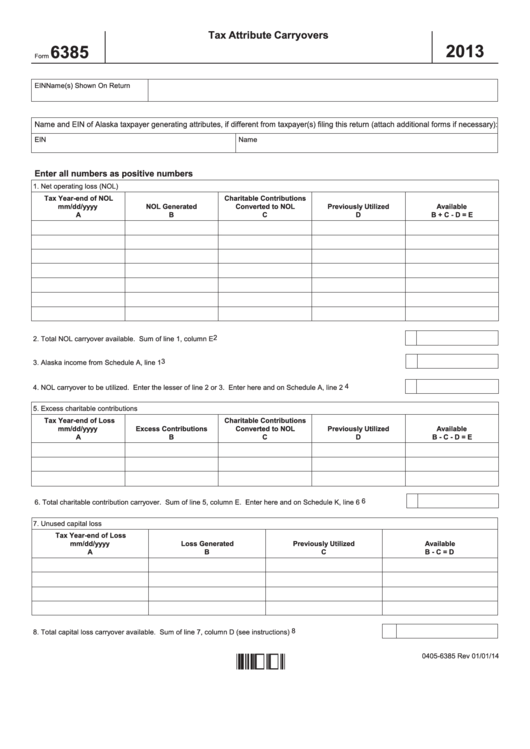

Form 6385 - Tax Attribute Carryovers - Alaska Department Of Revenue, 2013

ADVERTISEMENT

Tax Attribute Carryovers

2013

6385

Form

EIN

Name(s) Shown On Return

Name and EIN of Alaska taxpayer generating attributes, if different from taxpayer(s) filing this return (attach additional forms if necessary):

EIN

Name

Enter all numbers as positive numbers

1. Net operating loss (NOL)

Tax Year-end of NOL

Charitable Contributions

mm/dd/yyyy

NOL Generated

Converted to NOL

Previously Utilized

Available

A

B

C

D

B + C - D = E

2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2. Total NOL carryover available. Sum of line 1, column E

3

3. Alaska income from Schedule A, line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

4. NOL carryover to be utilized. Enter the lesser of line 2 or 3. Enter here and on Schedule A, line 2

.

.

.

.

.

.

5. Excess charitable contributions

Tax Year-end of Loss

Charitable Contributions

mm/dd/yyyy

Excess Contributions

Converted to NOL

Previously Utilized

Available

A

B

C

D

B - C - D = E

6

6. Total charitable contribution carryover. Sum of line 5, column E. Enter here and on Schedule K, line 6

.

.

.

.

.

7. Unused capital loss

Tax Year-end of Loss

mm/dd/yyyy

Loss Generated

Previously Utilized

Available

A

B

C

B - C = D

8

8. Total capital loss carryover available. Sum of line 7, column D (see instructions)

.

.

.

.

.

.

.

.

.

0405-6385 Rev 01/01/14

6385:01 01 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2