Instructions For Form Ir - Evendale Individual Income Tax Return

ADVERTISEMENT

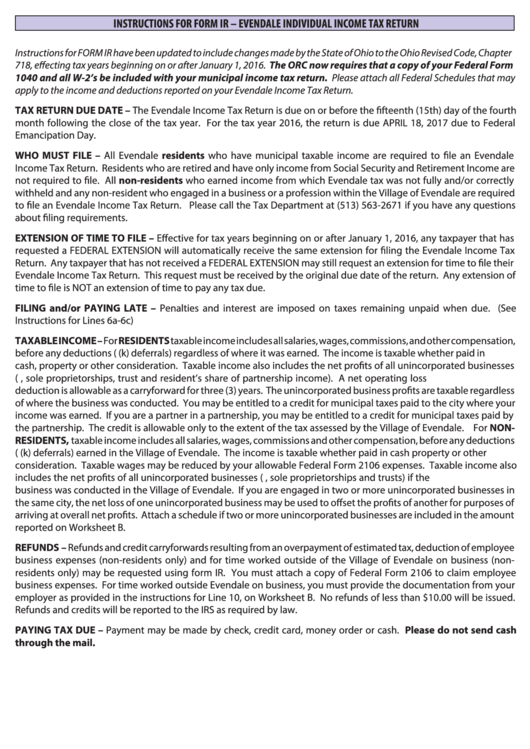

INSTRUCTIONS FOR FORM IR – EVENDALE INDIVIDUAL INCOME TAX RETURN

Instructions for FORM IR have been updated to include changes made by the State of Ohio to the Ohio Revised Code, Chapter

718, effecting tax years beginning on or after January 1, 2016. The ORC now requires that a copy of your Federal Form

1040 and all W-2’s be included with your municipal income tax return. Please attach all Federal Schedules that may

apply to the income and deductions reported on your Evendale Income Tax Return.

TAX RETURN DUE DATE – The Evendale Income Tax Return is due on or before the fifteenth (15th) day of the fourth

month following the close of the tax year. For the tax year 2016, the return is due APRIL 18, 2017 due to Federal

Emancipation Day.

WHO MUST FILE – All Evendale residents who have municipal taxable income are required to file an Evendale

Income Tax Return. Residents who are retired and have only income from Social Security and Retirement Income are

not required to file. All non-residents who earned income from which Evendale tax was not fully and/or correctly

withheld and any non-resident who engaged in a business or a profession within the Village of Evendale are required

to file an Evendale Income Tax Return. Please call the Tax Department at (513) 563-2671 if you have any questions

about filing requirements.

EXTENSION OF TIME TO FILE – Effective for tax years beginning on or after January 1, 2016, any taxpayer that has

requested a FEDERAL EXTENSION will automatically receive the same extension for filing the Evendale Income Tax

Return. Any taxpayer that has not received a FEDERAL EXTENSION may still request an extension for time to file their

Evendale Income Tax Return. This request must be received by the original due date of the return. Any extension of

time to file is NOT an extension of time to pay any tax due.

FILING and/or PAYING LATE – Penalties and interest are imposed on taxes remaining unpaid when due. (See

Instructions for Lines 6a-6c)

TAXABLE INCOME – For RESIDENTS taxable income includes all salaries, wages, commissions, and other compensation,

before any deductions (i.e. 401(k) deferrals) regardless of where it was earned. The income is taxable whether paid in

cash, property or other consideration. Taxable income also includes the net profits of all unincorporated businesses

(i.e. real estate rental , sole proprietorships, trust and resident’s share of partnership income). A net operating loss

deduction is allowable as a carryforward for three (3) years. The unincorporated business profits are taxable regardless

of where the business was conducted. You may be entitled to a credit for municipal taxes paid to the city where your

income was earned. If you are a partner in a partnership, you may be entitled to a credit for municipal taxes paid by

the partnership. The credit is allowable only to the extent of the tax assessed by the Village of Evendale. For NON-

RESIDENTS, taxable income includes all salaries, wages, commissions and other compensation, before any deductions

(i.e. 401(k) deferrals) earned in the Village of Evendale. The income is taxable whether paid in cash property or other

consideration. Taxable wages may be reduced by your allowable Federal Form 2106 expenses. Taxable income also

includes the net profits of all unincorporated businesses (i.e. real estate rental, sole proprietorships and trusts) if the

business was conducted in the Village of Evendale. If you are engaged in two or more unincorporated businesses in

the same city, the net loss of one unincorporated business may be used to offset the profits of another for purposes of

arriving at overall net profits. Attach a schedule if two or more unincorporated businesses are included in the amount

reported on Worksheet B.

REFUNDS – Refunds and credit carryforwards resulting from an overpayment of estimated tax, deduction of employee

business expenses (non-residents only) and for time worked outside of the Village of Evendale on business (non-

residents only) may be requested using form IR. You must attach a copy of Federal Form 2106 to claim employee

business expenses. For time worked outside Evendale on business, you must provide the documentation from your

employer as provided in the instructions for Line 10, on Worksheet B. No refunds of less than $10.00 will be issued.

Refunds and credits will be reported to the IRS as required by law.

PAYING TAX DUE – Payment may be made by check, credit card, money order or cash. Please do not send cash

through the mail.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4