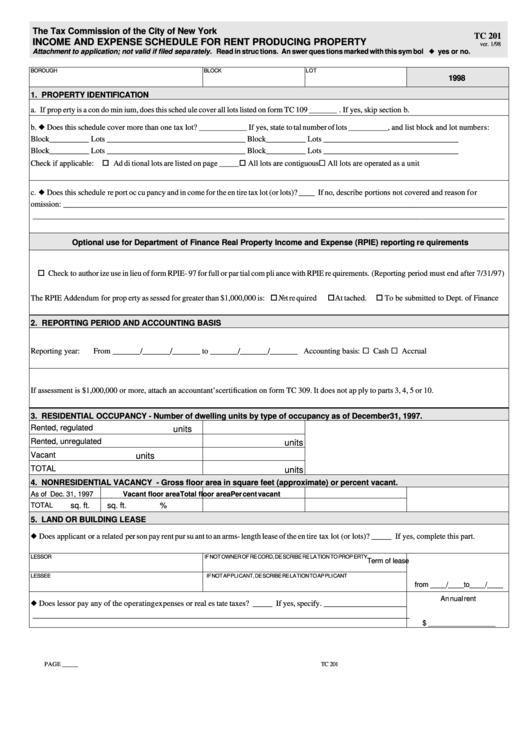

The Tax Com mis sion of the City of New York

TC 201

IN COME AND EX PENSE SCHED ULE FOR RENT PRO DUC ING PROP ERTY

ver. 1/98

At tach ment to ap pli ca tion; not valid if filed sepa rately. Read in struc tions. An swer ques tions marked with this sym bol u yes or no.

BOR OUGH

BLOCK

LOT

1998

1. PROP ERTY IDEN TI FI CA TION

a. If prop erty is a con do min ium, does this sched ule cover all lots listed on form TC 109 _______ . If yes, skip sec tion b.

b. u Does this sched ule cover more than one tax lot? ____________ If yes, state to tal number of lots __________, and list block and lot num bers:

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Check if ap pli ca ble: o Ad di tional lots are listed on page _____

o All lots are con tigu ous

¨ All lots are op er ated as a unit

c. u Does this sched ule re port oc cu pancy and in come for the en tire tax lot (or lots)? ____ If no, de scribe por tions not cov ered and rea son for

omis sion: ________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

Optional use for De part ment of Fi nance Real Prop erty In come and Ex pense (RPIE) re port ing re quire ments

o Check to author ize use in lieu of form RPIE- 97 for full or par tial com pli ance with RPIE re quire ments. (Re port ing pe riod must end af ter 7/31/97)

The RPIE Ad den dum for prop erty as sessed for greater than $1,000,000 is: o Not re quired

o At tached. o To be sub mit ted to Dept. of Fi nance

2. RE PORT ING PE RIOD AND AC COUNT ING BA SIS

Ac count ing ba sis: ¨ Cash

¨ Ac crual

Re port ing year:

From _______/_______/_______ to _______/_______/_______

If as sess ment is $1,000,000 or more, at tach an ac count ant’s cer ti fi ca tion on form TC 309. It does not ap ply to parts 3, 4, 5 or 10.

3. RESI DEN TIAL OC CU PANCY - Num ber of dwell ing units by type of oc cu pancy as of De cem ber 31, 1997.

Rented, regulated

units

Rented, un regu lated

units

Va cant

units

TO TAL

units

4. NON RESI DEN TIAL VACANCY - Gross floor area in square feet (ap proxi mate) or per cent va cant.

As of Dec. 31, 1997

Vacant floor area

To tal floor area

Per cent vacant

TO TAL

sq. ft.

sq. ft.

%

5. LAND OR BUILD ING LEASE

u Does ap pli cant or a re lated per son pay rent pur su ant to an arms- length lease of the en tire tax lot (or lots)? _____ If yes, com plete this part.

LES SOR

IF NOT OWNER OF RE CORD, DE SCRIBE RE LA TION TO PROP ERTY

Term of lease

LES SEE

IF NOT AP PLI CANT, DE SCRIBE RE LA TION TO AP PLI CANT

from ____/____to____/____

An nual rent

u Does les sor pay any of the op er at ing ex penses or real es tate taxes? _____ If yes, spec ify. _____________________

_______________________________________________________________________________________________

$ _________________

PAGE _____

TC 201

1

1 2

2