Instructions For Form Tpt-1x - Amended Transaction Privilege, Use And Severance Tax Amended Return

ADVERTISEMENT

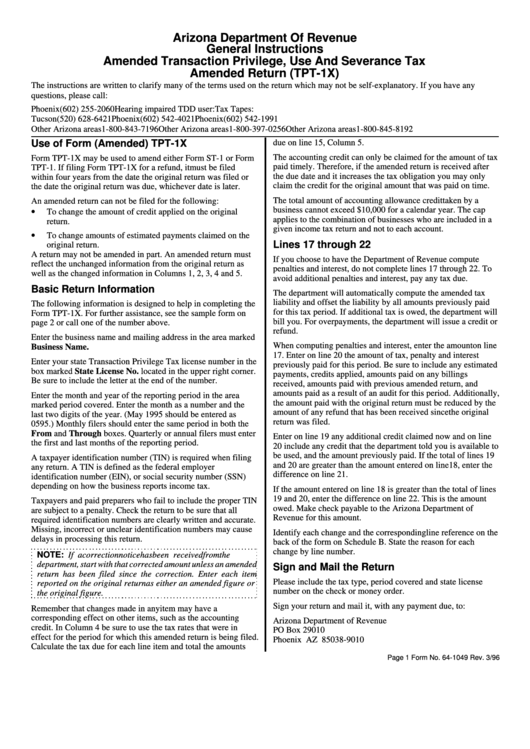

Arizona Department Of Revenue

General Instructions

Amended Transaction Privilege, Use And Severance Tax

Amended Return (TPT-1X)

The instructions are written to clarify many of the terms used on the return which may not be self-explanatory. If you have any

questions, please call:

Phoenix

(602) 255-2060

Hearing impaired TDD user:

Tax Tapes:

Tucson

(520) 628-6421

Phoenix

(602) 542-4021

Phoenix

(602) 542-1991

Other Arizona areas

1-800-843-7196

Other Arizona areas

1-800-397-0256

Other Arizona areas

1-800-845-8192

due on line 15, Column 5.

Use of Form (Amended) TPT-1X

The accounting credit can only be claimed for the amount of tax

Form TPT-1X may be used to amend either Form ST-1 or Form

paid timely. Therefore, if the amended return is received after

TPT-1. If filing Form TPT-1X for a refund, it must be filed

the due date and it increases the tax obligation you may only

within four years from the date the original return was filed or

claim the credit for the original amount that was paid on time.

the date the original return was due, whichever date is later.

The total amount of accounting allowance credit taken by a

An amended return can not be filed for the following:

•

business cannot exceed $10,000 for a calendar year. The cap

To change the amount of credit applied on the original

applies to the combination of businesses who are included in a

return.

given income tax return and not to each account.

•

To change amounts of estimated payments claimed on the

Lines 17 through 22

original return.

A return may not be amended in part. An amended return must

If you choose to have the Department of Revenue compute

reflect the unchanged information from the original return as

penalties and interest, do not complete lines 17 through 22. To

well as the changed information in Columns 1, 2, 3, 4 and 5.

avoid additional penalties and interest, pay any tax due.

Basic Return Information

The department will automatically compute the amended tax

liability and offset the liability by all amounts previously paid

The following information is designed to help in completing the

for this tax period. If additional tax is owed, the department will

Form TPT-1X. For further assistance, see the sample form on

bill you. For overpayments, the department will issue a credit or

page 2 or call one of the number above.

refund.

Enter the business name and mailing address in the area marked

When computing penalties and interest, enter the amount on line

Business Name.

17. Enter on line 20 the amount of tax, penalty and interest

Enter your state Transaction Privilege Tax license number in the

previously paid for this period. Be sure to include any estimated

box marked State License No. located in the upper right corner.

payments, credits applied, amounts paid on any billings

Be sure to include the letter at the end of the number.

received, amounts paid with previous amended return, and

amounts paid as a result of an audit for this period. Additionally,

Enter the month and year of the reporting period in the area

the amount paid with the original return must be reduced by the

marked period covered. Enter the month as a number and the

amount of any refund that has been received since the original

last two digits of the year. (May 1995 should be entered as

return was filed.

0595.) Monthly filers should enter the same period in both the

From and Through boxes. Quarterly or annual filers must enter

Enter on line 19 any additional credit claimed now and on line

the first and last months of the reporting period.

20 include any credit that the department told you is available to

be used, and the amount previously paid. If the total of lines 19

A taxpayer identification number (TIN) is required when filing

and 20 are greater than the amount entered on line 18, enter the

any return. A TIN is defined as the federal employer

difference on line 21.

identification number (EIN), or social security number (SSN)

depending on how the business reports income tax.

If the amount entered on line 18 is greater than the total of lines

19 and 20, enter the difference on line 22. This is the amount

Taxpayers and paid preparers who fail to include the proper TIN

owed. Make check payable to the Arizona Department of

are subject to a penalty. Check the return to be sure that all

Revenue for this amount.

required identification numbers are clearly written and accurate.

Missing, incorrect or unclear identification numbers may cause

Identify each change and the corresponding line reference on the

delays in processing this return.

back of the form on Schedule B. State the reason for each

change by line number.

NOTE: If a correction notice has been received from the

department, start with that corrected amount unless an amended

Sign and Mail the Return

return has been filed since the correction. Enter each item

Please include the tax type, period covered and state license

reported on the original return as either an amended figure or

number on the check or money order.

the original figure.

Sign your return and mail it, with any payment due, to:

Remember that changes made in any item may have a

corresponding effect on other items, such as the accounting

Arizona Department of Revenue

credit. In Column 4 be sure to use the tax rates that were in

PO Box 29010

effect for the period for which this amended return is being filed.

Phoenix AZ 85038-9010

Calculate the tax due for each line item and total the amounts

Page 1 Form No. 64-1049 Rev. 3/96

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1