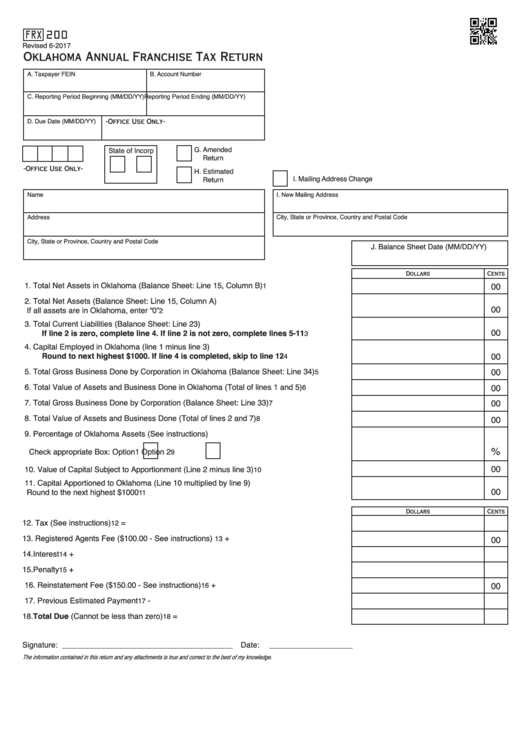

FRX

200

Revised 6-2017

Oklahoma Annual Franchise Tax Return

A. Taxpayer FEIN

B. Account Number

C. Reporting Period Beginning (MM/DD/YY) Reporting Period Ending (MM/DD/YY)

D. Due Date (MM/DD/YY)

-Office Use Only-

G. Amended

State of Incorp

Return

-Office Use Only-

H. Estimated

E.Okla F.Other

I. Mailing Address Change

Return

Name

I. New Mailing Address

Address

City, State or Province, Country and Postal Code

City, State or Province, Country and Postal Code

J. Balance Sheet Date (MM/DD/YY)

Dollars

Cents

1. Total Net Assets in Oklahoma (Balance Sheet: Line 15, Column B) ..................................

00

1

2. Total Net Assets (Balance Sheet: Line 15, Column A)

00

If all assets are in Oklahoma, enter “0” ..............................................................................

2

3. Total Current Liabilities (Balance Sheet: Line 23)

00

If line 2 is zero, complete line 4. If line 2 is not zero, complete lines 5-11 ..................

3

4. Capital Employed in Oklahoma (line 1 minus line 3)

Round to next highest $1000. If line 4 is completed, skip to line 12 ...........................

00

4

5. Total Gross Business Done by Corporation in Oklahoma (Balance Sheet: Line 34) .........

00

5

6. Total Value of Assets and Business Done in Oklahoma (Total of lines 1 and 5) ................

00

6

7. Total Gross Business Done by Corporation (Balance Sheet: Line 33) ...............................

00

7

8. Total Value of Assets and Business Done (Total of lines 2 and 7) ......................................

00

8

9. Percentage of Oklahoma Assets (See instructions)

%

Check appropriate Box:

Option1

Option 2 .......................................

9

00

10. Value of Capital Subject to Apportionment (Line 2 minus line 3) ......................................

10

11. Capital Apportioned to Oklahoma (Line 10 multiplied by line 9)

00

Round to the next highest $1000 .....................................................................................

11

Dollars

Cents

12. Tax (See instructions) ....................................................................................................

=

12

13. Registered Agents Fee ($100.00 - See instructions).....................................................

+

13

00

14. Interest ..........................................................................................................................

+

14

15. Penalty ..........................................................................................................................

+

15

16. Reinstatement Fee ($150.00 - See instructions) ...........................................................

+

00

16

17. Previous Estimated Payment .........................................................................................

-

17

18. Total Due (Cannot be less than zero) ...........................................................................

=

18

Signature: _______________________________________

Date: ___________________

The information contained in this return and any attachments is true and correct to the best of my knowledge.

1

1 2

2 3

3 4

4