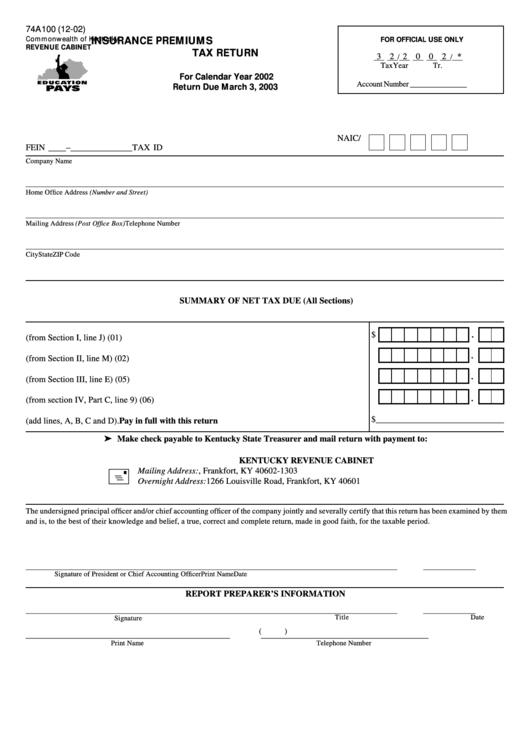

74A100 (12-02)

Commonwealth of Kentucky

INSURANCE PREMIUMS

FOR OFFICIAL USE ONLY

REVENUE CABINET

TAX RETURN

3 2

2 0 0 2

*

___ ___ / ___ ___ ___ ___ / ___

Tax

Year

Tr.

For Calendar Year 2002

Account Number ___ ___ ___ ___ ___

Return Due March 3, 2003

NAIC/

FEIN __ __ – __ __ __ __ __ __ __

TAX ID

Company Name

Home Office Address (Number and Street)

Mailing Address (Post Office Box)

Telephone Number

City

State

ZIP Code

SUMMARY OF NET TAX DUE (All Sections)

.

$

A.

Net domestic and foreign life insurance tax (from Section I, line J) ................................. (01)

.

B.

Net other than life insurance tax (from Section II, line M) ............................................... (02)

.

C.

Fire insurance tax (from Section III, line E) ...................................................................... (05)

.

D.

Net retaliatory taxes and fees (from section IV, Part C, line 9) ......................................... (06)

$_____________________________

E.

Total net tax liability due (add lines, A, B, C and D). Pay in full with this return ...............

Make check payable to Kentucky State Treasurer and mail return with payment to:

KENTUCKY REVENUE CABINET

+

Mailing Address:

P.O. Box 1303, Frankfort, KY 40602-1303

Overnight Address:

1266 Louisville Road, Frankfort, KY 40601

The undersigned principal officer and/or chief accounting officer of the company jointly and severally certify that this return has been examined by them

and is, to the best of their knowledge and belief, a true, correct and complete return, made in good faith, for the taxable period.

_______________________________________

________________________________

__________

Signature of President or Chief Accounting Officer

Print Name

Date

REPORT PREPARER’S INFORMATION

_______________________________________

________________________________

__________

Title

Date

Signature

_______________________________________

________________________________

(

)

Print Name

Telephone Number

1

1 2

2 3

3 4

4