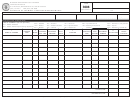

This schedule provides detail in support of the amount(s) shown as disbursements on the terminal report.

Each disbursement of product from the terminal should be listed on separate lines. Complete a separate schedule for each product type.

Company Name and FEIN:

Enter the name, schedule type and FEIN for the terminal operator shown on the terminal report.

Terminal Code:

Use the IRS Terminal Control Code.

Schedule Type:

Schedule TD — Gallons disbursed from the terminal.

Schedule 6X — Gallons disbursed per exchange agreement.

Columns 1 and 2:

Carrier — Enter the name and FEIN of the company that transports the product from the terminal.

Column 3:

Mode of Transport — Enter the mode of transport from the terminal. Use one of the following:

J = Truck

R = Rail

B = Barge

PL = Pipeline

S = Ship (Great lakes or ocean marine vessel)

BA = Book Adjustment

ST = Stationary Transfer

Columns 4 and 5:

Exchange Partner — Enter the FEIN and company name of the receiving exchange partner.

Column 6:

Destination State — Enter the state, territory, or foreign country to which any reportable motor fuel is directed for delivery into any storage

facility, receptacle, container, or any type of transportation equipment, for purpose of resale or use.

Columns 7 and 8:

Supplier — Enter name and FEIN of company that owns the product as reflected on the records of the terminal operator.

Column 9:

Date Shipped — Enter the date the carrier leaves the terminal with the product.

Column 10:

Document Number — Enter the identifying number from the document issued at the terminal when product is removed from the rack. In

case of pipeline or barge movements, enter the pipeline or barge ticket number.

Columns 11 and 12:

Net and Gross Gallons — Enter the net and gross amount of gallons withdrawn from the terminal. Complete a separate schedule for each

product type. The total amount for each product type withdrawn should be entered onto Line 4 of the Terminal Operator’s Report in the

appropriate column. You may use either the net or gross gallons.

Form 3008 (Revised 04-2015)

Mail To:

Taxation Division

Phone: (573) 751-2611

P.O. Box 300

Fax: (573) 522-1720

Visit

for additional information.

Jefferson City, MO 65105-0300

TTY: (800) 735-2966

E-mail:

excise@dor.mo.gov

1

1 2

2