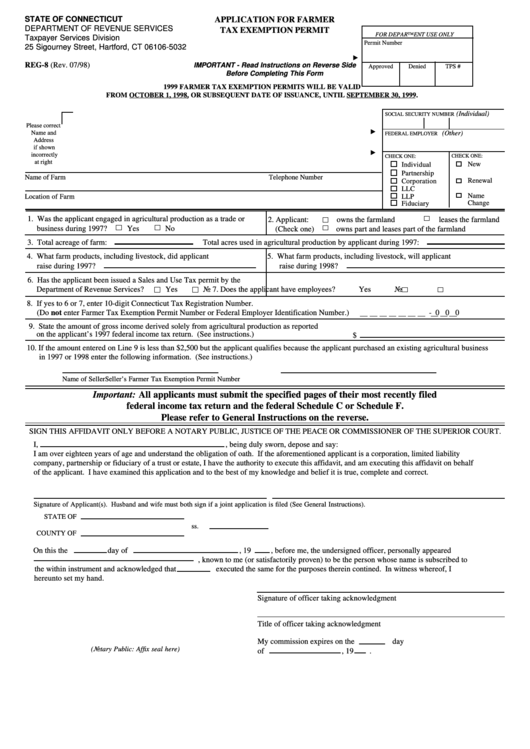

STATE OF CONNECTICUT

APPLICATION FOR FARMER

DEPARTMENT OF REVENUE SERVICES

TAX EXEMPTION PERMIT

FOR DEPARTMENT USE ONLY

Taxpayer Services Division

Permit Number

25 Sigourney Street, Hartford, CT 06106-5032

REG-8 (Rev. 07/98)

IMPORTANT - Read Instructions on Reverse Side

Approved

Denied

TPS #

Before Completing This Form

1999 FARMER TAX EXEMPTION PERMITS WILL BE VALID

FROM OCTOBER 1, 1998, OR SUBSEQUENT DATE OF ISSUANCE, UNTIL SEPTEMBER 30, 1999.

(Individual)

SOCIAL SECURITY NUMBER

Please correct

Name and

(Other)

FEDERAL EMPLOYER I.D. NUMBER

Address

if shown

incorrectly

CHECK ONE:

CHECK ONE:

at right

New

Individual

Partnership

Name of Farm

Telephone Number

Renewal

Corporation

LLC

Name

Location of Farm

LLP

Change

Fiduciary

1. Was the applicant engaged in agricultural production as a trade or

2. Applicant:

owns the farmland

leases the farmland

business during 1997?

Yes

No

(Check one)

owns part and leases part of the farmland

3. Total acreage of farm:

Total acres used in agricultural production by applicant during 1997:

4. What farm products, including livestock, did applicant

5. What farm products, including livestock, will applicant

raise during 1997?

raise during 1998?

6. Has the applicant been issued a Sales and Use Tax permit by the

Department of Revenue Services?

Yes

No

7. Does the applicant have employees?

Yes

No

8. If yes to 6 or 7, enter 10-digit Connecticut Tax Registration Number.

(Do not enter Farmer Tax Exemption Permit Number or Federal Employer Identification Number.)

- 0 0 0

9. State the amount of gross income derived solely from agricultural production as reported

on the applicant’s 1997 federal income tax return. (See instructions.)

$

10. If the amount entered on Line 9 is less than $2,500 but the applicant qualifies because the applicant purchased an existing agricultural business

in 1997 or 1998 enter the following information. (See instructions.)

Name of Seller

Seller’s Farmer Tax Exemption Permit Number

Important: All applicants must submit the specified pages of their most recently filed

federal income tax return and the federal Schedule C or Schedule F.

Please refer to General Instructions on the reverse.

SIGN THIS AFFIDAVIT ONLY BEFORE A NOTARY PUBLIC, JUSTICE OF THE PEACE OR COMMISSIONER OF THE SUPERIOR COURT.

I,

, being duly sworn, depose and say:

I am over eighteen years of age and understand the obligation of oath. If the aforementioned applicant is a corporation, limited liability

company, partnership or fiduciary of a trust or estate, I have the authority to execute this affidavit, and am executing this affidavit on behalf

of the applicant. I have examined this application and to the best of my knowledge and belief it is true, complete and correct.

Signature of Applicant(s). Husband and wife must both sign if a joint application is filed (See General Instructions).

STATE OF

ss.

COUNTY OF

On this the

day of

, 19

, before me, the undersigned officer, personally appeared

, known to me (or satisfactorily proven) to be the person whose name is subscribed to

the within instrument and acknowledged that

executed the same for the purposes therein contined. In witness whereof, I

hereunto set my hand.

Signature of officer taking acknowledgment

Title of officer taking acknowledgment

My commission expires on the

day

(Notary Public: Affix seal here)

of

, 19

.

1

1