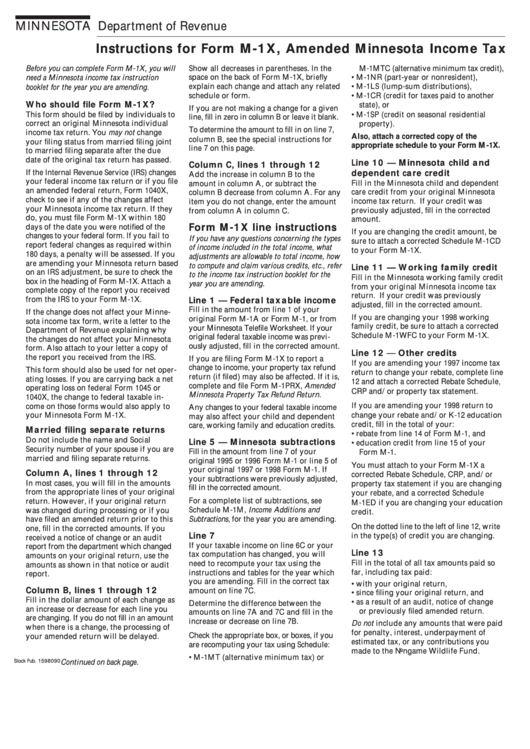

Instructions For Form M-1x - Amended Minnesota Income Tax

ADVERTISEMENT

MINNESOTA Department of Revenue

Instructions for Form M-1X, Amended Minnesota Income Tax

Show all decreases in parentheses. In the

M-1MTC (alternative minimum tax credit),

Before you can complete Form M-1X, you will

space on the back of Form M-1X, briefly

• M-1NR (part-year or nonresident),

need a Minnesota income tax instruction

explain each change and attach any related

• M-1LS (lump-sum distributions),

booklet for the year you are amending.

schedule or form.

• M-1CR (credit for taxes paid to another

Who should file Form M-1X?

state), or

If you are not making a change for a given

This form should be filed by individuals to

• M-1SP (credit on seasonal residential

line, fill in zero in column B or leave it blank.

correct an original Minnesota individual

property).

To determine the amount to fill in on line 7,

income tax return. You may not change

Also, attach a corrected copy of the

column B, see the special instructions for

your filing status from married filing joint

appropriate schedule to your Form M-1X.

line 7 on this page.

to married filing separate after the due

date of the original tax return has passed.

Line 10 — Minnesota child and

Column C, lines 1 through 12

If the Internal Revenue Service (IRS) changes

dependent care credit

Add the increase in column B to the

your federal income tax return or if you file

Fill in the Minnesota child and dependent

amount in column A, or subtract the

an amended federal return, Form 1040X,

care credit from your original Minnesota

column B decrease from column A. For any

check to see if any of the changes affect

income tax return. If your credit was

item you do not change, enter the amount

your Minnesota income tax return. If they

previously adjusted, fill in the corrected

from column A in column C.

do, you must file Form M-1X within 180

amount.

Form M-1X line instructions

days of the date you were notified of the

If you are changing the credit amount, be

changes to your federal form. If you fail to

If you have any questions concerning the types

sure to attach a corrected Schedule M-1CD

report federal changes as required within

of income included in the total income, what

to your Form M-1X.

180 days, a penalty will be assessed. If you

adjustments are allowable to total income, how

are amending your Minnesota return based

to compute and claim various credits, etc., refer

Line 11 — Working family credit

on an IRS adjustment, be sure to check the

to the income tax instruction booklet for the

Fill in the Minnesota working family credit

box in the heading of Form M-1X. Attach a

year you are amending.

from your original Minnesota income tax

complete copy of the report you received

return. If your credit was previously

Line 1 — Federal taxable income

from the IRS to your Form M-1X.

adjusted, fill in the corrected amount.

Fill in the amount from line 1 of your

If the change does not affect your Minne-

If you are changing your 1998 working

original Form M-1A or Form M-1, or from

sota income tax form, write a letter to the

family credit, be sure to attach a corrected

your Minnesota Telefile Worksheet. If your

Department of Revenue explaining why

Schedule M-1WFC to your Form M-1X.

original federal taxable income was previ-

the changes do not affect your Minnesota

ously adjusted, fill in the corrected amount.

form. Also attach to your letter a copy of

Line 12 — Other credits

the report you received from the IRS.

If you are filing Form M-1X to report a

If you are amending your 1997 income tax

change to income, your property tax refund

This form should also be used for net oper-

return to change your rebate, complete line

return (if filed) may also be affected. If it is,

ating losses. If you are carrying back a net

12 and attach a corrected Rebate Schedule,

complete and file Form M-1PRX, Amended

operating loss on federal Form 1045 or

CRP and/or property tax statement.

Minnesota Property Tax Refund Return.

1040X, the change to federal taxable in-

If you are amending your 1998 return to

come on those forms would also apply to

Any changes to your federal taxable income

your Minnesota Form M-1X.

change your rebate and/or K-12 education

may also affect your child and dependent

credit, fill in the total of your:

care, working family and education credits.

Married filing separate returns

• rebate from line 14 of Form M-1, and

Do not include the name and Social

Line 5 — Minnesota subtractions

• education credit from line 15 of your

Security number of your spouse if you are

Fill in the amount from line 7 of your

Form M-1.

married and filing separate returns.

original 1995 or 1996 Form M-1 or line 5 of

You must attach to your Form M-1X a

your original 1997 or 1998 Form M-1. If

Column A, lines 1 through 12

corrected Rebate Schedule, CRP, and/or

your subtractions were previously adjusted,

In most cases, you will fill in the amounts

property tax statement if you are changing

fill in the corrected amount.

from the appropriate lines of your original

your rebate, and a corrected Schedule

For a complete list of subtractions, see

return. However, if your original return

M-1ED if you are changing your education

Schedule M-1M, Income Additions and

was changed during processing or if you

credit.

have filed an amended return prior to this

Subtractions, for the year you are amending.

On the dotted line to the left of line 12, write

one, fill in the corrected amounts. If you

Line 7

in the type(s) of credit you are changing.

received a notice of change or an audit

If your taxable income on line 6C or your

report from the department which changed

Line 13

tax computation has changed, you will

amounts on your original return, use the

need to recompute your tax using the

Fill in the total of all tax amounts paid so

amounts as shown in that notice or audit

instructions and tables for the year which

far, including tax paid:

report.

you are amending. Fill in the correct tax

• with your original return,

Column B, lines 1 through 12

amount on line 7C.

• since filing your original return, and

Fill in the dollar amount of each change as

• as a result of an audit, notice of change

Determine the difference between the

an increase or decrease for each line you

or previously filed amended return.

amounts on line 7A and 7C and fill in the

are changing. If you do not fill in an amount

increase or decrease on line 7B.

Do not include any amounts that were paid

when there is a change, the processing of

for penalty, interest, underpayment of

Check the appropriate box, or boxes, if you

your amended return will be delayed.

estimated tax, or any contributions you

are recomputing your tax using Schedule:

made to the Nongame Wildlife Fund.

• M-1MT (alternative minimum tax) or

Stock Pub. 1598090

Continued on back page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2