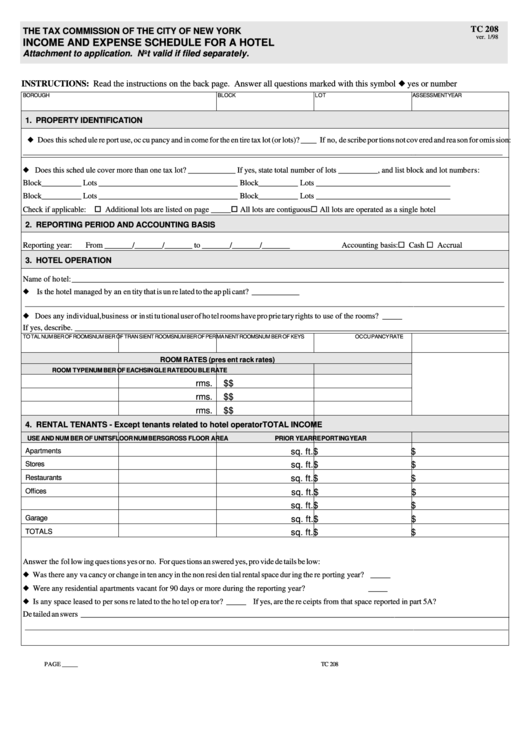

TC 208

THE TAX COM MIS SION OF THE CITY OF NEW YORK

ver. 1/98

IN COME AND EX PENSE SCHED ULE FOR A HO TEL

At tach ment to ap pli ca tion. Not valid if filed sepa rately.

IN STRUC TIONS: Read the in struc tions on the back page. An swer all ques tions marked with this sym bol u yes or number

BOR OUGH

BLOCK

LOT

AS SESS MENT YEAR

1. PROPERTY IDENTIFICATION

u Does this sched ule re port use, oc cu pancy and in come for the en tire tax lot (or lots)? ____ If no, de scribe por tions not cov ered and rea son for omis sion:

_________________________________________________________________________________________________________________________

u Does this sched ule cover more than one tax lot? ____________ If yes, state to tal number of lots __________, and list block and lot num bers:

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Check if ap pli ca ble: o Ad di tional lots are listed on page _____

o All lots are con tigu ous

¨ All lots are op er ated as a sin gle ho tel

2. REPORTING PERIOD AND ACCOUNTING BASIS

Ac count ing ba sis: ¨ Cash

¨ Ac crual

Re port ing year:

From _______/_______/_______ to _______/_______/_______

3. HOTEL OPERATION

Name of ho tel: _____________________________________________________________________________________________________________

u Is the ho tel man aged by an en tity that is un re lated to the ap pli cant? ____________

_________________________________________________________________________________________________________________________

u Does any in di vid ual, busi ness or in sti tu tional user of ho tel rooms have pro prie tary rights to use of the rooms? _____

If yes, de scribe. _____________________________________________________________________________________________________________

TO TAL NUM BER OF ROOMS

NUM BER OF TRAN SIENT ROOMS

NUM BER OF PER MA NENT ROOMS

NUM BER OF KEYS

OC CU PANCY RATE

ROOM RATES (pres ent rack rates)

ROOM TYPE

NUM BER OF EACH

SIN GLE RATE

DOU BLE RATE

rms. $

$

rms. $

$

rms. $

$

4. RENTAL TENANTS - Except tenants related to hotel operator

TOTAL INCOME

USE AND NUM BER OF UNITS

FLOOR NUM BERS

GROSS FLOOR AREA

PRIOR YEAR

RE PORT ING YEAR

Apartments

sq. ft. $

$

Stores

sq. ft. $

$

Restaurants

sq. ft. $

$

Offices

sq. ft. $

$

sq. ft. $

$

Garage

sq. ft. $

$

TOTALS

sq. ft. $

$

An swer the fol low ing ques tions yes or no. For ques tions an swered yes, pro vide de tails be low:

u Was there any va cancy or change in ten ancy in the non resi den tial rental space dur ing the re port ing year? _____

u Were any resi den tial apart ments va cant for 90 days or more dur ing the re port ing year?

_____

u Is any space leased to per sons re lated to the ho tel op era tor? _____ If yes, are the re ceipts from that space re ported in part 5A?

De tailed an swers ____________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

PAGE _____

TC 208

1

1 2

2