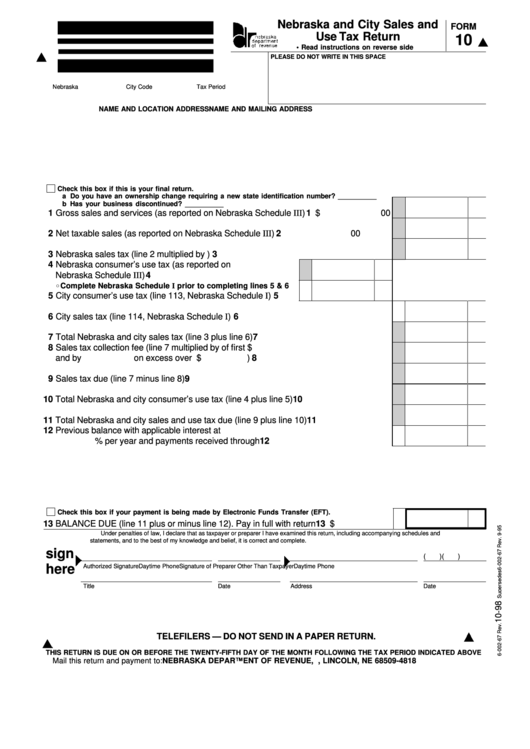

Nebraska and City Sales and

FORM

Use Tax Return

10

• Read instructions on reverse side

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska I.D. Number

City Code

Tax Period

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Check this box if this is your final return.

a Do you have an ownership change requiring a new state identification number? __________

b Has your business discontinued? __________

1 Gross sales and services (as reported on Nebraska Schedule III) .................................

1 $

00

2 Net taxable sales (as reported on Nebraska Schedule III) .............................................

2

00

3 Nebraska sales tax (line 2 multiplied by

) ..............................................

3

4 Nebraska consumer’s use tax (as reported on

Nebraska Schedule III)............................................................ 4

Complete Nebraska Schedule I prior to completing lines 5 & 6

5 City consumer’s use tax (line 113, Nebraska Schedule I) ......... 5

6 City sales tax (line 114, Nebraska Schedule I) ..............................................................

6

7 Total Nebraska and city sales tax (line 3 plus line 6)......................................................

7

8 Sales tax collection fee (line 7 multiplied by

of first $

and by

on excess over $

) .....................................

8

9 Sales tax due (line 7 minus line 8) .................................................................................

9

10 Total Nebraska and city consumer’s use tax (line 4 plus line 5) ..................................... 10

11 Total Nebraska and city sales and use tax due (line 9 plus line 10) ................................ 11

12 Previous balance with applicable interest at

% per year and payments received through

12

Check this box if your payment is being made by Electronic Funds Transfer (EFT).

13 BALANCE DUE (line 11 plus or minus line 12). Pay in full with return ............................ 13 $

Under penalties of law, I declare that as taxpayer or preparer I have examined this return, including accompanying schedules and

statements, and to the best of my knowledge and belief, it is correct and complete.

sign

(

)

(

)

here

Authorized Signature

Daytime Phone

Signature of Preparer Other Than Taxpayer

Daytime Phone

Title

Date

Address

Date

TELEFILERS — DO NOT SEND IN A PAPER RETURN.

THIS RETURN IS DUE ON OR BEFORE THE TWENTY-FIFTH DAY OF THE MONTH FOLLOWING THE TAX PERIOD INDICATED ABOVE

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

1

1 2

2 3

3