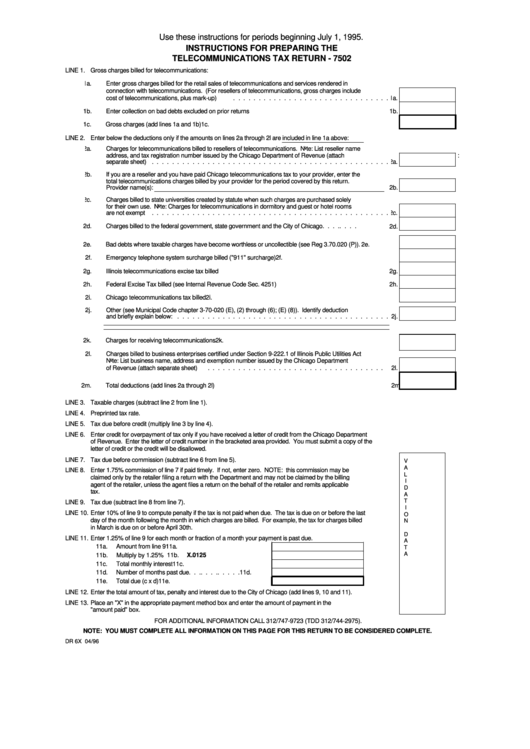

Form Dr 6x - Instructions For Preparing The Telecommunications Tax Return - 7502

ADVERTISEMENT

Use these instructions for periods beginning July 1, 1995.

INSTRUCTIONS FOR PREPARING THE

TELECOMMUNICATIONS TAX RETURN - 7502

LINE 1. Gross charges billed for telecommunications:

1a.

Enter gross charges billed for the retail sales of telecommunications and services rendered in

connection with telecommunications. (For resellers of telecommunications, gross charges include

cost of telecommunications, plus mark-up)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

1b.

Enter collection on bad debts excluded on prior returns

. . . . . . . . . . . . . . . . . . . . . . . . 1b.

1c.

Gross charges (add lines 1a and 1b)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c.

LINE 2. Enter below the deductions only if the amounts on lines 2a through 2l are included in line 1a above:

2a.

Charges for telecommunications billed to resellers of telecommunications. Note: List reseller name

address, and tax registration number issued by the Chicago Department of Revenue (attach

:

separate sheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a.

2b.

If you are a reseller and you have paid Chicago telecommunications tax to your provider, enter the

total telecommunications charges billed by your provider for the period covered by this return.

Provider name(s):

2b.

2c.

Charges billed to state universities created by statute when such charges are purchased solely

for their own use. Note: Charges for telecommunications in dormitory and guest or hotel rooms

are not exempt

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c.

2d.

Charges billed to the federal government, state government and the City of Chicago

. . . . . . . . 2d.

2e.

Bad debts where taxable charges have become worthless or uncollectible (see Reg 3.70.020 (P))

. 2e.

2f.

Emergency telephone system surcharge billed ("911" surcharge)

. . . . . . . . . . . . . . . . . . . 2f.

2g.

Illinois telecommunications excise tax billed

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2g.

2h.

Federal Excise Tax billed (see Internal Revenue Code Sec. 4251)

. . . . . . . . . . . . . . . . . . . 2h.

2i.

Chicago telecommunications tax billed

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2i.

2j.

Other (see Municipal Code chapter 3-70-020 (E), (2) through (6); (E) (8)). Identify deduction

and briefly explain below: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2j.

2k.

Charges for receiving telecommunications

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2k.

2l.

Charges billed to business enterprises certified under Section 9-222.1 of Illinois Public Utilities Act

Note: List business name, address and exemption number issued by the Chicago Department

of Revenue (attach separate sheet)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2l.

2m.

Total deductions (add lines 2a through 2l)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2m.

LINE 3. Taxable charges (subtract line 2 from line 1).

LINE 4. Preprinted tax rate.

LINE 5. Tax due before credit (multiply line 3 by line 4).

LINE 6. Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department

of Revenue. Enter the letter of credit number in the bracketed area provided. You must submit a copy of the

letter of credit or the credit will be disallowed.

LINE 7. Tax due before commission (subtract line 6 from line 5).

V

A

LINE 8. Enter 1.75% commission of line 7 if paid timely. If not, enter zero. NOTE: this commission may be

L

claimed only by the retailer filing a return with the Department and may not be claimed by the billing

I

agent of the retailer, unless the agent files a return on the behalf of the retailer and remits applicable

D

tax.

A

T

LINE 9. Tax due (subtract line 8 from line 7).

I

LINE 10. Enter 10% of line 9 to compute penalty if the tax is not paid when due. The tax is due on or before the last

O

day of the month following the month in which charges are billed. For example, the tax for charges billed

N

in March is due on or before April 30th.

D

LINE 11. Enter 1.25% of line 9 for each month or fraction of a month your payment is past due.

A

11a.

Amount from line 9 . . . . . . . . . . . . . . . . . 11a.

T

A

11b.

Multiply by 1.25% . . . . . . . . . . . . . . . . . . 11b.

X

.0125

11c.

Total monthly interest

. . . . . . . . . . . . . . . 11c.

11d.

Number of months past due

. . . . . . . . . . . . 11d.

11e.

Total due (c x d)

. . . . . . . . . . . . . . . . . . 11e.

LINE 12. Enter the total amount of tax, penalty and interest due to the City of Chicago (add lines 9, 10 and 11).

LINE 13. Place an "X" in the appropriate payment method box and enter the amount of payment in the

"amount paid" box.

FOR ADDITIONAL INFORMATION CALL 312/747-9723 (TDD 312/744-2975).

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

DR 6X 04/96

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1