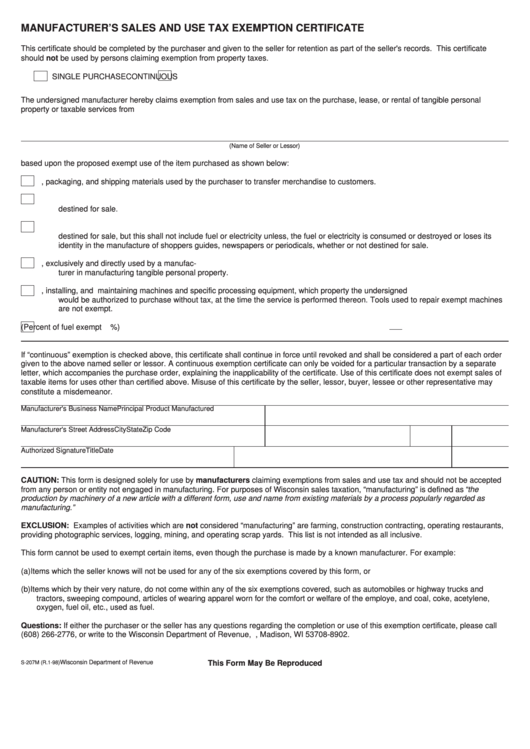

MANUFACTURER’S SALES AND USE TAX EXEMPTION CERTIFICATE

This certificate should be completed by the purchaser and given to the seller for retention as part of the seller's records. This certificate

should not be used by persons claiming exemption from property taxes.

SINGLE PURCHASE

CONTINUOUS

The undersigned manufacturer hereby claims exemption from sales and use tax on the purchase, lease, or rental of tangible personal

property or taxable services from

(Name of Seller or Lessor)

based upon the proposed exempt use of the item purchased as shown below:

1.

Containers and other packing, packaging, and shipping materials used by the purchaser to transfer merchandise to customers.

2.

Tangible personal property becoming an ingredient or component part of an article of tangible personal property in any form

destined for sale.

3.

Tangible personal property which is consumed or destroyed or loses its identity in the manufacture of tangible personal property

destined for sale, but this shall not include fuel or electricity unless, the fuel or electricity is consumed or destroyed or loses its

identity in the manufacture of shoppers guides, newspapers or periodicals, whether or not destined for sale.

4.

Machines and specific processing equipment and repair parts or replacements thereof, exclusively and directly used by a manufac-

turer in manufacturing tangible personal property.

5.

The service of repairing, installing, and maintaining machines and specific processing equipment, which property the undersigned

would be authorized to purchase without tax, at the time the service is performed thereon. Tools used to repair exempt machines

are not exempt.

6.

Portion of the amount of fuel converted to steam for purposes of resale. (Percent of fuel exempt

%)

If “continuous” exemption is checked above, this certificate shall continue in force until revoked and shall be considered a part of each order

given to the above named seller or lessor. A continuous exemption certificate can only be voided for a particular transaction by a separate

letter, which accompanies the purchase order, explaining the inapplicability of the certificate. Use of this certificate does not exempt sales of

taxable items for uses other than certified above. Misuse of this certificate by the seller, lessor, buyer, lessee or other representative may

constitute a misdemeanor.

Manufacturer's Business Name

Principal Product Manufactured

Manufacturer's Street Address

City

State

Zip Code

Authorized Signature

Title

Date

CAUTION: This form is designed solely for use by manufacturers claiming exemptions from sales and use tax and should not be accepted

from any person or entity not engaged in manufacturing. For purposes of Wisconsin sales taxation, “manufacturing” is defined as “ the

production by machinery of a new article with a different form, use and name from existing materials by a process popularly regarded as

manufacturing.”

EXCLUSION: Examples of activities which are not considered “manufacturing” are farming, construction contracting, operating restaurants,

providing photographic services, logging, mining, and operating scrap yards. This list is not intended as all inclusive.

This form cannot be used to exempt certain items, even though the purchase is made by a known manufacturer. For example:

(a) Items which the seller knows will not be used for any of the six exemptions covered by this form, or

(b) Items which by their very nature, do not come within any of the six exemptions covered, such as automobiles or highway trucks and

tractors, sweeping compound, articles of wearing apparel worn for the comfort or welfare of the employe, and coal, coke, acetylene,

oxygen, fuel oil, etc., used as fuel.

Questions: If either the purchaser or the seller has any questions regarding the completion or use of this exemption certificate, please call

(608) 266-2776, or write to the Wisconsin Department of Revenue, P.O. Box 8902, Madison, WI 53708-8902.

Wisconsin Department of Revenue

This Form May Be Reproduced

S-207M (R.1-98)

1

1