Form R-Ez Filing Instructions - Income Tax Return - Cincinnati - 1999

ADVERTISEMENT

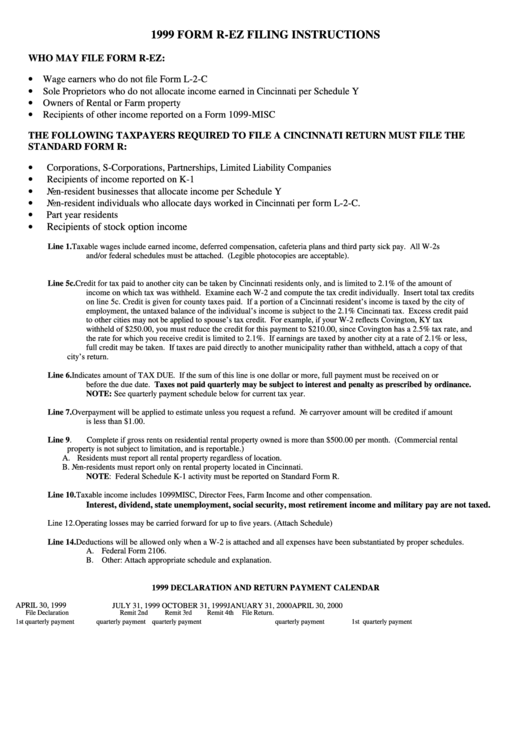

1999 FORM R-EZ FILING INSTRUCTIONS

WHO MAY FILE FORM R-EZ:

• Wage earners who do not file Form L-2-C

• Sole Proprietors who do not allocate income earned in Cincinnati per Schedule Y

• Owners of Rental or Farm property

• Recipients of other income reported on a Form 1099-MISC

THE FOLLOWING TAXPAYERS REQUIRED TO FILE A CINCINNATI RETURN MUST FILE THE

STANDARD FORM R:

• Corporations, S-Corporations, Partnerships, Limited Liability Companies

• Recipients of income reported on K-1

• Non-resident businesses that allocate income per Schedule Y

• Non-resident individuals who allocate days worked in Cincinnati per form L-2-C.

• Part year residents

•

Recipients of stock option income

Line 1.

Taxable wages include earned income, deferred compensation, cafeteria plans and third party sick pay. All W-2s

and/or federal schedules must be attached. (Legible photocopies are acceptable).

Line 5c.

Credit for tax paid to another city can be taken by Cincinnati residents only, and is limited to 2.1% of the amount of

income on which tax was withheld. Examine each W-2 and compute the tax credit individually. Insert total tax credits

on line 5c. Credit is given for county taxes paid. If a portion of a Cincinnati resident’ s income is taxed by the city of

employment, the untaxed balance of the individual’ s income is subject to the 2.1% Cincinnati tax. Excess credit paid

to other cities may not be applied to spouse’ s tax credit. For example, if your W-2 reflects Covington, KY tax

withheld of $250.00, you must reduce the credit for this payment to $210.00, since Covington has a 2.5% tax rate, and

the rate for which you receive credit is limited to 2.1%. If earnings are taxed by another city at a rate of 2.1% or less,

full credit may be taken. If taxes are paid directly to another municipality rather than withheld, attach a copy of that

city’ s return.

Line 6.

Indicates amount of TAX DUE. If the sum of this line is one dollar or more, full payment must be received on or

before the due date. Taxes not paid quarterly may be subject to interest and penalty as prescribed by ordinance.

NOTE: See quarterly payment schedule below for current tax year.

Line 7.

Overpayment will be applied to estimate unless you request a refund. No carryover amount will be credited if amount

is less than $1.00.

Line 9.

Complete if gross rents on residential rental property owned is more than $500.00 per month. (Commercial rental

property is not subject to limitation, and is reportable.)

A. Residents must report all rental property regardless of location.

B. Non-residents must report only on rental property located in Cincinnati.

NOTE: Federal Schedule K-1 activity must be reported on Standard Form R.

Line 10.

Taxable income includes 1099MISC, Director Fees, Farm Income and other compensation.

Interest, dividend, state unemployment, social security, most retirement income and military pay are not taxed.

Line 12.

Operating losses may be carried forward for up to five years. (Attach Schedule)

Line 14.

Deductions will be allowed only when a W-2 is attached and all expenses have been substantiated by proper schedules.

A. Federal Form 2106.

B. Other: Attach appropriate schedule and explanation.

1999 DECLARATION AND RETURN PAYMENT CALENDAR

APRIL 30, 1999

JULY 31, 1999

OCTOBER 31, 1999

JANUARY 31, 2000

APRIL 30, 2000

File Declaration

Remit 2nd

Remit 3rd

Remit 4th

File Return.

1st quarterly payment

quarterly payment

quarterly payment

quarterly payment

1st quarterly payment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1