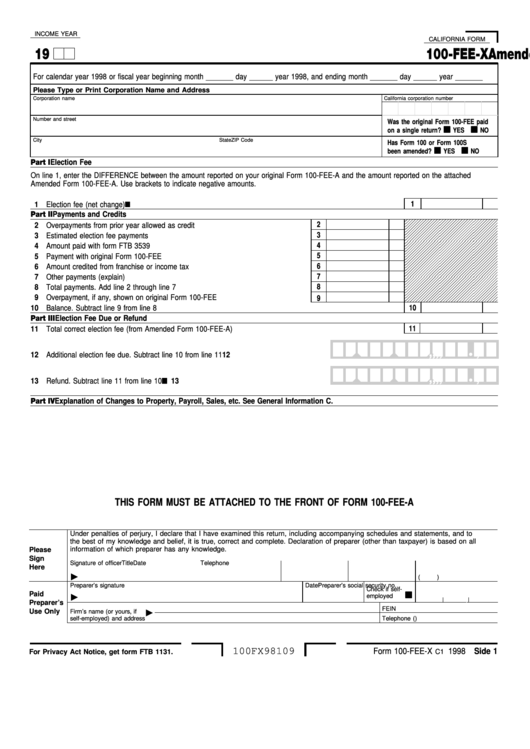

INCOME YEAR

CALIFORNIA FORM

19

Amended Water’s-Edge Election Fee

100-FEE-X

For calendar year 1998 or fiscal year beginning month _______ day ______ year 1998, and ending month _______ day ______ year _______

Please Type or Print Corporation Name and Address

Corporation name

California corporation number

Number and street

Was the original Form 100-FEE paid

on a single return?

YES

NO

City

State

ZIP Code

Has Form 100 or Form 100S

been amended?

YES

NO

Part I Election Fee

On line 1, enter the DIFFERENCE between the amount reported on your original Form 100-FEE-A and the amount reported on the attached

Amended Form 100-FEE-A. Use brackets to indicate negative amounts.

1

1 Election fee (net change) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part II Payments and Credits

2

2 Overpayments from prior year allowed as credit . . . . . . . . . . . . . . . . . . . . . .

3

3 Estimated election fee payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Amount paid with form FTB 3539 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Payment with original Form 100-FEE . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Amount credited from franchise or income tax . . . . . . . . . . . . . . . . . . . . . . .

7

7 Other payments (explain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Total payments. Add line 2 through line 7. . . . . . . . . . . . . . . . . . . . . . . . . .

9 Overpayment, if any, shown on original Form 100-FEE. . . . . . . . . . . . . . . . . .

9

10

10 Balance. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part III Election Fee Due or Refund

11

11 Total correct election fee (from Amended Form 100-FEE-A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

,

, ,

,

,

,

•

•

12 Additional election fee due. Subtract line 10 from line 11 . . . . . . . . . . . . . . .

12

,

,

,

, ,

,

,

,

•

•

13 Refund. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Part IV Explanation of Changes to Property, Payroll, Sales, etc. See General Information C.

THIS FORM MUST BE ATTACHED TO THE FRONT OF FORM 100-FEE-A

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all

information of which preparer has any knowledge.

Please

Sign

Signature of officer

Title

Date

Telephone

Here

(

)

Preparer’s signature

Date

Preparer’s social security no.

Check if self-

Paid

employed

Preparer’s

FEIN

Use Only

Firm’s name (or yours, if

self-employed) and address

Telephone (

)

100FX98109

Form 100-FEE-X

1998 Side 1

For Privacy Act Notice, get form FTB 1131.

C1

1

1