Instructions For Application For Qualified Equity And Subordinated Debt Investment Tax Credit Form Edc 2003

ADVERTISEMENT

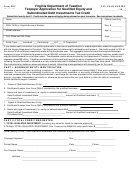

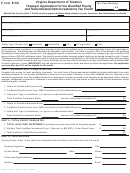

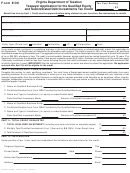

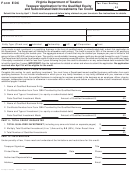

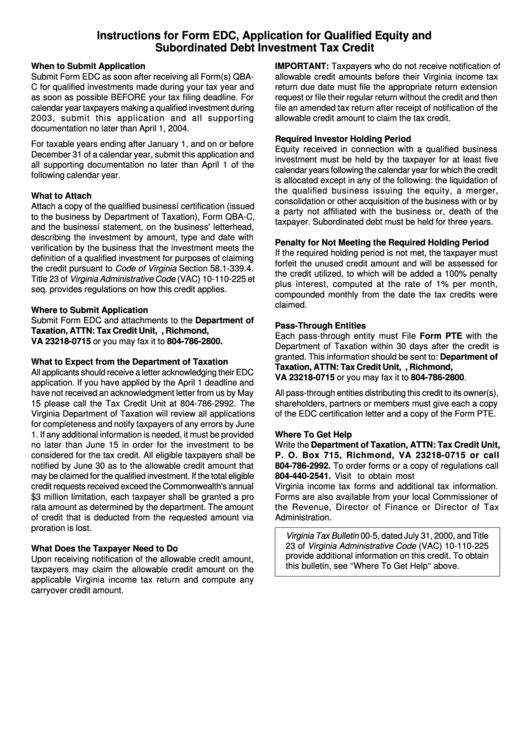

Instructions for Form EDC, Application for Qualified Equity and

Subordinated Debt Investment Tax Credit

When to Submit Application

IMPORTANT: Taxpayers who do not receive notification of

Submit Form EDC as soon after receiving all Form(s) QBA-

allowable credit amounts before their Virginia income tax

C for qualified investments made during your tax year and

return due date must file the appropriate return extension

as soon as possible BEFORE your tax filing deadline. For

request or file their regular return without the credit and then

calendar year taxpayers making a qualified investment during

file an amended tax return after receipt of notification of the

2003, submit this application and all supporting

allowable credit amount to claim the tax credit.

documentation no later than April 1, 2004.

Required Investor Holding Period

For taxable years ending after January 1, and on or before

Equity received in connection with a qualified business

December 31 of a calendar year, submit this application and

investment must be held by the taxpayer for at least five

all supporting documentation no later than April 1 of the

calendar years following the calendar year for which the credit

following calendar year.

is allocated except in any of the following: the liquidation of

the qualified business issuing the equity, a merger,

What to Attach

consolidation or other acquisition of the business with or by

Attach a copy of the qualified businessí certification (issued

a party not affiliated with the business or, death of the

to the business by Department of Taxation), Form QBA-C,

taxpayer. Subordinated debt must be held for three years.

and the businessí statement, on the business' letterhead,

describing the investment by amount, type and date with

Penalty for Not Meeting the Required Holding Period

verification by the business that the investment meets the

If the required holding period is not met, the taxpayer must

definition of a qualified investment for purposes of claiming

forfeit the unused credit amount and will be assessed for

the credit pursuant to Code of Virginia Section 58.1-339.4.

the credit utilized, to which will be added a 100% penalty

Title 23 of Virginia Administrative Code (VAC) 10-110-225 et

plus interest, computed at the rate of 1% per month,

seq. provides regulations on how this credit applies.

compounded monthly from the date the tax credits were

claimed.

Where to Submit Application

Submit Form EDC and attachments to the Department of

Pass-Through Entities

Taxation, ATTN: Tax Credit Unit, P.O. Box 715, Richmond,

Each pass-through entity must File Form PTE with the

VA 23218-0715 or you may fax it to 804-786-2800.

Department of Taxation within 30 days after the credit is

granted. This information should be sent to: Department of

What to Expect from the Department of Taxation

Taxation, ATTN: Tax Credit Unit, P.O. Box 715, Richmond,

All applicants should receive a letter acknowledging their EDC

VA 23218-0715 or you may fax it to 804-786-2800.

application. If you have applied by the April 1 deadline and

have not received an acknowledgment letter from us by May

All pass-through entities distributing this credit to its owner(s),

15 please call the Tax Credit Unit at 804-786-2992. The

shareholders, partners or members must give each a copy

Virginia Department of Taxation will review all applications

of the EDC certification letter and a copy of the Form PTE.

for completeness and notify taxpayers of any errors by June

1. If any additional information is needed, it must be provided

Where To Get Help

no later than June 15 in order for the investment to be

Write the Department of Taxation, ATTN: Tax Credit Unit,

considered for the tax credit. All eligible taxpayers shall be

P. O. Box 715, Richmond, VA 23218-0715 or call

notified by June 30 as to the allowable credit amount that

804-786-2992. To order forms or a copy of regulations call

may be claimed for the qualified investment. If the total eligible

804-440-2541. Visit to obtain most

credit requests received exceed the Commonwealth's annual

Virginia income tax forms and additional tax information.

$3 million limitation, each taxpayer shall be granted a pro

Forms are also available from your local Commissioner of

rata amount as determined by the department. The amount

the Revenue, Director of Finance or Director of Tax

of credit that is deducted from the requested amount via

Administration.

proration is lost.

Virginia Tax Bulletin 00-5, dated July 31, 2000, and Title

23 of Virginia Administrative Code (VAC) 10-110-225

What Does the Taxpayer Need to Do

provide additional information on this credit. To obtain

Upon receiving notification of the allowable credit amount,

this bulletin, see "Where To Get Help" above.

taxpayers may claim the allowable credit amount on the

applicable Virginia income tax return and compute any

carryover credit amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1