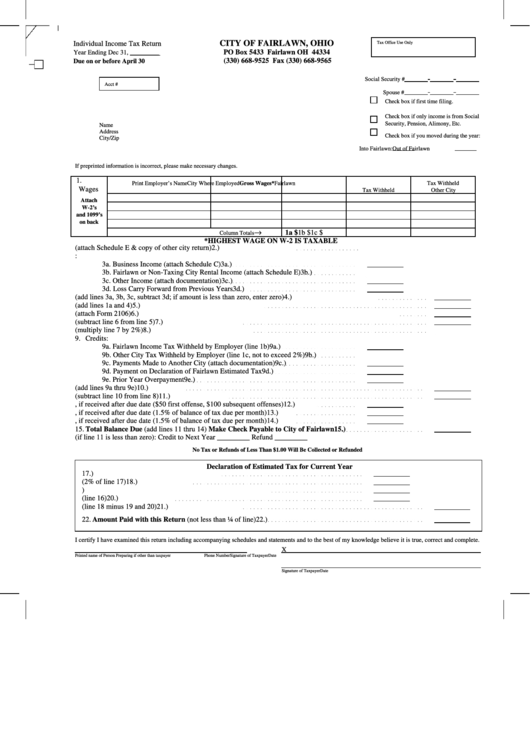

City Of Fairlawn, Ohio Individual Income Tax Return

ADVERTISEMENT

CITY OF FAIRLAWN, OHIO

Individual Income Tax Return

Tax Office Use Only

PO Box 5433 Fairlawn OH 44334

Year Ending Dec 31, _________

(330) 668-9525 Fax (330) 668-9565

Due on or before April 30

Social Security #

Acct #

Spouse #

Check box if first time filing.

Check box if only income is from Social

Security, Pension, Alimony, Etc.

Name

Address

Check box if you moved during the year:

City/Zip

Into Fairlawn:

Out of Fairlawn

If preprinted information is incorrect, please make necessary changes.

1.

Print Employer’s Name

City Where Employed

Gross Wages*

Fairlawn

Tax Withheld

Wages

Tax Withheld

Other City

Attach

W-2’s

and 1099’s

on back

→

1a $

1b $

1c $

Column Totals

*HIGHEST WAGE ON W-2 IS TAXABLE

2. Other City Rental Income (attach Schedule E & copy of other city return)

2.)

3. Other Taxable Income:

3a. Business Income (attach Schedule C)

3a.)

3b. Fairlawn or Non-Taxing City Rental Income (attach Schedule E)

3b.)

3c. Other Income (attach documentation)

3c.)

3d. Loss Carry Forward from Previous Years

3d.)

4. Total Other Taxable Income (add lines 3a, 3b, 3c, subtract 3d; if amount is less than zero, enter zero)

4.)

5. Total Taxable Income Before Deductions (add lines 1a and 4)

5.)

6. Deductions for Unreimbursed Expenses Incurred by a Fairlawn or Non-Taxing Employer (attach Form 2106)

6.)

7. Fairlawn Taxable Income (subtract line 6 from line 5)

7.)

8. Fairlawn Tax Due Before Credits (multiply line 7 by 2%)

8.)

9. Credits:

9a. Fairlawn Income Tax Withheld by Employer (line 1b)

9a.)

9b. Other City Tax Withheld by Employer (line 1c, not to exceed 2%)

9b.)

9c. Payments Made to Another City (attach documentation)

9c.)

9d. Payment on Declaration of Fairlawn Estimated Tax

9d.)

9e. Prior Year Overpayment

9e.)

10. Total Credits (add lines 9a thru 9e)

10.)

11. Balance of Tax Due (subtract line 10 from line 8)

11.)

12. Late Fee, if received after due date ($50 first offense, $100 subsequent offenses)

12.)

13. Interest, if received after due date (1.5% of balance of tax due per month)

13.)

14. Penalty, if received after due date (1.5% of balance of tax due per month)

14.)

15. Total Balance Due (add lines 11 thru 14) Make Check Payable to City of Fairlawn

15.)

16. Overpayment (if line 11 is less than zero): Credit to Next Year _________ Refund _________

No Tax or Refunds of Less Than $1.00 Will Be Collected or Refunded

Declaration of Estimated Tax for Current Year

17. Estimated Taxable Income for Current Year

17.)

18. Estimated Tax Due (2% of line 17)

18.)

19. Less Fairlawn Tax to be Withheld and/or Paid to Another City

19.)

20. Less Overpayment (line 16)

20.)

21. Total Estimated Tax Due (line 18 minus 19 and 20)

21.)

22. Amount Paid with this Return (not less than ¼ of line)

22.)

I certify I have examined this return including accompanying schedules and statements and to the best of my knowledge believe it is true, correct and complete.

X

Printed name of Person Preparing if other than taxpayer

Phone Number

Signature of Taxpayer

Date

Signature of Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1