SM

546 Wendel Road

Irwin, PA 15642

724-978-0300 fax 724-978-0339

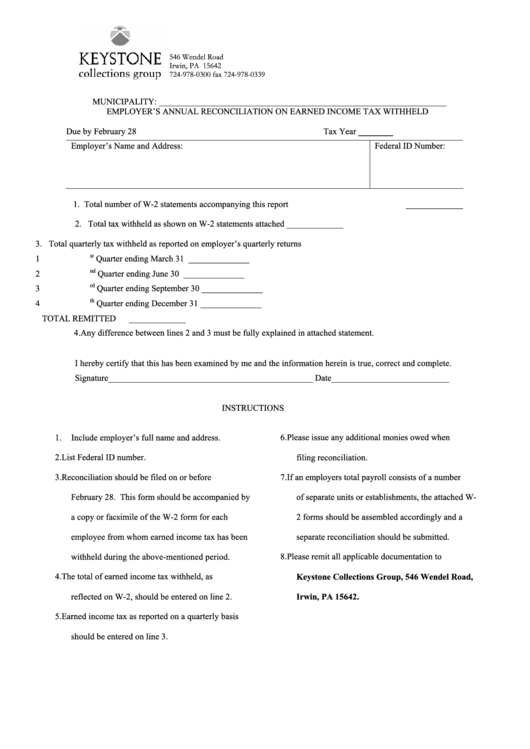

MUNICIPALITY: __________________________________________________________________

EMPLOYER’S ANNUAL RECONCILIATION ON EARNED INCOME TAX WITHHELD

Due by February 28

Tax Year ________

Employer’s Name and Address:

Federal ID Number:

1. Total number of W-2 statements accompanying this report

_____________

2. Total tax withheld as shown on W-2 statements attached

_____________

3. Total quarterly tax withheld as reported on employer’s quarterly returns

st

1

Quarter ending March 31

______________

nd

2

Quarter ending June 30

______________

rd

3

Quarter ending September 30

______________

th

4

Quarter ending December 31

______________

TOTAL REMITTED

_____________

4. Any difference between lines 2 and 3 must be fully explained in attached statement.

I hereby certify that this has been examined by me and the information herein is true, correct and complete.

Signature_______________________________________________ Date___________________________

INSTRUCTIONS

1.

Include employer’s full name and address.

6.

Please issue any additional monies owed when

2.

List Federal ID number.

filing reconciliation.

3. Reconciliation should be filed on or before

7.

If an employers total payroll consists of a number

February 28. This form should be accompanied by

of separate units or establishments, the attached W-

a copy or facsimile of the W-2 form for each

2 forms should be assembled accordingly and a

employee from whom earned income tax has been

separate reconciliation should be submitted.

withheld during the above-mentioned period.

8.

Please remit all applicable documentation to

4.

The total of earned income tax withheld, as

Keystone Collections Group, 546 Wendel Road,

reflected on W-2, should be entered on line 2.

Irwin, PA 15642.

5.

Earned income tax as reported on a quarterly basis

should be entered on line 3.

1

1