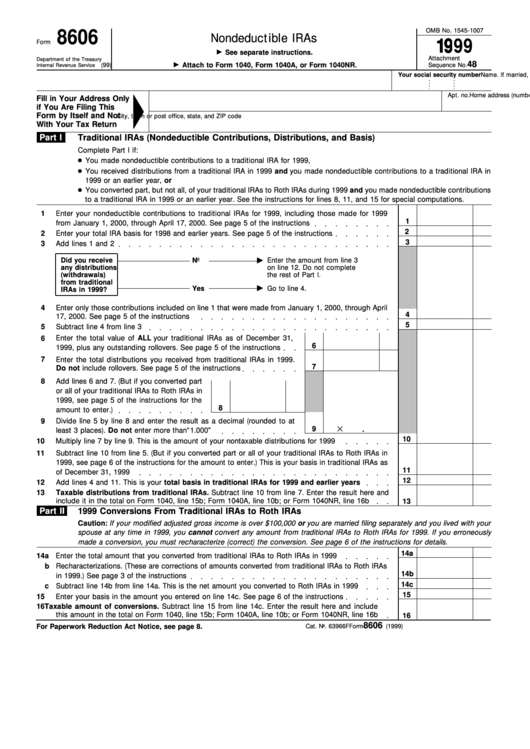

Form 8606 - Nondeductible Iras - 1999

ADVERTISEMENT

OMB No. 1545-1007

8606

Nondeductible IRAs

1999

Form

See separate instructions.

Attachment

Department of the Treasury

48

Attach to Form 1040, Form 1040A, or Form 1040NR.

(99)

Sequence No.

Internal Revenue Service

Name. If married, file a separate form for each spouse required to file Form 8606. See page 5 of the instructions.

Your social security number

Home address (number and street, or P.O. box if mail is not delivered to your home)

Apt. no.

Fill in Your Address Only

if You Are Filing This

Form by Itself and Not

City, town or post office, state, and ZIP code

With Your Tax Return

Part I

Traditional IRAs (Nondeductible Contributions, Distributions, and Basis)

Complete Part I if:

● You made nondeductible contributions to a traditional IRA for 1999,

● You received distributions from a traditional IRA in 1999 and you made nondeductible contributions to a traditional IRA in

1999 or an earlier year, or

● You converted part, but not all, of your traditional IRAs to Roth IRAs during 1999 and you made nondeductible contributions

to a traditional IRA in 1999 or an earlier year. See the instructions for lines 8, 11, and 15 for special computations.

1

Enter your nondeductible contributions to traditional IRAs for 1999, including those made for 1999

1

from January 1, 2000, through April 17, 2000. See page 5 of the instructions

2

2

Enter your total IRA basis for 1998 and earlier years. See page 5 of the instructions

3

3

Add lines 1 and 2

Did you receive

No

Enter the amount from line 3

any distributions

on line 12. Do not complete

(withdrawals)

the rest of Part I.

from traditional

Yes

Go to line 4.

IRAs in 1999?

4

Enter only those contributions included on line 1 that were made from January 1, 2000, through April

4

17, 2000. See page 5 of the instructions

5

5

Subtract line 4 from line 3

Enter the total value of ALL your traditional IRAs as of December 31,

6

6

1999, plus any outstanding rollovers. See page 5 of the instructions

7

Enter the total distributions you received from traditional IRAs in 1999.

7

Do not include rollovers. See page 5 of the instructions

8

Add lines 6 and 7. (But if you converted part

or all of your traditional IRAs to Roth IRAs in

1999, see page 5 of the instructions for the

8

amount to enter.)

9

Divide line 5 by line 8 and enter the result as a decimal (rounded to at

9

.

least 3 places). Do not enter more than “1.000”

10

10

Multiply line 7 by line 9. This is the amount of your nontaxable distributions for 1999

11

Subtract line 10 from line 5. (But if you converted part or all of your traditional IRAs to Roth IRAs in

1999, see page 6 of the instructions for the amount to enter.) This is your basis in traditional IRAs as

11

of December 31, 1999

12

12

Add lines 4 and 11. This is your total basis in traditional IRAs for 1999 and earlier years

13

Taxable distributions from traditional IRAs. Subtract line 10 from line 7. Enter the result here and

include it in the total on Form 1040, line 15b; Form 1040A, line 10b; or Form 1040NR, line 16b

13

Part II

1999 Conversions From Traditional IRAs to Roth IRAs

Caution: If your modified adjusted gross income is over $100,000 or you are married filing separately and you lived with your

spouse at any time in 1999, you cannot convert any amount from traditional IRAs to Roth IRAs for 1999. If you erroneously

made a conversion, you must recharacterize (correct) the conversion. See page 6 of the instructions for details.

14a

14

a

Enter the total amount that you converted from traditional IRAs to Roth IRAs in 1999

b

Recharacterizations. (These are corrections of amounts converted from traditional IRAs to Roth IRAs

14b

in 1999.) See page 3 of the instructions

14c

c

Subtract line 14b from line 14a. This is the net amount you converted to Roth IRAs in 1999

15

15

Enter your basis in the amount you entered on line 14c. See page 6 of the instructions

16

Taxable amount of conversions. Subtract line 15 from line 14c. Enter the result here and include

this amount in the total on Form 1040, line 15b; Form 1040A, line 10b; or Form 1040NR, line 16b

16

8606

For Paperwork Reduction Act Notice, see page 8.

Cat. No. 63966F

Form

(1999)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2