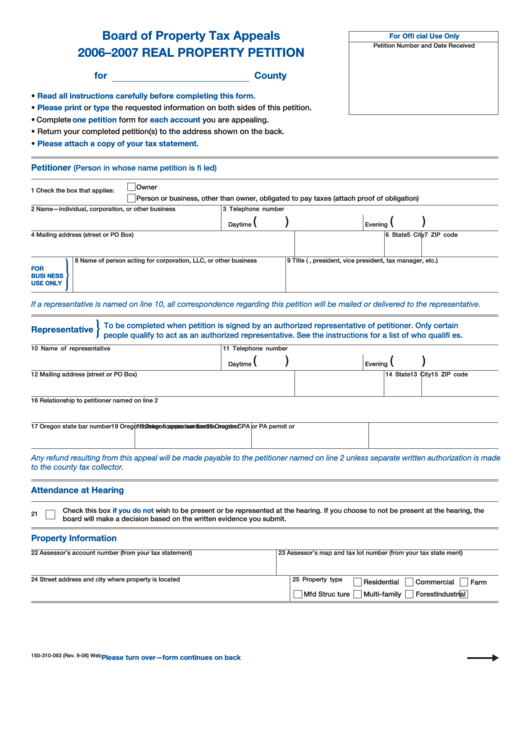

Board of Property Tax Appeals

For Offi cial Use Only

Petition Number and Date Received

2006–2007 REAL PROPERTY PETITION

for

County

•

Read all instructions carefully before completing this form.

•

Please print

or

type

the requested information on both sides of this petition.

• Complete

one petition

form for

each account

you are appealing.

• Return your completed petition(s) to the address shown on the back.

•

Please attach a copy of your tax statement.

Petitioner

(Person in whose name petition is fi led)

Owner

1 Check the box that applies:

Person or business, other than owner, obligated to pay taxes (attach proof of obligation)

2 Name—individual, corporation, or other business

3 Telephone number

(

)

(

)

Daytime

Evening

4 Mailing address (street or PO Box)

5 City

6 State

7 ZIP code

}

8 Name of person acting for corporation, LLC, or other business

9 Title (i.e., president, vice president, tax manager, etc.)

FOR

BUSI NESS

USE ONLY

If a representative is named on line 10, all correspondence regarding this petition will be mailed or delivered to the representative.

}

To be completed when petition is signed by an authorized representative of petitioner. Only certain

Representative

people qualify to act as an authorized representative. See the instructions for a list of who qualifi es.

10 Name of representative

11 Telephone number

(

)

(

)

Daytime

Evening

12 Mailing address (street or PO Box)

13 City

14 State

15 ZIP code

16 Relationship to petitioner named on line 2

17 Oregon state bar number

18 Oregon appraiser license number

19 Oregon broker license number

20 Oregon CPA or PA permit or S.E.A. number

Any refund resulting from this appeal will be made payable to the petitioner named on line 2 unless separate written authorization is made

to the county tax collector.

Attendance at Hearing

Check this box

if you do not

wish to be present or be represented at the hearing. If you choose to not be present at the hearing, the

21

board will make a decision based on the written evidence you submit.

Property Information

22 Assessor’s account number (from your tax statement)

23 Assessor’s map and tax lot number (from your tax state ment)

24 Street address and city where property is located

25 Property type

Residential

Commercial

Farm

Mfd Struc ture

Multi-family

Forest

Industrial

150-310-063 (Rev. 9-06) Web

Please turn over—form continues on back

1

1 2

2