Instructions For Form 302

ADVERTISEMENT

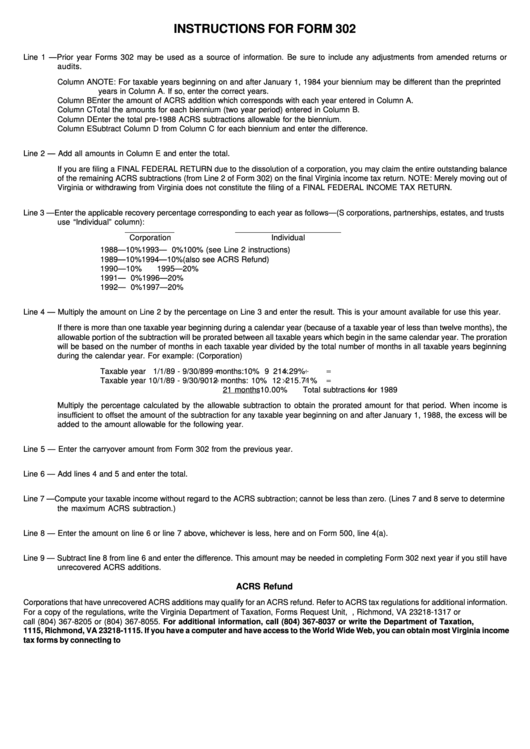

INSTRUCTIONS FOR FORM 302

Line 1 — Prior year Forms 302 may be used as a source of information. Be sure to include any adjustments from amended returns or

audits.

Column A NOTE: For taxable years beginning on and after January 1, 1984 your biennium may be different than the preprinted

years in Column A. If so, enter the correct years.

Column B Enter the amount of ACRS addition which corresponds with each year entered in Column A.

Column C Total the amounts for each biennium (two year period) entered in Column B.

Column D Enter the total pre-1988 ACRS subtractions allowable for the biennium.

Column E Subtract Column D from Column C for each biennium and enter the difference.

Line 2 — Add all amounts in Column E and enter the total.

If you are filing a FINAL FEDERAL RETURN due to the dissolution of a corporation, you may claim the entire outstanding balance

of the remaining ACRS subtractions (from Line 2 of Form 302) on the final Virginia income tax return. NOTE: Merely moving out of

Virginia or withdrawing from Virginia does not constitute the filing of a FINAL FEDERAL INCOME TAX RETURN.

Line 3 — Enter the applicable recovery percentage corresponding to each year as follows—(S corporations, partnerships, estates, and trusts

use “Individual” column):

Corporation

Individual

1988—10%

1993— 0%

100% (see Line 2 instructions)

1989—10%

1994—10%

(also see ACRS Refund)

1990—10%

1995—20%

1991— 0%

1996—20%

1992— 0%

1997—20%

Line 4 — Multiply the amount on Line 2 by the percentage on Line 3 and enter the result. This is your amount available for use this year.

If there is more than one taxable year beginning during a calendar year (because of a taxable year of less than twelve months), the

allowable portion of the subtraction will be prorated between all taxable years which begin in the same calendar year. The proration

will be based on the number of months in each taxable year divided by the total number of months in all taxable years beginning

during the calendar year. For example: (Corporation)

"

!

"

Taxable year 1/1/89 - 9/30/89

9 months: 10%

9

21

4.29%

"

!

"

Taxable year 10/1/89 - 9/30/90

12 months: 10%

12

21

5.71%

"

21 months

10.00%

Total subtractions for 1989

Multiply the percentage calculated by the allowable subtraction to obtain the prorated amount for that period. When income is

insufficient to offset the amount of the subtraction for any taxable year beginning on and after January 1, 1988, the excess will be

added to the amount allowable for the following year.

Line 5 — Enter the carryover amount from Form 302 from the previous year.

Line 6 — Add lines 4 and 5 and enter the total.

Line 7 — Compute your taxable income without regard to the ACRS subtraction; cannot be less than zero. (Lines 7 and 8 serve to determine

the maximum ACRS subtraction.)

Line 8 — Enter the amount on line 6 or line 7 above, whichever is less, here and on Form 500, line 4(a).

Line 9 — Subtract line 8 from line 6 and enter the difference. This amount may be needed in completing Form 302 next year if you still have

unrecovered ACRS additions.

ACRS Refund

Corporations that have unrecovered ACRS additions may qualify for an ACRS refund. Refer to ACRS tax regulations for additional information.

For a copy of the regulations, write the Virginia Department of Taxation, Forms Request Unit, P.O. Box 1317, Richmond, VA 23218-1317 or

call (804) 367-8205 or (804) 367-8055. For additional information, call (804) 367-8037 or write the Department of Taxation, P.O. Box

1115, Richmond, VA 23218-1115. If you have a computer and have access to the World Wide Web, you can obtain most Virginia income

tax forms by connecting to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1