Form 538-S - Claim For Credit/refund Of Sales Tax - 2008

ADVERTISEMENT

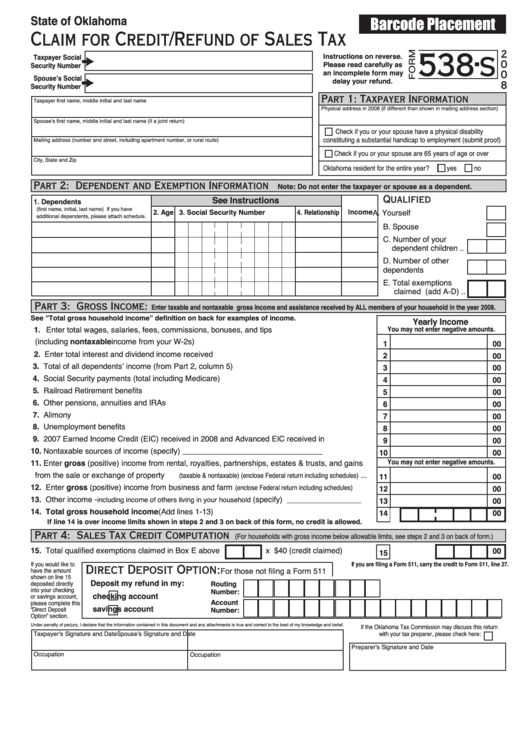

State of Oklahoma

Barcode Placement

Claim for Credit/Refund of Sales Tax

538 s

2

Instructions on reverse.

Taxpayer Social

0

Please read carefully as

Security Number

an incomplete form may

0

Spouse’s Social

delay your refund.

8

Security Number

Part 1: Taxpayer Information

Taxpayer first name, middle initial and last name

Physical address in 2008 (if different than shown in mailing address section)

Spouse’s first name, middle initial and last name (if a joint return)

Check if you or your spouse have a physical disability

constituting a substantial handicap to employment (submit proof)

Mailing address (number and street, including apartment number, or rural route)

Check if you or your spouse are 65 years of age or over

City, State and Zip

Oklahoma resident for the entire year?

yes

no

Part 2: Dependent and Exemption Information

Note: Do not enter the taxpayer or spouse as a dependent.

Qualified Exemptions...

See Instructions

1. Dependents

5.Yearly

(first name, initial, last name) If you have

2. Age 3. Social Security Number

4. Relationship

Income

A. Yourself ............................

additional dependents, please attach schedule.

B. Spouse ............................

C. Number of your

dependent children ..

D. Number of other

dependents .............

E. Total exemptions

claimed (add A-D) ..

Part 3: Gross Income:

Enter taxable and nontaxable gross income and assistance received by ALL members of your household in the year 2008.

See “Total gross household income” definition on back for examples of income.

Yearly Income

1. Enter total wages, salaries, fees, commissions, bonuses, and tips

You may not enter negative amounts.

(including nontaxable income from your W-2s) ........................................................................

1

00

2. Enter total interest and dividend income received .....................................................................

2

00

3. Total of all dependents’ income (from Part 2, column 5) ............................................................

3

00

4. Social Security payments (total including Medicare) .................................................................

4

00

5. Railroad Retirement benefits .....................................................................................................

5

00

6. Other pensions, annuities and IRAs ..........................................................................................

6

00

7. Alimony ......................................................................................................................................

7

00

8. Unemployment benefits .............................................................................................................

8

00

9. 2007 Earned Income Credit (EIC) received in 2008 and Advanced EIC received in 2008.........

9

00

10. Nontaxable sources of income (specify) ________________________________ ...................

10

00

You may not enter negative amounts.

11. Enter gross (positive) income from rental, royalties, partnerships, estates & trusts, and gains

from the sale or exchange of property

...

(taxable & nontaxable) (enclose Federal return including schedules)

11

00

12. Enter gross (positive) income from business and farm

.....

(enclose Federal return including schedules)

12

00

13. Other income -

(specify) _________________

including income of others living in your household

13

00

14. Total gross household income (Add lines 1-13) .......................................................................

14

00

If line 14 is over income limits shown in steps 2 and 3 on back of this form, no credit is allowed.

Part 4: Sales Tax Credit Computation

(For households with gross income below allowable limits, see steps 2 and 3 on back of form.)

15. Total qualified exemptions claimed in Box E above

x $40 (credit claimed) ..........

00

15

If you would like to

If you are filing a Form 511, carry the credit to Form 511, line 27.

Direct Deposit Option:

For those not filing a Form 511

have the amount

shown on line 15

Deposit my refund in my:

deposited directly

Routing

into your checking

Number:

checking account

or savings account,

Account

please complete this

savings account

“Direct Deposit

Number:

Option” section.

Under penalty of perjury, I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

If the Oklahoma Tax Commission may discuss this return

Taxpayer’s Signature and Date

Spouse’s Signature and Date

with your tax preparer, please check here:

Preparer’s Signature and Date

Occupation

Occupation

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2