Instructions Fo Form Tpt-1 - Transaction Privilege, Use And Severance Tax

ADVERTISEMENT

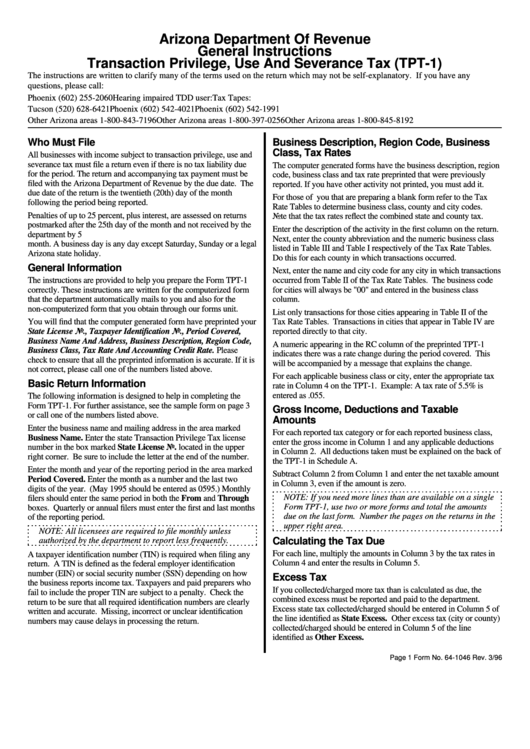

Arizona Department Of Revenue

General Instructions

Transaction Privilege, Use And Severance Tax (TPT-1)

The instructions are written to clarify many of the terms used on the return which may not be self-explanatory. If you have any

questions, please call:

Phoenix

(602) 255-2060

Hearing impaired TDD user:

Tax Tapes:

Tucson

(520) 628-6421

Phoenix

(602) 542-4021

Phoenix

(602) 542-1991

Other Arizona areas 1-800-843-7196

Other Arizona areas 1-800-397-0256

Other Arizona areas

1-800-845-8192

Who Must File

Business Description, Region Code, Business

Class, Tax Rates

All businesses with income subject to transaction privilege, use and

severance tax must file a return even if there is no tax liability due

The computer generated forms have the business description, region

for the period. The return and accompanying tax payment must be

code, business class and tax rate preprinted that were previously

filed with the Arizona Department of Revenue by the due date. The

reported. If you have other activity not printed, you must add it.

due date of the return is the twentieth (20th) day of the month

For those of you that are preparing a blank form refer to the Tax

following the period being reported.

Rate Tables to determine business class, county and city codes.

Penalties of up to 25 percent, plus interest, are assessed on returns

Note that the tax rates reflect the combined state and county tax.

postmarked after the 25th day of the month and not received by the

Enter the description of the activity in the first column on the return.

department by 5 p.m. of the next to the last business day of the

Next, enter the county abbreviation and the numeric business class

month. A business day is any day except Saturday, Sunday or a legal

listed in Table III and Table I respectively of the Tax Rate Tables.

Arizona state holiday.

Do this for each county in which transactions occurred.

General Information

Next, enter the name and city code for any city in which transactions

The instructions are provided to help you prepare the Form TPT-1

occurred from Table II of the Tax Rate Tables. The business code

correctly. These instructions are written for the computerized form

for cities will always be "00" and entered in the business class

that the department automatically mails to you and also for the

column.

non-computerized form that you obtain through our forms unit.

List only transactions for those cities appearing in Table II of the

You will find that the computer generated form have preprinted your

Tax Rate Tables. Transactions in cities that appear in Table IV are

State License No., Taxpayer Identification No., Period Covered,

reported directly to that city.

Business Name And Address, Business Description, Region Code,

A numeric appearing in the RC column of the preprinted TPT-1

Business Class, Tax Rate And Accounting Credit Rate. Please

indicates there was a rate change during the period covered. This

check to ensure that all the preprinted information is accurate. If it is

will be accompanied by a message that explains the change.

not correct, please call one of the numbers listed above.

For each applicable business class or city, enter the appropriate tax

Basic Return Information

rate in Column 4 on the TPT-1. Example: A tax rate of 5.5% is

entered as .055.

The following information is designed to help in completing the

Form TPT-1. For further assistance, see the sample form on page 3

Gross Income, Deductions and Taxable

or call one of the numbers listed above.

Amounts

Enter the business name and mailing address in the area marked

For each reported tax category or for each reported business class,

Business Name. Enter the state Transaction Privilege Tax license

enter the gross income in Column 1 and any applicable deductions

number in the box marked State License No. located in the upper

in Column 2. All deductions taken must be explained on the back of

right corner. Be sure to include the letter at the end of the number.

the TPT-1 in Schedule A.

Enter the month and year of the reporting period in the area marked

Subtract Column 2 from Column 1 and enter the net taxable amount

Period Covered. Enter the month as a number and the last two

in Column 3, even if the amount is zero.

digits of the year. (May 1995 should be entered as 0595.) Monthly

NOTE: If you need more lines than are available on a single

filers should enter the same period in both the From and Through

Form TPT-1, use two or more forms and total the amounts

boxes. Quarterly or annual filers must enter the first and last months

due on the last form. Number the pages on the returns in the

of the reporting period.

upper right area.

NOTE: All licensees are required to file monthly unless

authorized by the department to report less frequently.

Calculating the Tax Due

For each line, multiply the amounts in Column 3 by the tax rates in

A taxpayer identification number (TIN) is required when filing any

Column 4 and enter the results in Column 5.

return. A TIN is defined as the federal employer identification

number (EIN) or social security number (SSN) depending on how

Excess Tax

the business reports income tax. Taxpayers and paid preparers who

If you collected/charged more tax than is calculated as due, the

fail to include the proper TIN are subject to a penalty. Check the

combined excess must be reported and paid to the department.

return to be sure that all required identification numbers are clearly

Excess state tax collected/charged should be entered in Column 5 of

written and accurate. Missing, incorrect or unclear identification

the line identified as State Excess. Other excess tax (city or county)

numbers may cause delays in processing the return.

collected/charged should be entered in Column 5 of the line

identified as Other Excess.

Page 1 Form No. 64-1046 Rev. 3/96

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4