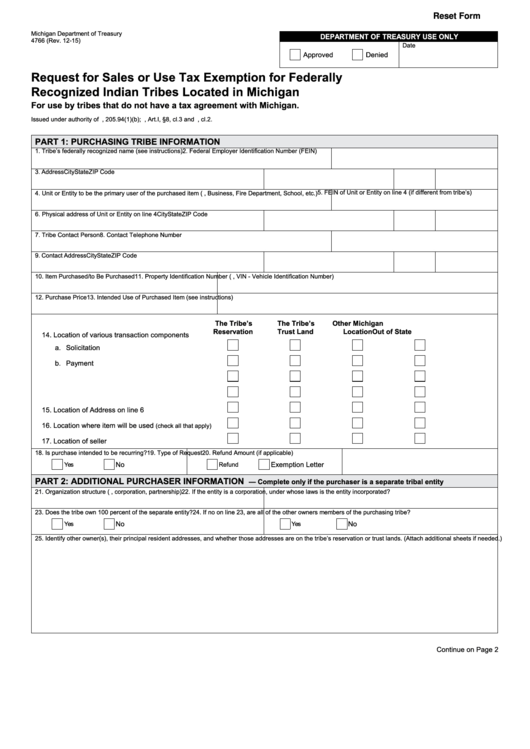

Reset Form

Michigan Department of Treasury

Department of treasury use only

4766 (Rev. 12-15)

Date

Approved

Denied

request for sales or use tax exemption for federally

recognized Indian tribes located in michigan

for use by tribes that do not have a tax agreement with michigan.

Issued under authority of M.C.L., 205.94(1)(b); U.S. Const., Art.I, §8, cl.3 and Art.VI, cl.2.

part 1: purchasIng trIbe InformatIon

1. Tribe’s federally recognized name (see instructions)

2. Federal Employer Identification Number (FEIN)

3. Address

City

State

ZIP Code

5. FEIN of Unit or Entity on line 4 (if different from tribe’s)

4. Unit or Entity to be the primary user of the purchased item (e.g., Business, Fire Department, School, etc.)

6. Physical address of Unit or Entity on line 4

City

State

ZIP Code

7. Tribe Contact Person

8. Contact Telephone Number

9. Contact Address

City

State

ZIP Code

10. Item Purchased/to Be Purchased

11. Property Identification Number (e.g., VIN - Vehicle Identification Number)

12. Purchase Price

13. Intended Use of Purchased Item (see instructions)

the tribe’s

the tribe’s

other michigan

reservation

trust land

location

out of state

14. Location of various transaction components

a. Solicitation ................................................................

.......................

.......................

.......................

b. Payment ...................................................................

.......................

.......................

.......................

c. Signing of Contract ...................................................

.......................

.......................

.......................

d. Exchange of Possession ..........................................

.......................

.......................

.......................

15. Location of Address on line 6 ..........................................

.......................

.......................

.......................

16. Location where item will be used

........

.......................

.......................

.......................

(check all that apply)

17. Location of seller .............................................................

.......................

.......................

.......................

18. Is purchase intended to be recurring?

19. Type of Request

20. Refund Amount (if applicable)

No

Exemption Letter

Yes

Refund

part 2: aDDItIonal purchaser InformatIon

— complete only if the purchaser is a separate tribal entity

21. Organization structure (e.g., corporation, partnership)

22. If the entity is a corporation, under whose laws is the entity incorporated?

23. Does the tribe own 100 percent of the separate entity?

24. If no on line 23, are all of the other owners members of the purchasing tribe?

No

No

Yes

Yes

25. Identify other owner(s), their principal resident addresses, and whether those addresses are on the tribe’s reservation or trust lands. (Attach additional sheets if needed.)

Continue on Page 2

1

1 2

2 3

3