Form 11a - Amended Employer'S Municipal Tax Withholding Statement

ADVERTISEMENT

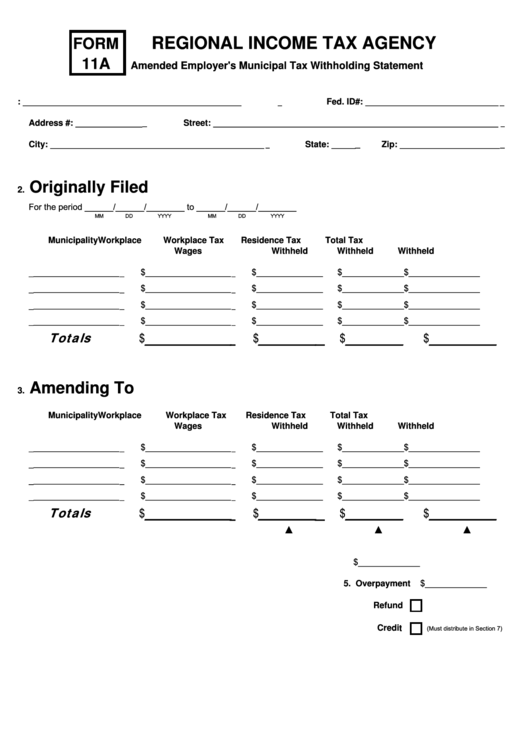

REGIONAL INCOME TAX AGENCY

FORM

11A

Amended Employer's Municipal Tax Withholding Statement

1. Name: _______________________________________________

Fed. ID#: _____________________________

Address #: _______________

Street: _____________________________________________________________

City: ______________________________________________

State: ______

Zip: ______________________

Originally Filed

2.

For the period ______/______/________ to ______/______/________

MM

DD

YYYY

MM

DD

YYYY

Municipality

Workplace

Workplace Tax

Residence Tax

Total Tax

Wages

Withheld

Withheld

Withheld

____________________

$___________________

$______________

$_____________

$_______________

____________________

$___________________

$______________

$_____________

$_______________

____________________

$___________________

$______________

$_____________

$_______________

____________________

$___________________

$______________

$_____________

$_______________

__________

_______

______

_______

Totals

$

$

$

$

Amending To

3.

Municipality

Workplace

Workplace Tax

Residence Tax

Total Tax

Wages

Withheld

Withheld

Withheld

____________________

$___________________

$______________

$_____________

$_______________

____________________

$___________________

$______________

$_____________

$_______________

____________________

$___________________

$______________

$_____________

$_______________

____________________

$___________________

$______________

$_____________

$_______________

__________

_______

______

_______

Totals

$

$

$

$

▲

▲

▲

$_____________

4. Balance Due

$_____________

5. Overpayment

Refund

Credit

(Must distribute in Section 7)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2