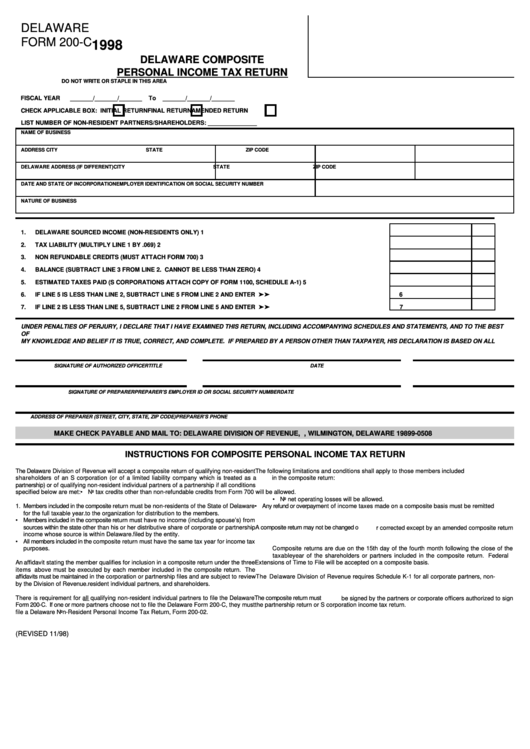

DELAWARE

FORM 200-C

1998

DELAWARE COMPOSITE

PERSONAL INCOME TAX RETURN

DO NOT WRITE OR STAPLE IN THIS AREA

FISCAL YEAR

_______/_______/_______

To

_______/_______/_______

CHECK APPLICABLE BOX:

INITIAL RETURN

FINAL RETURN

AMENDED RETURN

LIST NUMBER OF NON-RESIDENT PARTNERS/SHAREHOLDERS: _______________

NAME OF BUSINESS

ADDRESS

CITY

STATE

ZIP CODE

DELAWARE ADDRESS (IF DIFFERENT)

CITY

STATE

ZIP CODE

DATE AND STATE OF INCORPORATION

EMPLOYER IDENTIFICATION OR SOCIAL SECURITY NUMBER

NATURE OF BUSINESS

1.

DELAWARE SOURCED INCOME (NON-RESIDENTS ONLY)...............................................................................................

1

2.

TAX LIABILITY (MULTIPLY LINE 1 BY .069)..................................................................................................................

2

3.

NON REFUNDABLE CREDITS (MUST ATTACH FORM 700)..............................................................................................

3

4.

BALANCE (SUBTRACT LINE 3 FROM LINE 2. CANNOT BE LESS THAN ZERO).................................................................

4

5.

ESTIMATED TAXES PAID (S CORPORATIONS ATTACH COPY OF FORM 1100, SCHEDULE A-1).......................................

5

6.

IF LINE 5 IS LESS THAN LINE 2, SUBTRACT LINE 5 FROM LINE 2 AND ENTER HERE...............................PAY IN FULL ' '

6

IF LINE 2 IS LESS THAN LINE 5, SUBTRACT LINE 2 FROM LINE 5 AND ENTER HERE......................................REFUND ' '

7.

7

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST

OF

MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, HIS DECLARATION IS BASED ON ALL

SIGNATURE OF AUTHORIZED OFFICER

TITLE

DATE

SIGNATURE OF PREPARER

PREPARER’S EMPLOYER ID OR SOCIAL SECURITY NUMBER

DATE

ADDRESS OF PREPARER (STREET, CITY, STATE, ZIP CODE)

PREPARER’S PHONE

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 508, WILMINGTON, DELAWARE 19899-0508

INSTRUCTIONS FOR COMPOSITE PERSONAL INCOME TAX RETURN

The Delaware Division of Revenue will accept a composite return of qualifying non-resident

The following limitations and conditions shall apply to those members included

shareholders of an S corporation (or of a limited liability company which is treated as a

in the composite return:

partnership) or of qualifying non-resident individual partners of a partnership if all conditions

specified below are met:

• No tax credits other than non-refundable credits from Form 700 will be allowed.

• No net operating losses will be allowed.

1. Members included in the composite return must be non-residents of the State of Delaware

• Any refund or overpayment of income taxes made on a composite basis must be remitted

for the full taxable year.

to the organization for distribution to the members.

• Members included in the composite return must have no income (including spouse’s) from

sources within the state other than his or her distributive share of corporate or partnership

A composite return may not be changed or corrected except by an amended composite return

income whose source is within Delaware.

filed by the entity.

• All members included in the composite return must have the same tax year for income tax

purposes.

Composite returns are due on the 15th day of the fourth month following the close of the

taxable year of the shareholders or partners included in the composite return. Federal

An affidavit stating the member qualifies for inclusion in a composite return under the three

Extensions of Time to File will be accepted on a composite basis.

items above must be executed by each member included in the composite return. The

affidavits must be maintained in the corporation or partnership files and are subject to review

The Delaware Division of Revenue requires Schedule K-1 for all corporate partners, non-

by the Division of Revenue.

resident individual partners, and shareholders.

There is requirement for all qualifying non-resident individual partners to file the Delaware

The composite return must be signed by the partners or corporate officers authorized to sign

Form 200-C. If one or more partners choose not to file the Delaware Form 200-C, they must

the partnership return or S corporation income tax return.

file a Delaware Non-Resident Personal Income Tax Return, Form 200-02.

(REVISED 11/98)

1

1