General Instructions For Preparing Employer'S Quarter/monthly Amended Missouri Withholding Tax Return (Form Mo-941x) - 1995

ADVERTISEMENT

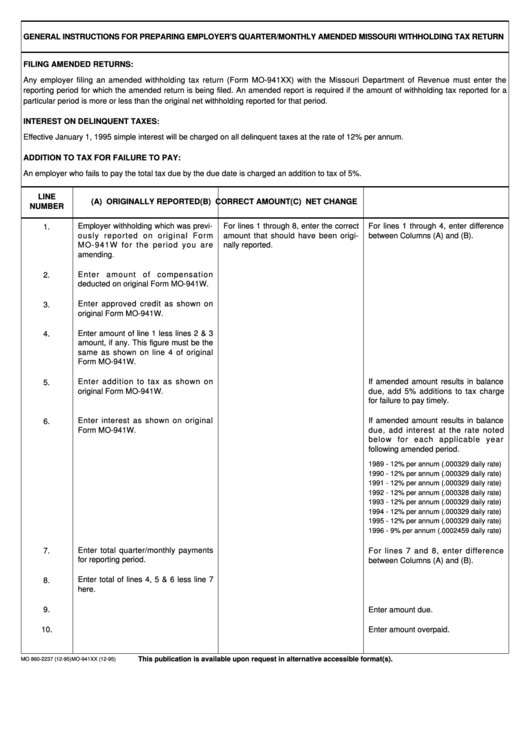

GENERAL INSTRUCTIONS FOR PREPARING EMPLOYER’S QUARTER/MONTHLY AMENDED MISSOURI WITHHOLDING TAX RETURN

FILING AMENDED RETURNS:

Any employer filing an amended withholding tax return (Form MO-941XX) with the Missouri Department of Revenue must enter the

reporting period for which the amended return is being filed. An amended report is required if the amount of withholding tax reported for a

particular period is more or less than the original net withholding reported for that period.

INTEREST ON DELINQUENT TAXES:

Effective January 1, 1995 simple interest will be charged on all delinquent taxes at the rate of 12% per annum.

ADDITION TO TAX FOR FAILURE TO PAY:

An employer who fails to pay the total tax due by the due date is charged an addition to tax of 5%.

LINE

(A) ORIGINALLY REPORTED

(B) CORRECT AMOUNT

(C) NET CHANGE

NUMBER

Employer withholding which was previ-

For lines 1 through 8, enter the correct

For lines 1 through 4, enter difference

1.

ously reported on original Form

amount that should have been origi-

between Columns (A) and (B).

MO-941W for the period you are

nally reported.

amending.

Enter amount of compensation

2.

deducted on original Form MO-941W.

Enter approved credit as shown on

3.

original Form MO-941W.

Enter amount of line 1 less lines 2 & 3

4.

amount, if any. This figure must be the

same as shown on line 4 of original

Form MO-941W.

Enter addition to tax as shown on

If amended amount results in balance

5.

original Form MO-941W.

due, add 5% additions to tax charge

for failure to pay timely.

Enter interest as shown on original

If amended amount results in balance

6.

Form MO-941W.

due, add interest at the rate noted

below for each applicable year

following amended period.

1989 - 12% per annum (.000329 daily rate)

1990 - 12% per annum (.000329 daily rate)

1991 - 12% per annum (.000329 daily rate)

1992 - 12% per annum (.000328 daily rate)

1993 - 12% per annum (.000329 daily rate)

1994 - 12% per annum (.000329 daily rate)

1995 - 12% per annum (.000329 daily rate)

1996 - 9% per annum (.0002459 daily rate)

Enter total quarter/monthly payments

7.

For lines 7 and 8, enter difference

for reporting period.

between Columns (A) and (B).

Enter total of lines 4, 5 & 6 less line 7

8.

here.

9.

Enter amount due.

10.

Enter amount overpaid.

This publication is available upon request in alternative accessible format(s).

MO 860-2237 (12-95)

MO-941XX (12-95)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1