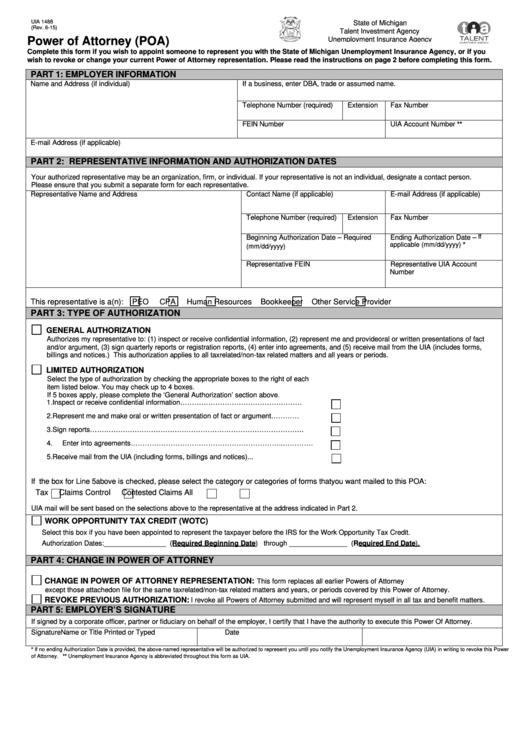

UIA 1488

State of Michigan

Reset Form

(Rev. 6-15)

Talent Investment Agency

Power of Attorney (POA)

Unemployment Insurance Agency

Complete this form if you wish to appoint someone to represent you with the State of Michigan Unemployment Insurance Agency, or if you

wish to revoke or change your current Power of Attorney representation. Please read the instructions on page 2 before completing this form.

PART 1: EMPLOYER INFORMATION

Name and Address (if individual)

If a business, enter DBA, trade or assumed name.

Telephone Number (required)

Extension

Fax Number

FEIN Number

UIA Account Number

**

E-mail Address (if applicable)

PART 2: REPRESENTATIVE INFORMATION AND AUTHORIZATION DATES

Your authorized representative may be an organization, firm, or individual. If your representative is not an individual, designate a contact person.

Please ensure that you submit a separate form for each representative.

Representative Name and Address

Contact Name (if applicable)

E-mail Address (if applicable)

Telephone Number (required)

Extension

Fax Number

If

Beginning Authorization Date – Required

Ending Authorization Date –

applicable (mm/dd/yyyy) *

(mm/dd/yyyy)

Representative FEIN

Representative UIA Account

Number

This representative is a(n):

PEO

CPA

Human Resources

Bookkeeper

Other Service Provider

PART 3: TYPE OF AUTHORIZATION

GENERAL AUTHORIZATION

Authorizes my representative to: (1) inspect or receive confidential information, (2) represent me and provide oral or written presentations of fact

and/or argument, (3) sign quarterly reports or registration reports, (4) enter into agreements, and (5) receive mail from the UIA (includes forms,

billings and notices.) This authorization applies to all tax related/non-tax related matters and all years or periods.

LIMITED AUTHORIZATION

Select the type of authorization by checking the appropriate boxes to the right of each

item listed below. You may check up to 4 boxes.

If 5 boxes apply, please complete the ‘General Authorization’ section above.

1.

Inspect or receive confidential information…………………………………………….

2.

Represent me and make oral or written presentation of fact or argument…………

3.

Sign reports……………………………………………………………………………….

4.

Enter into agreements………………………………………………………..………….

5.

Receive mail from the UIA (including forms, billings and notices)...........................

If the box for Line 5 above is checked, please select the category or categories of forms that you want mailed to this POA:

Tax

Claims Control

Contested Claims

All

UIA mail will be sent based on the selections above to the representative at the address indicated in Part 2.

WORK OPPORTUNITY TAX CREDIT (WOTC)

Select this box if you have been appointed to represent the taxpayer before the IRS for the Work Opportunity Tax Credit.

Authorization Dates:________________ (Required Beginning Date) through

_______________ (Required End Date).

PART 4: CHANGE IN POWER OF ATTORNEY

CHANGE IN POWER OF ATTORNEY REPRESENTATION:

This form replaces all earlier Powers of Attorney

except those attached on file for the same tax related/non-tax related matters and years, or periods covered by this Power of Attorney.

REVOKE PREVIOUS AUTHORIZATION:

I revoke all Powers of Attorney submitted and will represent myself in all tax and benefit matters.

PART 5: EMPLOYER’S SIGNATURE

If signed by a corporate officer, partner or fiduciary on behalf of the employer, I certify that I have the authority to execute this Power Of Attorney.

Signature

Name or Title Printed or Typed

Date

* If no ending Authorization Date is provided, the above-named representative will be authorized to represent you until you notify the Unemployment Insurance Agency (UIA) in writing to revoke this Power

of Attorney. ** Unemployment Insurance Agency is abbreviated throughout this form as UIA.

1

1