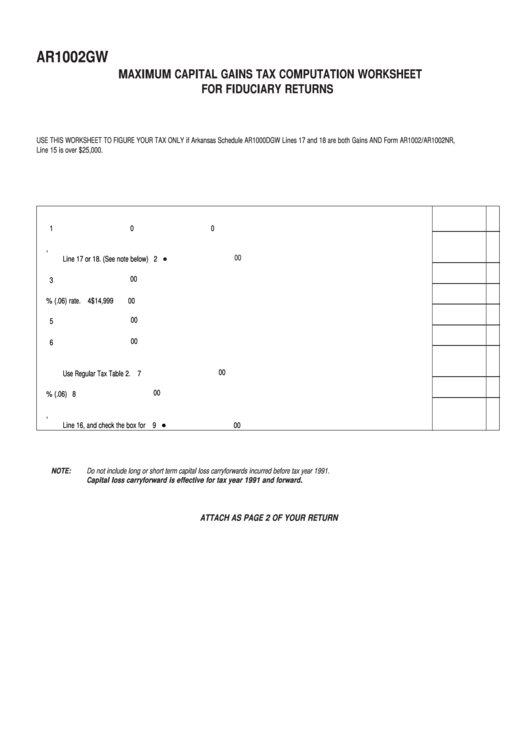

AR1002GW

MAXIMUM CAPITAL GAINS TAX COMPUTATION WORKSHEET

FOR FIDUCIARY RETURNS

USE THIS WORKSHEET TO FIGURE YOUR TAX ONLY if Arkansas Schedule AR1000DGW Lines 17 and 18 are both Gains AND Form AR1002/AR1002NR,

Line 15 is over $25,000.

01.

Enter amounts from Form AR1002/AR1002NR. Line 15 ............................................................................................................. 01

00

02.

Enter the smaller of Arkansas Schedule AR1000DGW,

00

Line 17 or 18. (See note below)................................................................................................................................................... 02

00

03.

Subtract Line 2 from Line 1. ....................................................................................................................................................... 03

04.

Minimum 6% (.06) rate. ............................................................................................................................................................. 04

$14,999

00

00

05.

Enter the greater of Line 3 or 4. .................................................................................................................................................. 05

00

06.

Subtract Line 5 from Line 1. ....................................................................................................................................................... 06

07.

Figure the tax on the amount of Line 5.

00

Use Regular Tax Table 2. ............................................................................................................................................................. 07

00

08.

Multiply Line 6 by 6% (.06)......................................................................................................................................................... 08

09.

Add Lines 7 and 8. Enter result here and on Form AR1002/AR1002NR,

Line 16, and check the box for AR1002GW.................................................................................................................................. 09

00

NOTE:

Do not include long or short term capital loss carryforwards incurred before tax year 1991.

Capital loss carryforward is effective for tax year 1991 and forward.

ATTACH AS PAGE 2 OF YOUR RETURN

1

1