Instructions For Form 105 - South Carolina Withholding Tax - 2001

ADVERTISEMENT

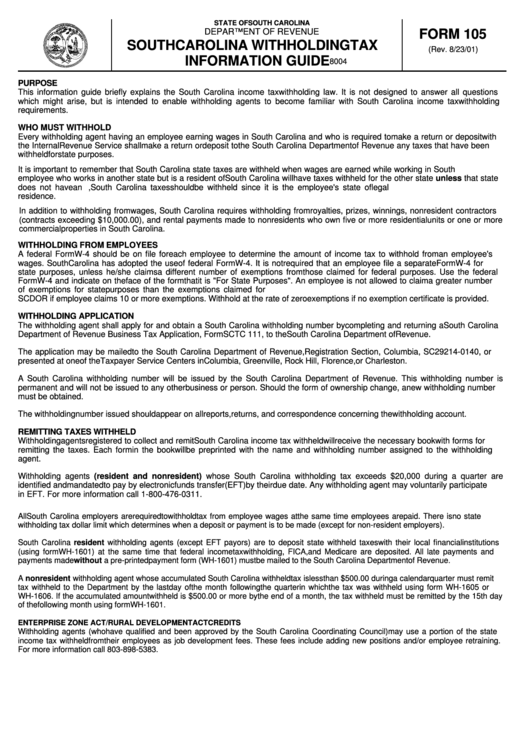

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

FORM 105

SOUTH CAROLINA WITHHOLDING TAX

(Rev. 8/23/01)

INFORMATION GUIDE

8004

PURPOSE

This information guide briefly explains the South Carolina income tax withholding law. It is not designed to answer all questions

which might arise, but is intended to enable withholding agents to become familiar with South Carolina income tax withholding

requirements.

WHO MUST WITHHOLD

Every withholding agent having an employee earning wages in South Carolina and who is required to make a return or deposit with

the Internal Revenue Service shall make a return or deposit to the South Carolina Department of Revenue any taxes that have been

withheld for state purposes.

It is important to remember that South Carolina state taxes are withheld when wages are earned while working in South Carolina. An

employee who works in another state but is a resident of South Carolina will have taxes withheld for the other state unless that state

does not have an income tax. In that case, South Carolina taxes should be withheld since it is the employee's state of legal

residence.

In addition to withholding from wages, South Carolina requires withholding from royalties, prizes, winnings, nonresident contractors

(contracts exceeding $10,000.00), and rental payments made to nonresidents who own five or more residential units or one or more

commercial properties in South Carolina.

WITHHOLDING FROM EMPLOYEES

A federal Form W-4 should be on file for each employee to determine the amount of income tax to withhold from an employee's

wages. South Carolina has adopted the use of federal Form W-4. It is not required that an employee file a separate Form W-4 for

state purposes, unless he/she claims a different number of exemptions from those claimed for federal purposes. Use the federal

Form W-4 and indicate on the face of the form that it is "For State Purposes". An employee is not allowed to claim a greater number

of exemptions for state purposes than the exemptions claimed for federal purposes. The IRS provides federal form W-4. Notify

SCDOR if employee claims 10 or more exemptions. Withhold at the rate of zero exemptions if no exemption certificate is provided.

WITHHOLDING APPLICATION

The withholding agent shall apply for and obtain a South Carolina withholding number by completing and returning a South Carolina

Department of Revenue Business Tax Application, Form SCTC 111, to the South Carolina Department of Revenue.

The application may be mailed to the South Carolina Department of Revenue, Registration Section, Columbia, SC 29214-0140, or

presented at one of the Taxpayer Service Centers in Columbia, Greenville, Rock Hill, Florence, or Charleston.

A South Carolina withholding number will be issued by the South Carolina Department of Revenue. This withholding number is

permanent and will not be issued to any other business or person. Should the form of ownership change, a new withholding number

must be obtained.

The withholding number issued should appear on all reports, returns, and correspondence concerning the withholding account.

REMITTING TAXES WITHHELD

Withholding agents registered to collect and remit South Carolina income tax withheld will receive the necessary book with forms for

remitting the taxes. Each form in the book will be preprinted with the name and withholding number assigned to the withholding

agent.

Withholding agents (resident and nonresident) whose South Carolina withholding tax exceeds $20,000 during a quarter are

identified and mandated to pay by electronic funds transfer (EFT) by their due date. Any withholding agent may voluntarily participate

in EFT. For more information call 1-800-476-0311.

All South Carolina employers are required to withhold tax from employee wages at the same time employees are paid. There is no state

withholding tax dollar limit which determines when a deposit or payment is to be made (except for non-resident employers).

South Carolina resident withholding agents (except EFT payors) are to deposit state withheld taxes with their local financial institutions

(using form WH-1601) at the same time that federal income tax withholding, FICA, and Medicare are deposited. All late payments and

payments made without a pre-printed payment form (WH-1601) must be mailed to the South Carolina Department of Revenue.

A nonresident withholding agent whose accumulated South Carolina withheld tax is less than $500.00 during a calendar quarter must remit

tax withheld to the Department by the last day of the month following the quarter in which the tax was withheld using form WH-1605 or

WH-1606. If the accumulated amount withheld is $500.00 or more by the end of a month, the tax withheld must be remitted by the 15th day

of the following month using form WH-1601.

ENTERPRISE ZONE ACT/RURAL DEVELOPMENT ACT CREDITS

Withholding agents (who have qualified and been approved by the South Carolina Coordinating Council) may use a portion of the state

income tax withheld from their employees as job development fees. These fees include adding new positions and/or employee retraining.

For more information call 803-898-5383.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2