Form F-7004a - Corporate Income Tax - Florida Department Of Revenue

ADVERTISEMENT

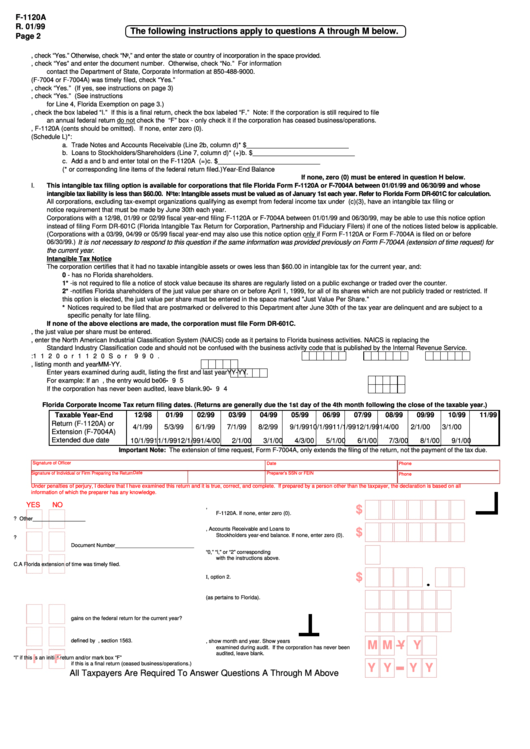

F-1120A

R. 01/99

The following instructions apply to questions A through M below.

Page 2

A.

If the corporation is incorporated in the State of Florida, check “Yes.” Otherwise, check “No,” and enter the state or country of incorporation in the space provided.

B.

If the corporation is registered with the Florida Secretary of State, check “Yes” and enter the document number. Otherwise, check “No.” For information

contact the Department of State, Corporate Information at 850-488-9000.

C.

If a Florida Extension of Time (F-7004 or F-7004A) was timely filed, check “Yes.”

D.

If the corporation reported net passive income or capital gains for the current year, check “Yes.” (If yes, see instructions on page 3)

E.

If the corporation is a member of a controlled group of corporations as defined in Section 1563 of the Internal Revenue Code, check “Yes.” (See instructions

for Line 4, Florida Exemption on page 3.)

F.

If this is an initial or first year return, check the box labeled “I.” If this is a final return, check the box labeled “F.” Note: If the corporation is still required to file

an annual federal return do not check the “F” box - only check it if the corporation has ceased business/operations.

G.

Enter only the dollar amount of state income tax included in Line 2, F-1120A (cents should be omitted). If none, enter zero (0).

H.

Enter the year-end amounts reported on the federal 1120 balance sheet (Schedule L)*:

a. Trade Notes and Accounts Receivable (Line 2b, column d)* ...................

a. $ ____________________________

b. Loans to Stockholders/Shareholders (Line 7, column d)* ......................... (+)b. $ ____________________________

c. Add a and b and enter total on the F-1120A coupon ................................. (=)c. $ ____________________________

(* or corresponding line items of the federal return filed.)

Year-End Balance

If none, zero (0) must be entered in question H below.

I.

This intangible tax filing option is available for corporations that file Florida Form F-1120A or F-7004A between 01/01/99 and 06/30/99 and whose

intangible tax liability is less than $60.00. Note: Intangible assets must be valued as of January 1st each year. Refer to Florida Form DR-601C for calculation.

All corporations, excluding tax-exempt organizations qualifying as exempt from federal income tax under I.R.C. 501(c)(3), have an intangible tax filing or

notice requirement that must be made by June 30th each year.

Corporations with a 12/98, 01/99 or 02/99 fiscal year-end filing F-1120A or F-7004A between 01/01/99 and 06/30/99, may be able to use this notice option

instead of filing Form DR-601C (Florida Intangible Tax Return for Corporation, Partnership and Fiduciary Filers) if one of the notices listed below is applicable.

(Corporations with a 03/99, 04/99 or 05/99 fiscal year-end may also use this notice option only if Form F-1120A or Form F-7004A is filed on or before

06/30/99.)

It is not necessary to respond to this question if the same information was provided previously on Form F-7004A (extension of time request) for

the current year.

Intangible Tax Notice

The corporation certifies that it had no taxable intangible assets or owes less than $60.00 in intangible tax for the current year, and:

0 - has no Florida shareholders.

1* -is not required to file a notice of stock value because its shares are regularly listed on a public exchange or traded over the counter.

2* -notifies Florida shareholders of the just value per share on or before April 1, 1999, for all of its shares which are not publicly traded or restricted. If

this option is elected, the just value per share must be entered in the space marked "Just Value Per Share."

* Notices required to be filed that are postmarked or delivered to this Department after June 30th of the tax year are delinquent and are subject to a

specific penalty for late filing.

If none of the above elections are made, the corporation must file Form DR-601C.

J.

If filing notice option 2 was elected in question I, the just value per share must be entered.

K.

If known, enter the North American Industrial Classification System (NAICS) code as it pertains to Florida business activities. NAICS is replacing the

Standard Industry Classification code and should not be confused with the business activity code that is published by the Internal Revenue Service.

L.

Enter the type of federal return filed with the Internal Revenue Service. For example:

1 1 2 0

or

1 1 2 0 S

or

9 9 0

.

M.

Enter date of last I.R.S. audit, listing month and year M M - Y Y .

Enter years examined during audit, listing the first and last year Y Y - Y Y .

For example: If an I.R.S. audit was completed June 1995 and included the years 1990-1994, the entry would be 0 6 - 9 5

If the corporation has never been audited, leave blank.

9 0 - 9 4

Florida Corporate Income Tax return filing dates. (Returns are generally due the 1st day of the 4th month following the close of the taxable year.)

Taxable Year-End

12/98

01/99

02/99

03/99

04/99

05/99

06/99

07/99

08/99

09/99

10/99

11/99

Return (F-1120A) or

4/1/99

5/3/99

6/1/99

7/1/99

8/2/99

9/1/99

10/1/99

11/1/99

12/1/99

1/4/00

2/1/00

3/1/00

Extension (F-7004A)

Extended due date

10/1/99

11/1/99

12/1/99

1/4/00

2/1/00

3/1/00

4/3/00

5/1/00

6/1/00

7/3/00

8/1/00

9/1/00

Important Note: The extension of time request, Form F-7004A, only extends the filing of the return, not the payment of the tax due.

Signature of Officer

Date

Phone

Date

Signature of Individual or Firm Preparing the Return

Preparer’s SSN or FEIN

Phone

Under penalties of perjury, I declare that I have examined this return and it is true, correct, and complete. If prepared by a person other than the taxpayer, the declaration is based on all

information of which the preparer has any knowledge.

YES

NO

G. Amount of state income taxes included in Line 2,

$

F-1120A. If none, enter zero (0).

A.

Incorporated in Florida? Other __________________

H. Trade Notes, Accounts Receivable and Loans to

$

Stockholders year-end balance. If none, enter zero (0).

B.

Registered with Florida Secretary of State?

Document Number ___________________________

I.

Intangible Tax Notice. Enter a “0,” “I,” or “2” corresponding

with the instructions above.

C.

A Florida extension of time was timely filed.

$

J.

Just value per share reported in question I, option 2.

K.

NAICS code (as pertains to Florida).

D.

Corporation reported net passive income or capital

gains on the federal return for the current year?

L.

Type of federal return filed.

E.

Corporation is a member of a controlled group as

defined by I.R.C., section 1563.

M. Date of last IRS audit, show month and year. Show years

M M

Y Y

examined during audit. If the corporation has never been

audited, leave blank.

I

F

F.

Mark box “I” if this is an initial return and/or mark box “F”

if this is a final return (ceased business/operations.)

Y Y

Y Y

All Taxpayers Are Required To Answer Questions A Through M Above

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4