Instructions For Form 540ez - California Resident Income Tax Return - 1998

ADVERTISEMENT

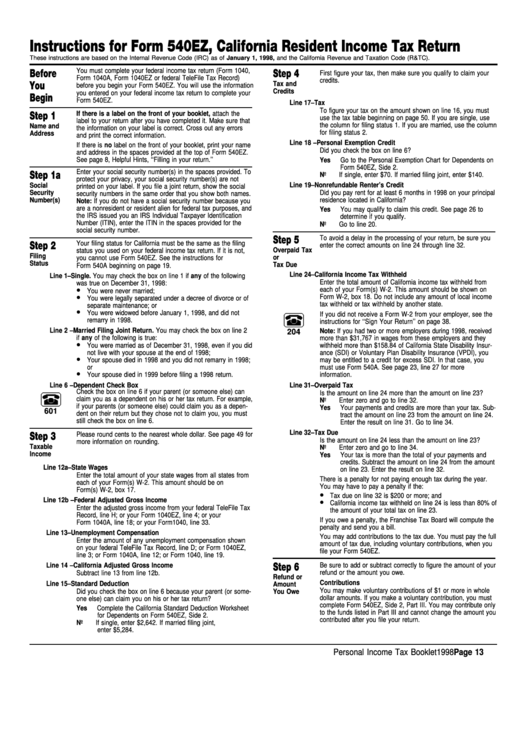

Instructions for Form 540EZ, California Resident Income Tax Return

These instructions are based on the Internal Revenue Code (IRC) as of January 1, 1998, and the California Revenue and Taxation Code (R&TC).

You must complete your federal income tax return (Form 1040,

Before

Step 4

First figure your tax, then make sure you qualify to claim your

Form 1040A, Form 1040EZ or federal TeleFile Tax Record)

credits.

Tax and

You

before you begin your Form 540EZ. You will use the information

Credits

you entered on your federal income tax return to complete your

Begin

Form 540EZ.

Line 17 – Tax

To figure your tax on the amount shown on line 16, you must

If there is a label on the front of your booklet, attach the

Step 1

use the tax table beginning on page 50. If you are single, use

label to your return after you have completed it. Make sure that

the column for filing status 1. If you are married, use the column

Name and

the information on your label is correct. Cross out any errors

for filing status 2.

Address

and print the correct information.

Line 18 – Personal Exemption Credit

If there is no label on the front of your booklet, print your name

Did you check the box on line 6?

and address in the spaces provided at the top of Form 540EZ.

See page 8, Helpful Hints, ‘‘Filling in your return.’’

Yes

Go to the Personal Exemption Chart for Dependents on

Form 540EZ, Side 2.

Enter your social security number(s) in the spaces provided. To

Step 1a

No

If single, enter $70. If married filing joint, enter $140.

protect your privacy, your social security number(s) are not

Line 19 – Nonrefundable Renter’s Credit

Social

printed on your label. If you file a joint return, show the social

Security

Did you pay rent for at least 6 months in 1998 on your principal

security numbers in the same order that you show both names.

Number(s)

residence located in California?

Note: If you do not have a social security number because you

are a nonresident or resident alien for federal tax purposes, and

Yes

You may qualify to claim this credit. See page 26 to

the IRS issued you an IRS Individual Taxpayer Identification

determine if you qualify.

Number (ITIN), enter the ITIN in the spaces provided for the

No

Go to line 20.

social security number.

To avoid a delay in the processing of your return, be sure you

Step 5

Your filing status for California must be the same as the filing

Step 2

enter the correct amounts on line 24 through line 32.

Overpaid Tax

status you used on your federal income tax return. If it is not,

Filing

or

you cannot use Form 540EZ. See the instructions for

Status

Tax Due

Form 540A beginning on page 19.

Line 24 – California Income Tax Withheld

Line 1 – Single. You may check the box on line 1 if any of the following

Enter the total amount of California income tax withheld from

was true on December 31, 1998:

•

each of your Form(s) W-2. This amount should be shown on

You were never married;

•

Form W-2, box 18. Do not include any amount of local income

You were legally separated under a decree of divorce or of

tax withheld or tax withheld by another state.

separate maintenance; or

•

You were widowed before January 1, 1998, and did not

If you did not receive a Form W-2 from your employer, see the

remarry in 1998.

instructions for ‘‘Sign Your Return’’ on page 38.

Line 2 – Married Filing Joint Return. You may check the box on line 2

Note: If you had two or more employers during 1998, received

204

if any of the following is true:

more than $31,767 in wages from these employers and they

•

You were married as of December 31, 1998, even if you did

withheld more than $158.84 of California State Disability Insur-

not live with your spouse at the end of 1998;

ance (SDI) or Voluntary Plan Disability Insurance (VPDI), you

•

Your spouse died in 1998 and you did not remarry in 1998;

may be entitled to a credit for excess SDI. In that case, you

or

must use Form 540A. See page 23, line 27 for more

•

Your spouse died in 1999 before filing a 1998 return.

information.

Line 6 – Dependent Check Box

Line 31 – Overpaid Tax

Check the box on line 6 if your parent (or someone else) can

Is the amount on line 24 more than the amount on line 23?

claim you as a dependent on his or her tax return. For example,

No

Enter zero and go to line 32.

if your parents (or someone else) could claim you as a depen-

Yes

Your payments and credits are more than your tax. Sub-

601

dent on their return but they chose not to claim you, you must

tract the amount on line 23 from the amount on line 24.

still check the box on line 6.

Enter the result on line 31. Go to line 34.

Line 32 – Tax Due

Please round cents to the nearest whole dollar. See page 49 for

Step 3

Is the amount on line 24 less than the amount on line 23?

more information on rounding.

Taxable

No

Enter zero and go to line 34.

Income

Yes

Your tax is more than the total of your payments and

credits. Subtract the amount on line 24 from the amount

Line 12a – State Wages

on line 23. Enter the result on line 32.

Enter the total amount of your state wages from all states from

There is a penalty for not paying enough tax during the year.

each of your Form(s) W-2. This amount should be on

You may have to pay a penalty if the:

Form(s) W-2, box 17.

•

Tax due on line 32 is $200 or more; and

•

Line 12b – Federal Adjusted Gross Income

California income tax withheld on line 24 is less than 80% of

Enter the adjusted gross income from your federal TeleFile Tax

the amount of your total tax on line 23.

Record, line H; or your Form 1040EZ, line 4; or your

If you owe a penalty, the Franchise Tax Board will compute the

Form 1040A, line 18; or your Form 1040, line 33.

penalty and send you a bill.

Line 13 – Unemployment Compensation

You may add contributions to the tax due. You must pay the full

Enter the amount of any unemployment compensation shown

amount of tax due, including voluntary contributions, when you

on your federal TeleFile Tax Record, line D; or Form 1040EZ,

file your Form 540EZ.

line 3; or Form 1040A, line 12; or Form 1040, line 19.

Be sure to add or subtract correctly to figure the amount of your

Line 14 – California Adjusted Gross Income

Step 6

refund or the amount you owe.

Subtract line 13 from line 12b.

Refund or

Contributions

Line 15 – Standard Deduction

Amount

You may make voluntary contributions of $1 or more in whole

Did you check the box on line 6 because your parent (or some-

You Owe

dollar amounts. If you make a voluntary contribution, you must

one else) can claim you on his or her tax return?

complete Form 540EZ, Side 2, Part III. You may contribute only

Yes

Complete the California Standard Deduction Worksheet

to the funds listed in Part III and cannot change the amount you

for Dependents on Form 540EZ, Side 2.

contributed after you file your return.

No

If single, enter $2,642. If married filing joint,

enter $5,284.

Personal Income Tax Booklet 1998 Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2