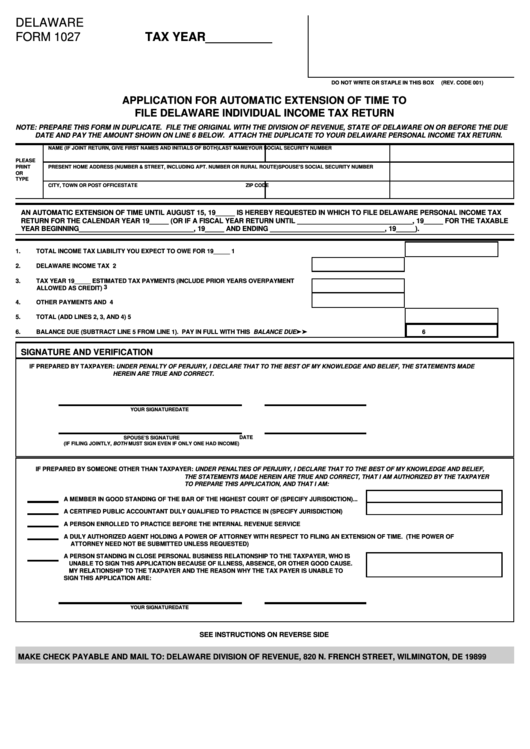

DELAWARE

FORM 1027

TAX YEAR__________

DO NOT WRITE OR STAPLE IN THIS BOX

(REV. CODE 001)

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO

FILE DELAWARE INDIVIDUAL INCOME TAX RETURN

NOTE: PREPARE THIS FORM IN DUPLICATE. FILE THE ORIGINAL WITH THE DIVISION OF REVENUE, STATE OF DELAWARE ON OR BEFORE THE DUE

DATE AND PAY THE AMOUNT SHOWN ON LINE 6 BELOW. ATTACH THE DUPLICATE TO YOUR DELAWARE PERSONAL INCOME TAX RETURN.

NAME (IF JOINT RETURN, GIVE FIRST NAMES AND INITIALS OF BOTH)

LAST NAME

YOUR SOCIAL SECURITY NUMBER

PLEASE

PRINT

PRESENT HOME ADDRESS (NUMBER & STREET, INCLUDING APT. NUMBER OR RURAL ROUTE)

SPOUSE’S SOCIAL SECURITY NUMBER

OR

TYPE

CITY, TOWN OR POST OFFICE

STATE

ZIP CODE

AN AUTOMATIC EXTENSION OF TIME UNTIL AUGUST 15, 19_____ IS HEREBY REQUESTED IN WHICH TO FILE DELAWARE PERSONAL INCOME TAX

RETURN FOR THE CALENDAR YEAR 19_____ (OR IF A FISCAL YEAR RETURN UNTIL ______________________________, 19_____ FOR THE TAXABLE

YEAR BEGINNING______________________________, 19_____ AND ENDING ______________________________, 19_____).

1.

TOTAL INCOME TAX LIABILITY YOU EXPECT TO OWE FOR 19_____.....................................................................................

1

2.

DELAWARE INCOME TAX WITHHELD...................................................................................

2

3.

TAX YEAR 19_____ ESTIMATED TAX PAYMENTS (INCLUDE PRIOR YEARS OVERPAYMENT

3

ALLOWED AS CREDIT).........................................................................................................

4.

OTHER PAYMENTS AND CREDITS........................................................................................

4

5.

TOTAL (ADD LINES 2, 3, AND 4)..........................................................................................................................................

5

BALANCE DUE (SUBTRACT LINE 5 FROM LINE 1). PAY IN FULL WITH THIS APPLICATION............................BALANCE DUE' '

6.

6

SIGNATURE AND VERIFICATION

IF PREPARED BY TAXPAYER: UNDER PENALTY OF PERJURY, I DECLARE THAT TO THE BEST OF MY KNOWLEDGE AND BELIEF, THE STATEMENTS MADE

HEREIN ARE TRUE AND CORRECT.

YOUR SIGNATURE

DATE

SPOUSE’S SIGNATURE

DATE

(IF FILING JOINTLY, BOTH MUST SIGN EVEN IF ONLY ONE HAD INCOME)

IF PREPARED BY SOMEONE OTHER THAN TAXPAYER: UNDER PENALTIES OF PERJURY, I DECLARE THAT TO THE BEST OF MY KNOWLEDGE AND BELIEF,

THE STATEMENTS MADE HEREIN ARE TRUE AND CORRECT, THAT I AM AUTHORIZED BY THE TAXPAYER

TO PREPARE THIS APPLICATION, AND THAT I AM:

A MEMBER IN GOOD STANDING OF THE BAR OF THE HIGHEST COURT OF (SPECIFY JURISDICTION)...

A CERTIFIED PUBLIC ACCOUNTANT DULY QUALIFIED TO PRACTICE IN (SPECIFY JURISDICTION)........

A PERSON ENROLLED TO PRACTICE BEFORE THE INTERNAL REVENUE SERVICE

A DULY AUTHORIZED AGENT HOLDING A POWER OF ATTORNEY WITH RESPECT TO FILING AN EXTENSION OF TIME. (THE POWER OF

ATTORNEY NEED NOT BE SUBMITTED UNLESS REQUESTED)

A PERSON STANDING IN CLOSE PERSONAL BUSINESS RELATIONSHIP TO THE TAXPAYER, WHO IS

UNABLE TO SIGN THIS APPLICATION BECAUSE OF ILLNESS, ABSENCE, OR OTHER GOOD CAUSE.

MY RELATIONSHIP TO THE TAXPAYER AND THE REASON WHY THE TAX PAYER IS UNABLE TO

SIGN THIS APPLICATION ARE:........................................................................................................

YOUR SIGNATURE

DATE

SEE INSTRUCTIONS ON REVERSE SIDE

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, 820 N. FRENCH STREET, WILMINGTON, DE 19899

1

1