Schedule Oa-N/p Oregon Adjustments For Form 40n And Form 40 P Filers - 2007

ADVERTISEMENT

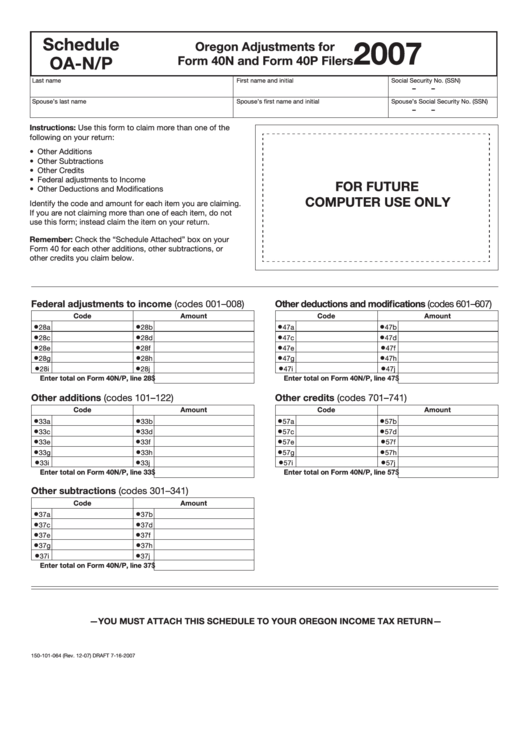

Schedule

2007

Oregon Adjustments for

OA-N/P

Form 40N and Form 40P Filers

Last name

First name and initial

Social Security No. (SSN)

–

–

Spouse’s last name

Spouse’s first name and initial

Spouse’s Social Security No. (SSN)

–

–

Instructions: Use this form to claim more than one of the

following on your return:

• Other Additions

• Other Subtractions

• Other Credits

• Federal adjustments to Income

FOR FUTURE

• Other Deductions and Modifications

COMPUTER USE ONLY

Identify the code and amount for each item you are claiming.

If you are not claiming more than one of each item, do not

use this form; instead claim the item on your return.

Remember: Check the “Schedule Attached” box on your

Form 40 for each other additions, other subtractions, or

other credits you claim below.

Federal adjustments to income (codes 001–008)

Other deductions and modifications (codes 601–607)

Code

Amount

Code

Amount

•

•

•

•

28a

28b

47a

47b

•

•

•

•

28c

28d

47c

47d

•

•

•

•

28e

28f

47e

47f

•

•

•

•

28g

28h

47g

47h

•

•

•

•

28i

28j

47i

47j

Enter total on Form 40N/P, line 28 $

Enter total on Form 40N/P, line 47 $

Other additions (codes 101–122)

Other credits (codes 701–741)

Code

Amount

Code

Amount

•

•

•

•

33a

33b

57a

57b

•

•

•

•

33c

33d

57c

57d

•

•

•

•

33e

33f

57e

57f

•

•

•

•

33g

33h

57g

57h

•

•

•

•

33i

33j

57i

57j

Enter total on Form 40N/P, line 33 $

Enter total on Form 40N/P, line 57 $

Other subtractions (codes 301–341)

Code

Amount

•

•

37a

37b

•

•

37c

37d

•

•

37e

37f

•

•

37g

37h

•

•

37i

37j

Enter total on Form 40N/P, line 37 $

—YOU MUST ATTACH THIS SCHEDULE TO YOUR OREGON INCOME TAX RETURN—

150-101-064 (Rev. 12-07) DRAFT 7-16-2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1